Navy Federal Credit Union 2012 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2012 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union28 Leading with Vision. Achieving Results. 29

2012 Financial Section

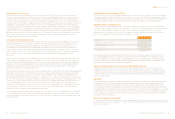

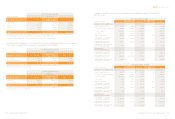

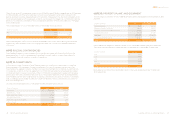

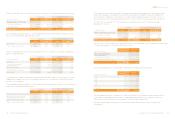

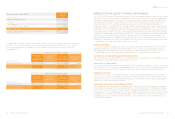

NOTE 15: MEMBERS’ ACCOUNTS

Interest rates on members’ share accounts are set by Navy Federal’s Board of Directors, based on an

evaluation of current and future market conditions.

Member deposit accounts as of December 31, 2012 and 2011 were as follows:

(dollars in thousands)

Weighted

Average Rate

for 2012

2012

Weighted

Average Rate

for 2011

2011

Money market 0.61% $ 7,672,947 0.71% $ 6,822,286

Savings 0.27% 8,436,922 0.32% 7,321,444

Member escrow 0.16% 143,181 0.22% 126,180

Checking 0.21% 6,217,947 0.27% 5,601,077

Share and IRA certificates 2.36% 13,887,953 2.63% 12,941,363

IRA shares 0.27% 517,224 0.32% 470,038

IRA MMSA 0.61% 176,471 0.69% 167,381

Investor custodial accounts 0.00% 312,787 0.00% 190,296

Total deposits $ 37,365,432 $ 33,640,065

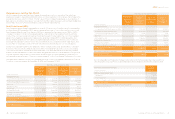

Overdrawn accounts totaled $23.7 million and $11.0 million as of December 31, 2012 and 2011, respectively,

and are classified as “Accounts receivable” in the Consolidated Statements of Financial Condition.

The Helping Families Save Their Homes Act of 2009, signed into law May 20, 2009, includes a provision

extending the $250,000 share insurance coverage provided by the National Credit Union Share Insurance

Fund through December 31, 2013. Previously, this level of coverage was set to expire on December 31,

2009. As such, the total uninsured amount of members’ accounts was $2.8 billion and $2.3 billion at

December 31, 2012 and 2011, respectively. Based on the original insurance coverage of $100,000 per

non-IRA account and $250,000 per IRA account, the amount of members’ accounts exceeding the

original coverage limits was $7.7 billion and $6.5 billion at December 31, 2012 and 2011, respectively.

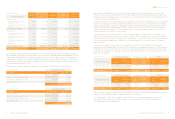

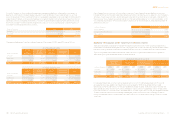

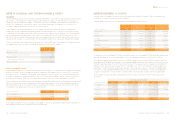

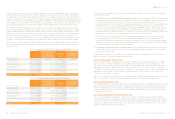

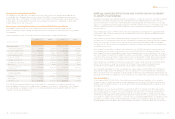

At December 31, 2012 and 2011, scheduled maturities of share certificates and IRA certificates were

as follows:

As of December 31, 2012

(dollars in thousands) 2013 2014 2015 2016 2017 Thereafter

0–2.00% $ 4,486,411 $ 1,503,492 $ 598,254 $ 79,670 $ 500,828 $ 841

2.01–3.00 1,170,643 39,198 346,027 407,897 86,246 582,776

3.01–4.00 98,504 473,181 130,097 15,519 620,434 611,569

4.01–5.00 814,947 14,551 299,612 456,868 5,375 —

5.01–6.00 242,029 302,679 23 — 11 —

6.01–7.00% 271 ————

Total $ 6,812,534 $ 2,333,372 $ 1,374,013 $ 959,954 $ 1,212,894 $ 1,195,186

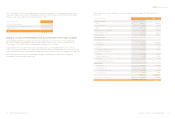

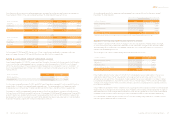

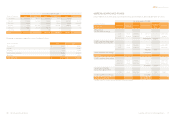

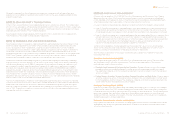

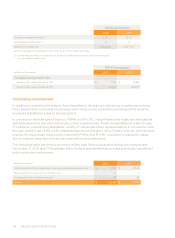

NOTE 14: GOODWILL AND OTHER INTANGIBLE ASSETS

Goodwill

Navy Federal recognizes the net assets acquired and liabilities assumed of acquired entities at estimated

fair value as of the acquisition date, and those fair values are subject to refinement as information

relative to the fair values at the date of acquisition becomes available. Navy Federal recognized the

excess of consideration over the fair value of net assets acquired in its acquisition of USAFCU on

October 1, 2010 as goodwill in the amount of $43.7 million.

In accordance with the requirements of ASC 350-20, Goodwill and Other, goodwill is evaluated for

impairment at the organizational reporting level annually and upon any changes in circumstances that

could likely result in reducing the fair value of a reporting unit below its carrying amount. Navy Federal

performed qualitative assessments of goodwill as of September 30, 2012 and 2011, pursuant to ASU

2011-08, Testing Goodwill for Impairment, and concluded that it was not likely that the fair value of any

reporting unit was below its carrying amount, and therefore did not recognize any impairment charges.

The following table summarizes the carrying amount of goodwill that is classified as “Goodwill and other

intangible assets, net” on the Consolidated Statements of Financial Condition:

(dollars in thousands)

Carrying Value

of Goodwill

December 31, 2010 $ 58,650

Post-acquisition adjustment 9/30/2011 254

December 31, 2011 58,904

Other adjustment during 2012 1

December 31, 2012 $ 58,905

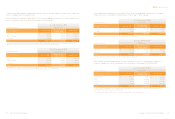

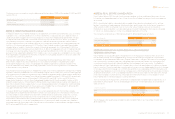

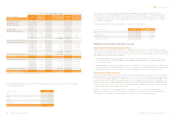

Other Intangible Assets

Navy Federal’s acquisition of USAFCU resulted in the recognition of a $2.0 million core deposit intangible

asset at October 1, 2010. Core deposit balances represent a favorable source of financing for financial

institutions, and a “core deposit intangible” asset represents the fair value of cost savings derived from

available core deposits acquired relative to the cost of alternative funding. The fair value of $2.0 million

recorded at October 1, 2010 was associated with money market accounts acquired from USAFCU.

The core deposit intangible is being amortized on a straight-line basis over its estimated remaining useful

life of four years. Amortization expense was $0.5 million during each of the years ended December 31,

2012 and 2011. The gross carrying amount, accumulated amortization, and net carrying amount of the

core deposit intangible were as follows at December 31:

(dollars in thousands) 2012 2011

Gross carrying amount $ 2,040 $ 2,040

Accumulated amortization (1,148) (638)

Net carrying amount $ 892 $ 1,402

Amortization expense of the core deposit intangible for the years ended December 31, 2013 and 2014 is

estimated to be $0.5 million and $0.4 million, respectively.