Navy Federal Credit Union 2012 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2012 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union2Leading with Vision. Achieving Results. 3

2012 Financial Section

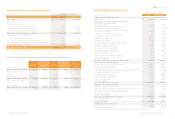

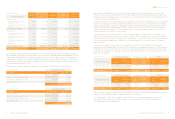

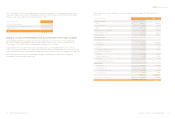

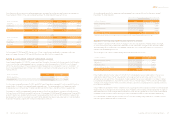

Consolidated Statements of Income

Years Ended December 31

(dollars in thousands) 2012 2011

Interest income

Interest on loans to members $ 2,242,663 $ 2,184,196

Interest on securities available-for-sale 280,668 259,986

Interest on securities held-to-maturity 16,352 20,618

Interest on other investments 7,513 4,543

Total interest income 2,547,196 2,469,343

Dividend and interest expense

Dividends to members 398,018 420,861

Interest on securities sold under repurchase

agreements and notes payable 259,972 257,856

Total dividend and interest expense 657,990 678,717

Net interest income 1,889,206 1,790,626

Provision for loan losses (455,189) (450,661)

Net interest income after provision for loan losses 1,434,017 1,339,965

Non-interest income

Gain on mortgage loan sales, net 290,683 88,216

Gain on investment sales 40,706 22,399

Mortgage servicing 61,882 57,466

Credit card interchange 169,440 143,529

Check card interchange 98,379 159,519

Payment protection plan 100,199 84,063

ATM convenience 35,159 34,286

Overdrawn checking fee 60,169 52,832

Other 247,515 189,865

Total non-interest income 1,104,132 832,175

Non-interest expense

Salaries and employee benefits 716,117 630,772

Oce operating 174,233 129,798

Loan servicing 278,949 232,031

Professional and outside services 180,698 120,211

Oce occupancy 55,689 52,050

Education and marketing 76,957 43,193

Fair value adjustment of mortgage servicing rights 51,053 51,258

Depreciation 122,224 101,026

Other 89,970 85,678

Total non-interest expense 1,745,890 1,446,017

Non-operating loss

Realized loss on NCUSIF stabilization and membership

capital for corporate credit unions (31,839) (76,795)

Net income $ 760,420 $ 649,328

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

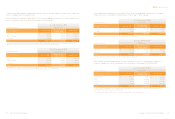

Consolidated Statements of Financial Condition

As of December 31

(dollars in thousands) 2012 2011

ASSETS

Cash $ 366,496 $ 307,231

Short-term investments 1,785,003 1,440,626

Securities available-for-sale 12,679,523 11,186,686

Securities held-to-maturity 469,752 794,529

Mortgage loans awaiting sale 1,442,868 692,740

Loans to members, net of allowance for loan losses of $643,336

at December 31, 2012 and $602,388 at December 31, 2011 33,170,924 30,191,509

Investment in FHLB 403,797 374,359

Interest-bearing deposits 100,940 8,781

Accounts receivable 315,499 284,490

Accrued interest receivable 177,914 169,528

Property, plant, and equipment 842,285 829,863

NCUSIF deposit 335,673 307,180

Mortgage servicing rights 144,089 142,368

Prepaid expenses 32,229 31,053

Goodwill and other intangible assets, net 59,797 60,307

Other assets 109,323 104,229

Total assets 52,436,112 46,925,479

LIABILITIES AND MEMBERS’ EQUITY

Members’ accounts

Savings accounts 8,892,890 7,637,920

Money market savings accounts 7,672,947 6,822,286

Checking accounts 6,217,947 5,601,077

Share certificate accounts 10,234,440 9,493,829

Individual retirement accounts 4,347,208 4,084,953

Total members’ accounts 37,365,432 33,640,065

Liabilities

Securities sold under repurchase agreements 50,000 —

Notes payable 8,354,185 7,605,185

Drafts payable 196,108 158,005

Accrued expenses and accounts payable 389,749 303,069

Accrued interest payable 24,467 23,727

Other liabilities 179,824 116,613

Total members’ accounts and liabilities 46,559,765 41,846,664

Members’ equity

Regular reserve 349,808 349,808

Capital reserve 5,316,885 4,556,465

Undivided earnings 50,000 50,000

Accumulated other comprehensive income 159,654 122,542

Total members’ equity 5,876,347 5,078,815

Total liabilities and members’ equity $ 52,436,112 $ 46,925,479

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.