Navy Federal Credit Union 2012 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2012 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union10 Leading with Vision. Achieving Results. 11

2012 Financial Section

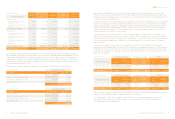

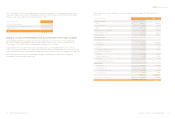

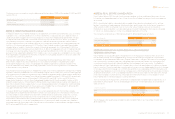

NOTE 2: RESTRICTIONS ON CASH

Navy Federal maintained a cash balance of $6.7 million as of December 31, 2011 with corporate credit

unions in the form of membership shares. These shares were not insured by the NCUSIF and required

three years’ notice prior to withdrawal. Navy Federal made a request to withdraw these shares in 2009

and subsequently closed out its membership with the corporate credit unions during 2012, leaving a

zero balance of membership shares as of December 31, 2012. As of December 31, 2011, Navy Federal

still maintained a cash balance of $50,000 as collateral for a line of credit with a corporate credit union,

which was also withdrawn during 2012, leaving a zero balance as of December 31, 2012.

All restricted cash amounts except membership capital shares are classified as “Other assets” on the

Consolidated Statements of Financial Condition.

NFFG had $1.0 million and $1.1 million set aside in restricted cash at December 31, 2012 and 2011,

respectively, as part of the agreement it entered into with Charlie Mac, LLC. See Note 8 for details.

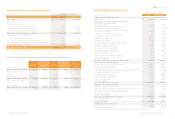

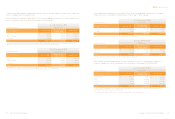

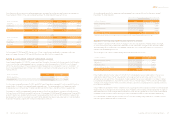

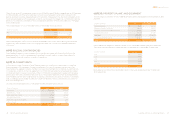

NOTE 3: INVESTMENTS

Navy Federal’s HTM and AFS securities as of December 31, 2012 and 2011 were as follows:

(dollars in thousands) Weighted

Average

Yield

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses)

Estimated

Fair Value

December 31, 2012

Held-to-maturity

U.S. government and federal

agency securities 2.47% $ 440,256 $ 15,612 $ — $ 455,868

Residential mortgage-backed

securities 0.62% 29,496 126 — 29,622

Total held-to-maturity 469,752 15,738 — 485,490

Available-for-sale

U.S. government and federal

agency securities 2.30% 5,998,082 304,812 (1,106) 6,301,788

Residential mortgage-backed

securities 2.12% 4,512,747 163,130 (1,884) 4,673,993

Commercial mortgage-backed

securities 2.90% 13,969 1,019 — 14,988

Bank notes 2.33% 1,525,505 55,037 (791) 1,579,751

Municipal securities 3.33% 95,952 2,412 (289) 98,075

Mutual funds -0.07% 10,939 — (11) 10,928

Total available-for-sale 12,157,194 526,410 (4,081) 12,679,523

Total securities $ 12,626,946 $ 542,148 $ (4,081) $ 13,165,013

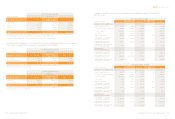

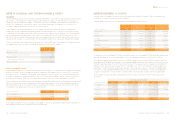

Pension Accounting and Retirement Benefit Plans

Navy Federal has defined benefit pension plans, 401(k) and 457(b) savings plans, and a non-qualified

supplemental retirement plan. Navy Federal also provides a contributory group medical plan for retired

employees. Navy Federal accounts for its defined benefit pension plans in accordance with ASC 715,

Compensation—Retirement Benefits. See Note 17 for details.

Income Taxes

Pursuant to the Federal Credit Union Act, Navy Federal is exempt from the payment of federal and state

income taxes. NFFG is a limited liability corporation, and thus is an entity “disregarded for federal tax

purposes” under the Internal Revenue Service Revenue Ruling.

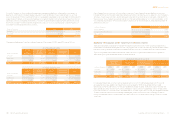

Dividends

Dividend rates on members’ accounts are set by the Board of Directors, and dividends are charged to

expense. Dividends on all share products are paid monthly.

Reclassifications

Certain amounts in the prior year have been reclassified to conform to the current year presentation.

New Accounting Pronouncements

In April 2011, the FASB issued Accounting Standards Update (ASU) 2011-02, A Creditor’s Determination

of Whether a Restructuring is a Troubled Debt Restructuring, eective for the year ended December

31, 2012. The purpose of this ASU was to address diversity in practice issues and help creditors in

determining whether a creditor has granted a concession and whether a debtor is experiencing financial

diculties for the purpose of determining whether a restructuring constitutes a TDR. The adoption of this

ASU did not significantly impact Navy Federal’s consolidated financial statements.

In April 2011, the FASB issued ASU 2011-3, Transfers and Servicing: Reconsideration of Eective Control

for Repurchase Agreements, eective for the year ended December 31, 2012. This ASU removed one of

the criteria considered to meet FASB’s definition of eective control, one of the factors required for sales

accounting treatment of repurchase agreements. The adoption of this ASU did not impact Navy Federal’s

consolidated financial statements.

In May 2011, the FASB issued ASU 2011-04, Amendments to Achieve Common Fair Value Measurement

and Disclosure Requirements in U.S. GAAP and IFRSs, eective for the year ended December 31, 2012.

The adoption of this ASU did not impact Navy Federal’s consolidated financial statements.

In June 2011, the FASB issued ASU 2011-05, Presentation of Comprehensive Income, eective for the

year ended December 31, 2012. It requires that all items that meet the definition of comprehensive income

be reported in a financial statement for the period recognized. Navy Federal has chosen to report its

components of comprehensive income in a separate statement. See the Consolidated Statements of

Comprehensive Income.