Nordstrom 1999 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. AND SUBSIDIARIES

42

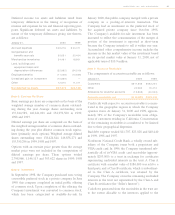

(Note 7 continued)

payment of interest on the Class A and Class B certifi-

cates, absorption of credit losses, and payment of servicing

fees to the Company, which services the receivables for

the trust. Excess cash flows revert to the Company. The

Company’s investment in the Class B certificate and the

Seller’s Interest totals $42,754 and $8,208 at January 31,

2000 and 1999, and is included in customer accounts

receivable.

Pursuant to the terms of operative documents of the

trust, in certain events the Company may be required to

fund certain amounts pursuant to a recourse obligation

for credit losses. Based on current cash flow projections,

the Company does not believe any additional funding

will be required.

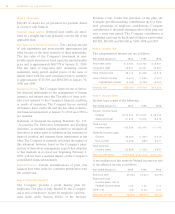

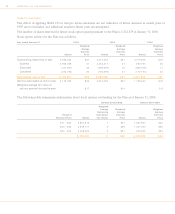

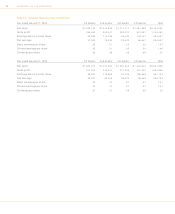

Note 8: Land, Buildings and Equipment

Land, buildings and equipment consist of the following

(at cost):

January 31, 2000 1999

Land and land improvements $ 59,237 $ 57,337

Buildings 650,414 500,831

Leasehold improvements 870,821 957,877

Capitalized software 20,150 7,603

Store fixtures and equipment 1,037,936 944,202

2,638,558 2,467,850

Less accumulated depreciation

and amortization (1,370,726) (1,235,410)

1,267,832 1,232,440

Construction in progress 161,660 145,566

Land, buildings and

equipment, net $1,429,492 $1,378,006

At January 31, 2000, the net book value of property

located in California is approximately $335,000. The

Company does not carry earthquake insurance in

California because of its high cost.

At January 31, 2000, the Company has contractual com-

mitments of approximately $80 million for the construc-

tion of new stores or remodel of existing stores.

Note 9: Notes Payable

A summary of notes payable is as follows:

Year ended January 31 , 2000 1999 1998

Average daily short-

term borrowings $ 45,030 $195,596 $193,811

Maximum amount

outstanding 178,533 385,734 278,471

Weighted average

interest rate:

During the year 5.8% 5.5% 5.6%

At year-end 6.0% 5.2% 5.5%

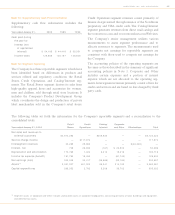

At January 31, 2000, the Company has an unsecured

line of credit with a group of commercial banks totaling

$500,000 which is available as liquidity support for the

Company’s commercial paper program, and expires in

July 2002.The line of credit agreement contains restric-

tive covenants which, among other things, require the

Company to maintain a certain minimum level of net

worth and a coverage ratio (as defined) of no less than 2

to 1.The Company pays a commitment fee for the line

based on the Company’s debt rating.

Note 10: Long-Term Debt

A summary of long-term debt is as follows:

January 31, 2000 1999

Senior debentures, 6.95%,

due 2028 $ 300,000 $ 300,000

Senior notes, 5.625%, due 2009 250,000 250,000

Medium-term notes, payable by

Nordstrom Credit, Inc.,

7.0%-8.67%, due 2000-2002 145,350 203,350

Notes payable, of

Nordstrom Credit, Inc.,

6.7%, due 2005 100,000 100,000

Other 9,632 14,884

Total long-term debt 804,982 868,234

Less current portion (58,191) (63,341)

Total due beyond one year $746,791 $804 ,893

Aggregate principal payments on long-term debt are as

follows: 2000-$58,191; 2001-$11,454; 2002-$77,247;

2003-$319; 2004-$350; and thereafter-$657,421.