Navy Federal Credit Union 2012 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2012 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union4Leading with Vision. Achieving Results. 5

2012 Financial Section

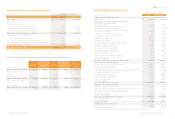

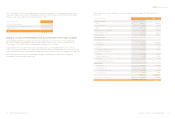

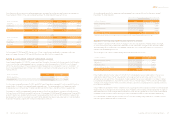

Consolidated Statements of Comprehensive Income

(dollars in thousands) Years Ended December 31

2012 2011

Net income $ 760,420 $ 649,328

Other Comprehensive Income

Defined benefit pension plans:

Prior service cost/(credit) amortized during period 4,813 4,813

Net unamortized (loss)/gain arising during period (64,774) (129,757)

Less: amortization of prior service cost included in net 22,976 11,374

Adjustments related to pension accounting (36,985) (113,570)

Unrealized gains on securities and derivatives

Unrealized holding gains arising during period 114,220 334,648

Less: reclassification adjustment for gains included in net income (40,123) 2,316

Net unrealized gain/(loss) on available-for-sale securities and derivatives 74,097 336,964

Total Other Comprehensive Income 37,112 223,394

Total Comprehensive Income $ 797,532 $ 872,722

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

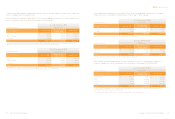

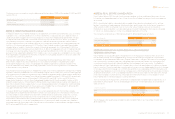

Consolidated Statements of Changes in Reserves and Undivided Earnings

(dollars in thousands)

Regular

Reserve

Capital

Reserve

Undivided

Earnings

Accumulated

Other

Comprehensive

Income

Total Reserves

and Undivided

Earnings

Balance at December 31, 2010 $ 349,808 $ 3,907,137 $ 50,000 $ (100,852) $ 4,206,093

Other comprehensive income — — — 223,394 223,394

Net income — — 649,328 — 649,328

Discretionary transfer — 649,328 (649,328) — —

Balance at December 31, 2011 349,808 4,556,465 50,000 122,542 5,078,815

Other comprehensive income — — — 37,112 37,112

Net income — — 760,420 — 760,420

Discretionary transfer — 760,420 (760,420) — —

Balance at December 31, 2012 $ 349,808 $ 5,316,885 $ 50,000 $ 159,654 $ 5,876,347

