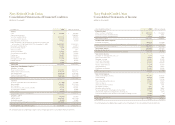

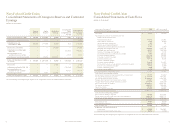

Navy Federal Credit Union 2008 Annual Report Download - page 8

Download and view the complete annual report

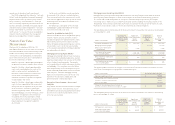

Please find page 8 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.zation of premiums and accretion of discounts.

Management has the ability and intent to hold

these securities to maturity.

Securities classified as available-for-sale are carried

at fair value, with any unrealized gains and losses

recorded as a separate component of members’

equity (see Note 4). Gains and losses on dispositions

are computed using the specific identification

method. Resale and repurchase agreements are

treated as financing transactions and are carried at

the amounts at which the securities were initially

acquired or sold. Navy Federal takes title to securities

purchased under resale agreements, monitors the fair

value of the underlying securities, (which are prima-

rily U.S. Government and federal agency securities)

and requests additional collateral when appropriate.

Declines in the fair value of held-to-maturity and

available-for-sale securities below their cost that are

deemed to be other than temporary are reflected in

earnings as realized losses. In estimating other-than-

temporary impairment losses, management considers

(1) the length of time and the extent to which the

fair value has been less than cost, (2) the financial

condition and near-term prospects of the issuer,

(3) the intent and ability to retain the investment for

a period of time that is sufficient to allow for any

anticipated recovery in fair value, and (4) materiality.

Mortgage Loans Awaiting Sale

Mortgage loans awaiting sale are carried at the lower

of original cost or market value in compliance with

SFAS No. 65, Accounting for Certain Mortgage Bank-

ing Activities. Market value is determined on a loan

by loan basis and is based on a market price offered

by the appropriate government sponsored enterprise

at the end of each month. Net unrealized losses are

recognized through a valuation allowance by charges

to income. Mortgage loans awaiting sale are sold

with the mortgage servicing rights retained by

Navy Federal.

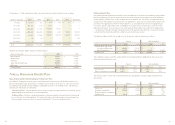

Credit Enhanced Mortgage Loans

In February 2004, Navy Federal entered into an agree-

ment with NFFG and Charlie Mac, LLC, an investor

subsidiary of U.S. Central Credit Union, in which

Charlie Mac purchases up to $200.0 million of credit

enhanced mortgage loans from Navy Federal while

Navy Federal retains the mortgage servicing rights.

Should a credit enhanced loan default, Charlie Mac

will recover the loan amount from NFFG. The maxi-

mum total credit enhancement liability allowed in this

agreement is $8.5 million. Of that total, $1.0 million is

set aside by NFFG as non-current restricted cash with

a designated financial institution. For the remaining

amount of $7.5 million, Navy Federal issued an irrevo-

cable transferable standby letter of credit to Charlie

Mac as part of the agreement. In 2004, the aggre-

gate amount of credit enhanced mortgage loans

purchased by Charlie Mac had reached the $200.0

million limit. At the time of origination, all loans pur-

chased pursuant to the agreement had FICO credit

scores, loan to value ratios and debt to income ratios

greater than those required by the agreement. During

2008 and 2007, no new loans were sold to Charlie

Mac under this agreement. The total principal balance

of these loans as of December 31, 2008 and 2007,

was $122.7 million and $138.3 million, respectively.

As of December 31, 2008, there were no delinquent

loans under this agreement. Navy Federal has not

accrued an estimated loss regarding the credit en-

hanced mortgage loans for it is less than probable

that a liability had been incurred at the date of the

financial statements. Any liability reasonably expected

to result from this agreement is not expected to be

material to Navy Federal.

