Navy Federal Credit Union 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Navy Federal Credit Union22 Leading with Vision. Achieving Results. 23

2012 Financial Section

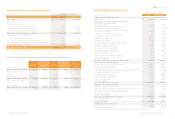

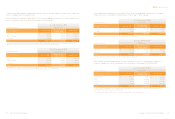

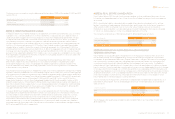

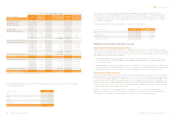

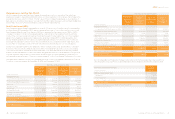

Accretable yield activity for acquired credit-impaired loans was as follows for the years ended

December 31, 2012 and 2011:

Accretable Yield

(dollars in thousands) 2012 2011

Balance, beginning of period $ 28,770 $ 38,328

Accretion (4,524) (4,889)

Net reclassifications* 2,566 (1,446)

Removals (4,106) (3,223)

Balance, end of period $ 22,706 $ 28,770

*Includes transfers between accretable and non-accretable as well as Navy Federal and USAFCU loan IDs.

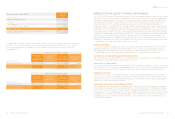

NOTE 7: MORTGAGE SERVICING RIGHTS (MSRs)

Navy Federal capitalizes MSRs when mortgage loans are sold and Navy Federal retains the right

to service the loans. Navy Federal records MSRs at fair value with changes in fair value recorded

and separately disclosed in the Consolidated Statement of Income. MSR valuation is sensitive to

interest rate and prepayment risk.

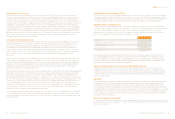

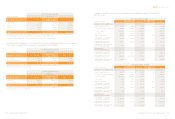

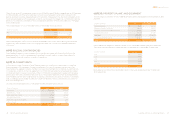

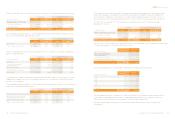

The changes in fair value of MSRs during 2012 and 2011 were as follows:

(dollars in thousands) 2012 2011

Balance, beginning of period $ 142,368 $ 161,150

Originations 52,773 32,476

Payos/Maturities (39,642) (21,426)

(Loss) on changes in value of MSRs (11,410) (29,832)

Balance, end of period $ 144,089 $ 142,368

Navy Federal obtains the fair value of its MSRs from a third-party service organization. The service

organization determines the fair value by discounting projected net servicing cash flows of the

remaining servicing portfolio. The valuation model used by the service organization considers market

loan prepayment predictions and other economic factors. The fair value of MSRs is mostly aected by

changes in mortgage interest rates since rate changes cause the loan prepayment acceleration factors

to increase or decrease.

Navy Federal received $61.7 million and $57.5 million during the years ended December 31, 2012 and 2011,

respectively, in mortgage loan servicing fees. Navy Federal’s servicing fees are priced based on agency-

required minimums. Late charges and miscellaneous fees are recognized as income when received and

totaled $1.4 million and $1.1 million during the years ended December 31, 2012 and 2011, respectively.

As of December 31, 2012 and 2011, the amount of loans serviced by Navy Federal for outside investors

was $16.7 billion and $15.9 billion, respectively.

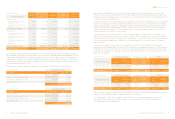

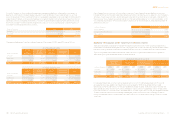

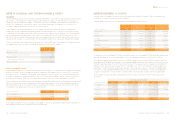

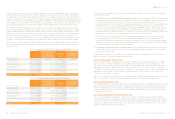

Cumulative total loan amounts, related impairment, average loan balances, and interest recognized on

Navy Federal’s TDRs for the years ended December 31, 2012 and 2011 were as follows:

2012

(dollars in thousands) Loan Amount Average Balance Interest Impairment

Consumer $ 254,513 $ 169,283 $ 24,433 $ 63,864

Credit card 142,756 146,411 13,354 51,906

Real estate 465,964 452,660 13,400 58,389

Total $ 863,233 $ 768,354 $ 51,187 $ 174,159

2011

(dollars in thousands) Loan Amount Average Balance Interest Impairment

Consumer $ 84,053 $ 106,659 $ 6,742 $ 7,141

Credit card 150,067 127,623 8,322 32,873

Real estate 439,356 406,515 9,908 41,343

Total $ 673,476 $ 640,797 $ 24,972 $ 81,357

At December 31, 2012 and 2011, the amount of loan commitments available to members that had

previously been through a TDR was $43.0 million and $28.4 million, respectively.

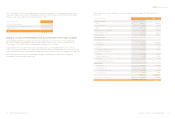

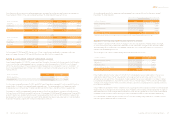

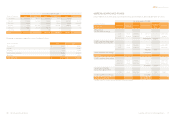

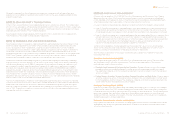

NOTE 6: ACQUIRED CREDIT-IMPAIRED LOANS

Navy Federal applies ASC 310-30, Loans and Debt Securities Acquired with Deteriorated Credit Quality,

to account for the credit-impaired loans in connection with the acquisition of USAFCU on October 1,

2010. The carrying value of these acquired credit-impaired loans is included in “Loans to members” on

the Consolidated Statements of Financial Condition, and their outstanding balances at December 31

were as follows:

(dollars in thousands) 2012 2011

Outstanding balance $ 81,067 $ 81,516

Carrying amount $ 38,814 $ 47,560

For the years ended December 31, 2012 and 2011, Navy Federal recognized $3.1 million and $3.5 million,

respectively, of interest on acquired credit-impaired loans. The average balance of acquired credit-

impaired loans as of December 31, 2012 and 2011 was $43.2 million and $55.6 million, respectively.

Decreases in cash flows expected to be received on these loans resulted in increases in the allowance

for loan losses of $0.9 million and $6.1 million as of December 31, 2012 and 2011, respectively. During 2012

and 2011, previously established allowances were reduced by $4.4 million and $5.0 million, respectively,

because either cash flow received was significantly greater than previously expected or it was probable

that there would be a significant increase in expected cash flows.