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

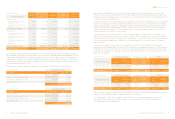

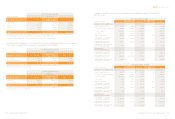

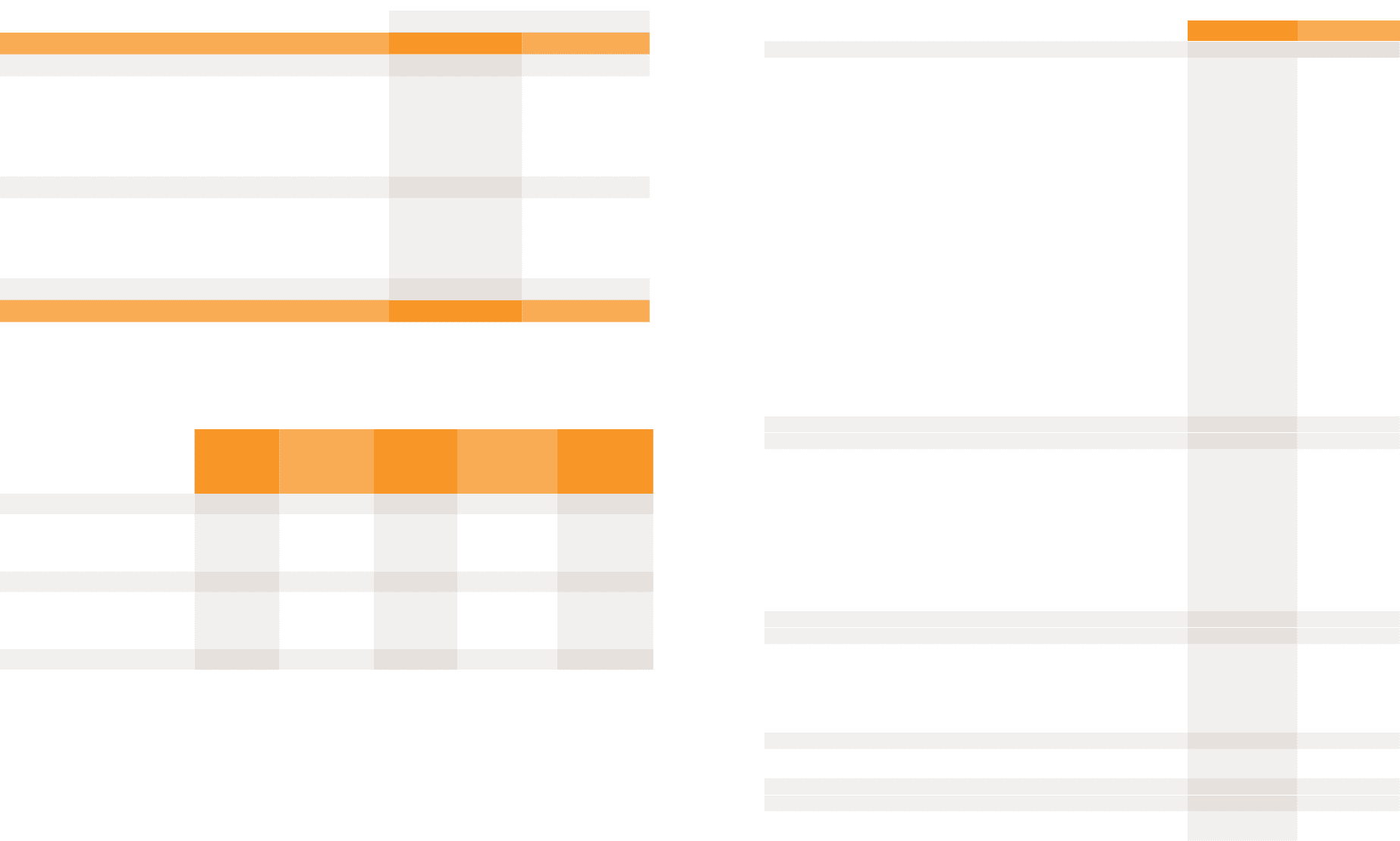

Consolidated Statements of Cash Flows

Years Ended December 31

(dollars in thousands) 2012 2011

Cash flows from operating activities

Net income $ 760,420 $ 649,328

Adjustments to reconcile net income to net cash

provided by operating activities

Provision for loan losses 455,189 450,661

Depreciation of property, plant, and equipment 122,224 101,026

Loss on disposal of property, plant, and equipment 1,505 1,516

Recovery of loss on membership capital in other credit unions (49) —

Gain on sale of investments (40,706) (22,399)

Amortization of loan origination fees and costs 3,525 11,219

Loss on change of value in mortgage servicing assets 51,053 51,258

Mortgage loans originated for sale (6,161,347) (3,022,064)

Gain on sale of mortgage loans (94,202) (43,312)

Mortgage loan sales proceeds 4,647,984 2,493,074

Accretion and amortization of AFS investment securities 72,350 42,163

Accretion and amortization of HTM investment securities 1,172 465

(Increase) in mortgage servicing assets (44,744) (29,483)

(Increase) in accrued interest receivable (8,386) (13,523)

(Increase)/decrease in prepaid expenses (1,177) 6,056

(Increase)/decrease in accounts receivable (31,009) 366,348

(Increase) in intangible and other assets (78,909) (93,262)

Increase in drafts payable 38,103 9,614

Increase in accrued expenses and accounts payable 86,680 33,832

Increase/(decrease) in accrued interest payable 741 (1,327)

Increase in other liabilities 34,506 41,681

Net cash (used in)/provided by operating activities (185,077) 1,032,871

Cash flows from investing activities

Net increase in short-term and interest-bearing deposits (436,487) (485,851)

Purchases of AFS investment securities (4,152,670) (3,770,057)

Purchases of HTM investment securities (150,766) (49,621)

Proceeds from maturities, paydowns, calls, and sales of AFS investment securities 3,580,242 1,964,384

Proceeds from maturities, paydowns, and calls of HTM investment securities 474,371 99,145

Net (purchases)/redemptions of FHLB stock (29,438) 25,608

Net increase in loans to members (3,438,129) (514,490)

Purchase of property, plant, and equipment (294,275) (315,287)

Sale of property, plant, and equipment 158,124 176,878

Increase in deposit to NCUSIF (28,493) (19,315)

Proceeds from REO sales 37,496 43,515

Net cash used in investing activities (4,280,025) (2,845,091)

Cash flows from financing activities

Net increase in members’ accounts—other 2,967,755 2,493,510

Net increase/(decrease) in members’ accounts from issuance and maturity of CDs 740,610 (97,457)

Net increase in members’ accounts from borrowers’ escrow 17,002 8,124

Net increase in securities sold under repurchase agreements 50,000 —

Proceeds from borrowings 15,791,141 8,173,283

Repayment of notes payable (15,042,141) (8,806,873)

Net cash provided by financing activities 4,524,367 1,770,587

Net increase/(decrease) in cash 59,265 (41,633)

Cash at beginning of year 307,231 348,864

Cash at end of year $ 366,496 $ 307,231

Additional cash flow information:

Interest paid 657,249 680,044

Transfers from loans to other real estate 77,082 88,219

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.