Navy Federal Credit Union 2012 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2012 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union26 Leading with Vision. Achieving Results. 27

2012 Financial Section

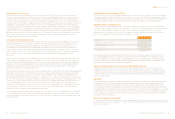

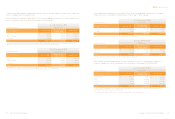

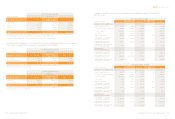

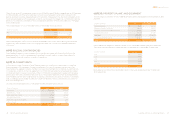

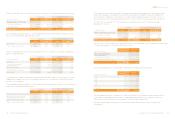

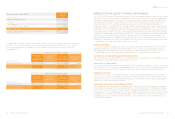

NOTE 13: PROPERTY, PLANT, AND EQUIPMENT

The following is a summary of Navy Federal’s property, plant, and equipment at December 31, 2012

and 2011:

(dollars in thousands) 2012 2011

Land and buildings $ 731,925 $ 709,360

Equipment, furniture, and fixtures 365,418 376,350

Computer software and capitalized IT projects 424,745 326,421

Leasehold improvements 106,599 110,088

Subtotal 1,628,687 1,522,219

Less: Accumulated depreciation (786,402) (692,356)

Total $ 842,285 $ 829,863

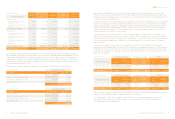

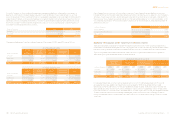

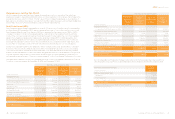

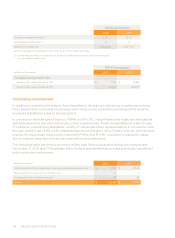

Navy Federal has obligations under a number of non-cancelable operating leases for premises.

The future minimum payments under the terms of the leases as of December 31, 2012 were:

(dollars in thousands) Amount

2013 $ 16,653

2014 12,915

2015 10,195

2016 8,668

Thereafter 11,995

Total $ 60,426

Rent expense was $21.6 million and $20.9 million for the years ended December 31, 2012 and

2011, respectively.

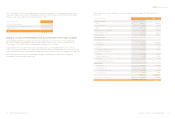

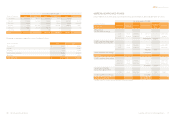

The notional value of forward sales contracts was $2.4 billion and $1.1 billion, respectively, as of December

31, 2012 and 2011. All of these forward sales contracts are scheduled to settle within a three-month

period, and their note rates range between 2.5% and 4.0%. Management has the intent and ability to fill

the incremental balance of forward sales contracts over the open mortgage loan commitments with the

balance of closed loans classified on the Consolidated Statements of Financial Condition as “Mortgage

loans awaiting sale.”

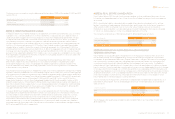

The unrealized gain or loss on these derivatives at December 31 was as follows:

(dollars in thousands) 2012 2011

Gain $ 1,402 $ 25

Loss (3,115) (7,337)

Net $ (1,713) $ (7,312)

Net unrealized gains of $33.4 million and net unrealized losses of $2.6 million during 2012 and 2011,

respectively, are included in “Gain on mortgage loan sales, net” on the Consolidated Statements

of Income.

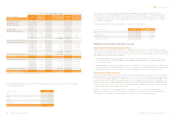

NOTE 11: LEGAL CONTINGENCIES

Navy Federal is a party to various legal actions normally associated with financial institutions, the

aggregate eect of which, in management’s and legal counsel’s opinion, would not be material to

Navy Federal’s financial condition or results of operations.

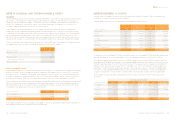

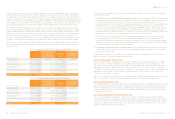

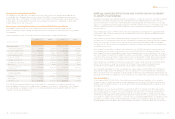

NOTE 12: COMMITMENTS

In the normal course of business, Navy Federal enters into conditional commitments to meet the

financing needs of its members. Unused commitments for loans to members are amounts that

Navy Federal has agreed to lend to members as long as the members do not default on existing loans

or violate any condition of the loan agreement. Commitments generally have fixed expiration dates

or other termination clauses. Since many of the commitments are expected to expire without being

drawn upon, the total commitment amounts do not necessarily represent future cash requirements.

Navy Federal uses the same credit policies in making commitments as it does for all loans to members

and, accordingly, at December 31, 2012, the credit risk related to these commitments was similar to

that on its existing loans.

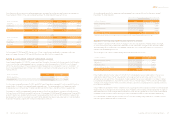

Unused commitment balances as of December 31, 2012 and 2011 were as follows:

(dollars in thousands) 2012 2011

Credit cards $ 9,480,072 $ 7,760,576

Overdraft lines of credit 770,056 707,678

Home equity lines of credit 923,661 973,931

Pre-approved auto loans 249,953 187,930

Utility deposit guarantee programs 1,817 2,035

Letters of credit 7,870 7,820

Total $ 11,433,429 $ 9,639,970