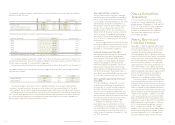

Loans and Leases

Loans, except for mortgage loans awaiting sale,

are stated at the amount of unpaid principal less

an allowance for loan losses. Interest on loans is

recognized on an accrual basis except for credit card

interest which is recognized on the member’s state-

ment date. Interest on loans is calculated using the

simple-interest method on the principal amount out-

standing except for credit cards. Interest on credit

cards is calculated by applying the periodic rate to

the average daily balance outstanding. Accrual of

interest on all loans is discontinued where manage-

ment believes collectibility is uncertain or payments

of principal or interest are past due by more than 90

days. All interest accrued but not collected on loans

that are placed in non-accrual status is reversed

against interest income. The interest on these loans

is accounted for on the cash basis until the loans

return to accrual status. Loans are returned to accrual

status when all the principal and interest amounts

contrac tually due are brought current and future

payments are reasonably assured. Fees and costs

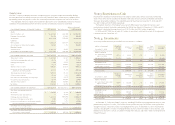

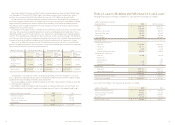

Note 1: Summary of

Significant Accounting

Policies

Navy Federal Credit Union is a member-owned,

not-for-profit financial institution formed to provide

a variety of savings and lending programs to those

individuals in its field of membership which includes

military and civilian personnel who are or were

employed by the Department of the Navy and their

families. During the 2nd quarter of 2008, Navy

Federal expanded its field of membership to include

the Department of Defense and their families.

Navy Federal Financial Group (NFFG) is a wholly-

owned credit union service organization that provides

investment, insurance and other financial services to

members of Navy Federal Credit Union. Navy Federal

Brokerage Services and Navy Federal Asset Manage-

ment are wholly-owned subsidiaries of NFFG. In this

Annual Report, Navy Federal Credit Union and NFFG

(consolidated) are called Navy Federal.

Navy Federal Real Estate Services (NFRES), which

was a wholly-owned subsidiary of NFFG, discontinued

its operations as of December 31, 2008. NFFG lost

$1.2 million in its investment in NFRES.

The significant accounting policies are:

Basis of Accounting

Navy Federal maintains its accounting records on the

accrual basis, which is in accordance with accounting

principles generally accepted in the United States of

America (GAAP).

Consolidation

The consolidated financial statements include the

accounts of Navy Federal Credit Union and NFFG.

Significant intercompany accounts and transactions

were eliminated in consolidation.

Change in Accounting Principle

In September 2006, the Financial Accounting

Standards Board (FASB) issued Statement of Financial

Accounting Standards (SFAS) No. 157, Fair Value

Measurements. SFAS 157 enhances existing guid-

ance for measuring assets and liabilities using fair

value. Prior to the issuance of SFAS No. 157, guid-

ance for applying fair value was incorporated in

several accounting pronouncements. SFAS No. 157

provides a single definition of fair value, establishes

a consistent framework for measuring fair value,

and expands disclosure requirements for fair value

measurements.

Navy Federal adopted SFAS No. 157 on its effec-

tive date of January 1, 2008 and the adoption did

not have a material impact on financial condition,

results of operations, or liquidity. Furthermore,

as permitted under FASB Staff Position (FSP) No.

157-2, Effective Date of FASB Statement No. 157,

Navy Federal elected to defer the application of

SFAS No. 157 to certain non-financial assets and

liabilities, which are measured at fair value on a

recurring basis, until January 1, 2009.

See Note 16 for a discussion regarding the January

1, 2008 implementation of SFAS No. 157 relating to

Navy Federal’s financial assets and liabilities.

Use of Estimates

The preparation of consolidated financial statements

in conformity with GAAP requires management to

make estimates and assumptions that affect the

reported amounts of assets, liabilities, revenues and

expenses and the disclosure of contingent assets

and liabilities in the consolidated financial statements

and accompanying notes. Actual results could differ

from those estimates.

Cash

For purposes of the consolidated financial statements,

cash includes cash and balances due from banks and

other credit unions.

Short Term Investments

For purposes of the consolidated financial statements,

short term investments include federal funds sold and

securities purchased under agreements to resell, all

of which have original maturities of 90 days or less.

As of December 31, 2008 and 2007, all short term

investments were recorded at cost which approxi-

mated market value.

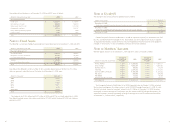

Securities

Investment securities are classified as held-to-matu-

rity or available-for-sale in compliance with SFAS No.

115, Accounting for Certain Investments in Debt and

Equity Securities. Investments classified as held-to-

maturity are carried at cost, adjusted for the amor ti-

NAVY FEDERAL CREDIT UNION

6 7

2008 FINANCIAL SECTION