Navy Federal Credit Union 2012 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2012 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union46

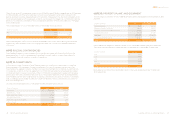

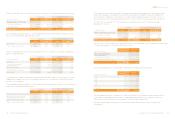

GNMA mortgages

2012 2011

Constant prepayment rate(1) 8.6% 12.2%

Anticipated credit losses(2) 0 0

Weighted average life 6.28 years 5.82 years

(1) CPR is based on the average of the CPRs for all of the GNMA securities.

(2) Ginnie Mae securities are explicitly backed by the federal government; therefore, there are

no anticipated credit losses.

GNMA mortgages

(dollars in thousands) 2012 2011

Constant prepayment rate

Adverse fair value change of 10% $ 7,166 $ 12,813

Adverse fair value change of 20% 13,929 24,664

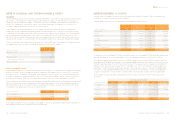

Continuing Involvement

In addition to retained servicing on loans transferred through securitizations or sales transactions,

Navy Federal has continuing involvement with certain loans pursuant to provisions that allow for

or require transferred loans to be reacquired.

In connection with the sale of loans to FNMA and FHLMC, Navy Federal has made representations

and warranties that the loans sold meet certain requirements. These representations relate to type

of collateral, underwriting standards, validity of certain borrower representations in connection with

the loan, and the use of the GSE’s standard legal documentation. Navy Federal may be, and has been,

required to repurchase loans and/or indemnify FNMA and FHLMC and other investors for losses

due to material breaches of these representations and warranties.

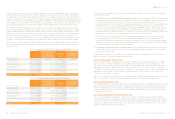

The following table provides a summary of the cash flows exchanged during the years ended

December 31, 2012 and 2011 between Navy Federal and transferees on loans previously transferred

with continuing involvement:

(dollars in millions) 2012 2011

Cash from sale of mortgage loans and mortgage-backed securities $ 5,167 $ 2,948

Repurchase of previously transferred loans 19 9

Contractual servicing fees received 62 58

Total $ 5,248 $ 3,015