Navy Federal Credit Union 2008 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

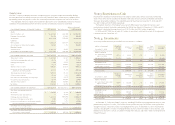

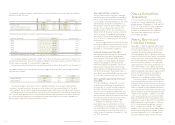

derivative financial instruments at December 31,

2008 and 2007: mortgage loan commitments to

members at specified interest rates and forward sales

contracts to offset the risk of making the mortgage

loan commitments at specified interest rates. See

Note 7 for details.

Pension Accounting and Retirement

Benefit Plans

Navy Federal has defined benefit pension plans,

401(k) and 457(b) savings plans and a non-qualified

supplemental retirement plan. Navy Federal also

provides a contributory group medical plan for retired

employees. Navy Federal accounts for its defined

benefit pension plans in accordance with SFAS

No. 87, Employers’ Accounting for Pensions. Non-

pension postretirement benefits are accounted for

in accordance with SFAS No. 106, Employers’

Accounting for Postretirement Benefits Other Than

Pensions. In 2004, Navy Federal adopted SFAS No.

132, Employers’ Disclosures about Pensions and

Other Postretirement Benefits. As of December 31,

2007, Navy Federal adopted SFAS No. 158, Employ-

ers’ Accounting for Defined Benefit Pension and

Other Postretirement Plans. See Note 13 for more

information.

Income Taxes

Pursuant to the Federal Credit Union Act, Navy Federal

is exempt from the payment of federal and state

income taxes. NFFG is a limited liability corporation

and thus, is an entity “disregarded for federal tax

purposes” under Internal Revenue Service Revenue

Ruling. Consequently, it did not incur federal or state

income tax liability.

Dividends

Dividend rates on members’ accounts are set by

the Board of Directors and dividends are charged

to operations. Dividends on all share products are

paid monthly.

Reclassifications

Certain amounts in the prior year have been

reclassified to conform to current year presentation.

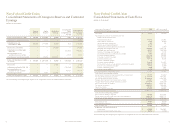

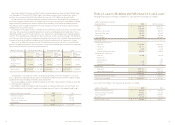

Note 2: Restatement of 2007

Financial Statements

Navy Federal chose to restate its 2007 financial

statements for adjustments related to deferred

loan fees under Statement of Financial Accounting

Standards No. 91, Accounting for Nonrefundable

Fees and Costs Associated with Originating and

Acquiring Loan and Initial Direct Costs of Leases

(SFAS No. 91), certain loan sales under Statement

of Financial Accounting Standards No. 140, Account-

ing for Transfers and Servicing of Financial Assets

and Extinguishments of Liabilities (SFAS No. 140)

and property leases under Statement of Financial

Accounting Standards No. 13, Accounting for

Leases (SFAS No. 13) as further described below:

SFAS No. 91 Adjustment

SFAS No. 91 establishes the accounting for nonre-

fundable fees and costs associated with lending,

committing to lend, or purchasing a loan or group

of loans. Prior to 2008, Navy Federal did not apply

SFAS No. 91 as the impact was not material. Navy

Federal implemented SFAS No. 91 in 2008 and

chose to restate 2007 in order to show comparative

statements for the years ended 2008 and 2007.

SFAS No.140 Adjustment

Navy Federal sold certain mortgage loans to the

Federal National Mortgage Association (Fannie Mae)

and accounted for these loans as sales transactions

under SFAS No. 140. In 2008, it was determined

that these transactions should have been treated as

secured borrowings. Therefore, Navy Federal restated

its 2007 financial statements to reflect the impact of

accounting for these transactions as secured borrow-

ings. The contract with Fannie Mae was amended

in August 2008, and accordingly, the loans were

treated as sales at that time. A recourse obligation

of $1.4 million was established in 2008 which was

reflected in Other Liabilities.

for loan and lease products are deferred and

amortized over the life of the loans under SFAS No.

91, Accounting for Nonrefundable Fees and Costs

Associated With Originating or Acquiring Loans and

Initial Direct Costs of Leases.

Navy Federal currently uses the direct financing

method to account for all automobile leases. Under

this method, lease contract receivables are the total

minimum lease payments plus residual value of

the leased automobiles, net of unearned interest

revenue. Interest revenue is recognized monthly

on receipt of rental payment.

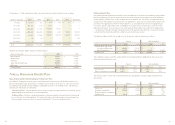

Allowance for Loan Losses

Navy Federal accrues estimated losses in accordance

with SFAS No. 5, Accounting for Contingencies. The

allowance for loan losses is established through a

provision for loan losses charged to expense. Loan

principal is charged against the allowance for loan

losses when management believes that the collectibil-

ity of the amount is unlikely; subsequent recoveries

are credited to the allowance for loan losses. Navy

Federal’s loan portfolio consists mainly of large groups

of smaller balance homogeneous loans that are

collectively evaluated for impairment. The allowance

for loan losses is maintained at a level that, in man-

agement’s judgment, is sufficient to absorb losses

inherent in the portfolio, based on evaluations of the

collectibility of loans and prior loan loss experience.

The evaluations take into consideration such factors

as changes in the value of loans outstanding, prior

history of charge-offs and recoveries, overall delin-

quency and delinquencies by loan product, and

current economic conditions and trends that may

affect a borrower’s ability to pay. The allowance

for loan and lease losses is reviewed on a monthly

basis and the provision that is charged to expense

is adjusted accordingly.

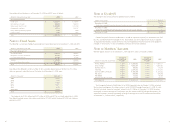

Fixed Assets

Land is carried at cost. Building, leasehold improve-

ments, furniture, fixtures, and equipment are carried

at cost, less accumulated depreciation and amortiza-

tion. Buildings, furniture, fixtures and equipment are

depreciated using the straight-line method over their

estimated useful lives. The cost of leasehold improve-

ments is amortized over the lease term or the useful

life of the improvement, whichever is shorter.

Navy Federal uses the straight-line method to

account for its operating leases. Under this method,

Navy Federal divides the total contractual rent by the

total term of the lease. The average monthly rent is

recorded as rent expense and the remaining rent

amount is deferred.

NCUSIF Deposit

The deposit in the National Credit Union Share

Insurance Fund (NCUSIF) is in accordance with the

Federal Credit Union Act and the National Credit

Union Administration (NCUA) regulations, which

require the maintenance of a deposit by each insured

credit union in an amount equal to one percent of

its insured shares. The deposit would be refunded to

Navy Federal if its insurance coverage is terminated,

it converts to insurance coverage from another

source, or the operations of the fund are transferred

from the NCUA Board.

See Note 21 for additional information about the

NCUSIF deposit.

Goodwill

Goodwill represents the excess of purchase price

over the fair value of net assets acquired in business

combinations. SFAS No. 142, Goodwill and Other

Intangible Assets, provides that intangible assets

with finite useful lives be amortized and that goodwill

and intangible assets with indefinite lives not be

amortized, but rather be tested at least annually for

impairment. Navy Federal tests goodwill for impair-

ment quarterly in compliance with SFAS No. 142.

Impairment exists when the carrying amount of

the goodwill exceeds its implied fair value.

Derivative Financial Instruments

In compliance with SFAS No. 133, Accounting for

Derivative Instruments and Hedging Activities, all

derivative financial instruments are recognized on the

balance sheet at fair value. Changes in the fair value

of derivative financial instruments are recorded in

current earnings. Navy Federal owned the following

NAVY FEDERAL CREDIT UNION

8 9

2008 FINANCIAL SECTION

Useful Life

Buildings 24 to 40 years

Furniture and equipment 5 to 7 years

Computer equipment 2 to 5 years

Computer software 5 years