Nordstrom 1999 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 1999 Nordstrom annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NORDSTROM, INC. AND SUBSIDIARIES

32

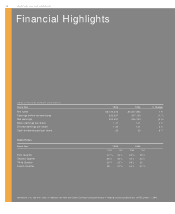

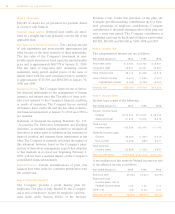

Selling, General, and Administrative

Selling, general, and administrative expenses as a percent-

age of net sales were 29.1% in 1999, 28.0% in 1998, and

27.3% in 1997.

The 1999 increase, as a percentage of net sales, was due to

the aforementioned $10 million of pre-tax restructuring

charges. In addition, the Company incurred substantial

additional costs associated with the accelerated develop-

ment of NORD STROM.com and N ORD STRO Mshoes.com. In

August 1999, the Company announced that, compared to

its plan prior thereto, N O RDST ROM.com would increase

operating expenses by approximately $22 million over the

balance of the year, in order to accelerate growth and

development of its Internet business channel. The actual

increase for 1999 was $23 million. These increases were

partially offset by lower bad debt expense due to the

improved credit quality of the Company’s credit card

receivables.

The 1998 increase in selling, general, and administrative

expenses, as a percentage of net sales, was due to higher

sales promotion costs for the Company’s direct sales cata-

log division, and spending on Year 2000 compliance and

other information system operational costs. The increase

was partially offset by decreases in bad debt expenses

associated with the Company’s credit card business and

lower selling expenses, as a percentage of sales.

Interest Expense, Net

Interest expense, net increased 7% in 1999 and 37% in

1998 as a result of higher average borrowings to finance

share repurchases.The Company repurchased 10.2 million

shares and 11.2 million shares at an aggregate cost of $303

million and $346 million in 1999 and 1998, respectively.

Service Charge Income and Other, Net

Service charge income and other, net primarily repre-

sents income from the Company’s credit card operations,

offset by miscellaneous expenses.

Service charge income and other, net was flat in 1999

and 1998, both in dollars and as a percent of sales.

Net Earnings

Net earnings for 1999 were slightly lower than 1998 as

the Company’s record sales and gross margin were offset

by increases in selling, general, and administrative expens-

es. Net earnings for 1998 increased as compared to 1997

primarily due to gross margin improvements.

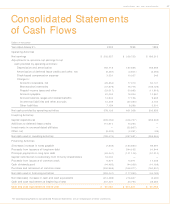

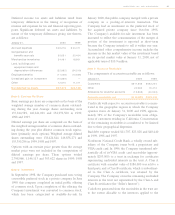

Liquidity and Capital Resources

The Company finances its working capital needs, capital

expenditures and share repurchase activity with cash pro-

vided by operations and borrowings.

For the fiscal year ended January 31, 2000, net cash pro-

vided by operating activities decreased approximately

$223 million compared to the fiscal year ended January

31, 1999, primarily due to the non-recurring benefit of

prior year reductions in inventories and customer receiv-

able account balances. Net cash provided by operating

activities for the fiscal year ended January 31, 1999

increased by approximately $301 million as compared to

the fiscal year ended January 31, 1998, primarily due to a

reduction in merchandise inventories resulting from

management’s focus on managing inventory levels and a

decrease in customer receivable balances.

For the fiscal year ended January 31, 2000, net cash used in

investing activities decreased approximately $68 million

compared to the fiscal year ended January 31, 1999, prima-

rily due to an increase in funds provided by developers to

defray part of the Company’s costs of constructing new

stores. The Company’s capital expenditures aggregated

approximately $700 million over the last three years, net

of deferred lease credits, principally to add new stores and

facilities and to improve existing stores and facilities.

Over 2.7 million square feet of retail store space has been

added during this time period, representing an increase

of 23% since January 31, 1997.

The Company plans to spend approximately $1.0 billion,

net of deferred lease credits, on capital projects during the

next three years, including new stores, the remodeling of

existing stores, new systems and technology, and other

items. At January 31, 2000, approximately $80 million has

been contractually committed for the construction of

new stores or remodel of existing stores. Although the

Company has made commitments for stores opening in

2000 and beyond, it is possible that some stores may not

be opened as scheduled because of delays inherent in the

development process, or for other reasons. In addition to

its cash flow from operations, the Company has funds

available under its revolving credit facility. Management

believes that the Company’s current financial strength and

credit position enable it to maintain its existing stores and

to take advantage of attractive new opportunities.