Navy Federal Credit Union 2012 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2012 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union40 Leading with Vision. Achieving Results. 41

2012 Financial Section

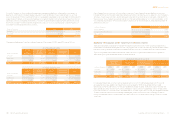

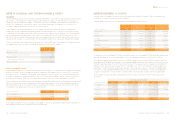

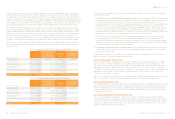

Fair Value at December 31, 2011

(dollars in thousands)

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance

as of

December 31,

2011

Available-for-sale

U.S. government and federal agency securities $ — $ 5,728,404 $ — $ 5,728,404

Residential mortgage-backed securities — 4,585,224 — 4,585,224

Commercial mortgage-backed securities — 14,781 — 14,781

Bank notes — 858,277 — 858,277

Total available-for-sale — 11,186,686 — 11,186,686

Mortgage loans awaiting sale — 692,740 — 692,740

Mortgage servicing rights — — 142,368 142,368

Other assets—Derivative commitments — 20,748 — 20,748

Total assets at fair value on a

recurring basis — 11,900,174 142,368 12,042,542

Other liabilities—Derivative commitments — 7,636 — 7,636

Total liabilities at fair

value on a recurring basis $ — $ 7,636 $ — $ 7,636

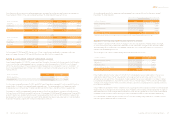

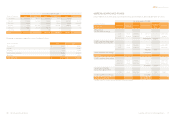

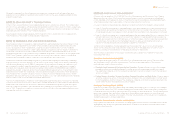

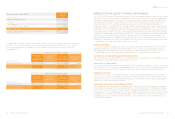

The following tables summarize the changes in fair value for items measured at fair value (Level 3) on

a recurring basis using significant unobservable inputs at December 31, 2012 and December 31, 2011:

Fair Value at December 31, 2012 Mortgage

servicing

rights

(dollars in thousands)

Balance, beginning of year $ 142,368

Originations 52,773

Payos/Maturities (39,642)

(Loss) on changes in value of MSRs (11,410)

Balance, end of year $ 144,089

Change in unrealized gains/(losses) related to financial instruments

still held at December 31, 2012 $ (12,650)

Mortgage Loans Awaiting Sale (MLAS)

MLAS comprise those loans that Navy Federal intends either to sell or to securitize. The initial loan

level basis is equal to unpaid principal balance plus or minus origination costs and fees. Navy Federal has

elected the fair value option for MLAS. The fair value of MLAS is determined based on an evaluation of

best execution forward contract prices sourced from the TBA market, by agency (Ginnie Mae/Freddie Mac/

Fannie Mae). As such, MLAS are classified as Level 2 in the fair value hierarchy.

Real Estate Owned (REO)

Navy Federal acquires residential properties as a result of foreclosure or forfeiture, and those properties

are classified as REO properties. REOs are recognized at the lower of cost or fair value less costs to sell.

Navy Federal utilizes Broker Price Opinions (BPOs) to estimate the fair market value of REOs. A BPO

considers the value of similar surrounding properties, sales trends in the neighborhood, an estimate

of any of the costs associated with getting the property ready for sale, and/or the cost of any needed

repairs. Navy Federal evaluates reasonableness by obtaining multiple BPOs on REO properties and

also by analyzing significant fluctuations on a period-by-period basis. Fair value less costs to sell is an

estimated value based on relevant recent historical data that are considered unobservable inputs, and

as such, REO is classified as Level 3 in the fair value hierarchy and valued on a non-recurring basis.

During the holding period, BPOs are updated to reflect changes in fair value, and the REO is carried at

the lower of the amount recorded at acquisition date or estimated fair value less costs to sell. Holding

costs such as insurance, maintenance, taxes, and utility costs are expensed as incurred. Navy Federal

markets the REO properties for sale to the public and generally does not hold properties for longer than

one year. Valuation adjustments on these assets as well as gains or losses realized from disposition of

such properties are reflected in “Other non-interest expense” on the Consolidated Statements of Income.

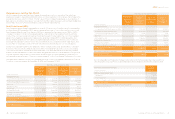

The tables below present the items recognized at fair value on the Consolidated Statements of Financial

Condition on a recurring basis at December 31, 2012 and December 31, 2011:

Fair Value at December 31, 2012

(dollars in thousands)

Quoted Prices

in Active

Markets for

Identical

Assets

(Level 1)

Significant

Other

Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance

as of

December 31,

2012

Available-for-sale

U.S. government and federal agency securities $ — $ 6,301,788 $ — $ 6,301,788

Residential mortgage-backed securities — 4,673,993 — 4,673,993

Commercial mortgage-backed securities — 14,988 — 14,988

Bank notes — 1,579,751 — 1,579,751

Municipal securities — 98,075 — 98,075

Mutual funds 10,928 — — 10,928

Total available-for-sale 10,928 12,668,595 — 12,679,523

Mortgage loans awaiting sale — 1,442,868 — 1,442,868

Mortgage servicing rights — — 144,089 144,089

Other assets—Derivative commitments — 51,842 — 51,842

Total assets at fair value on a

recurring basis 10,928 14,163,305 144,089 14,318,322

Other liabilities—Derivative commitments — 7,597 — 7,597

Total liabilities at fair

value on a recurring basis $ — $ 7,597 $ — $ 7,597