Navy Federal Credit Union 2008 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15

2008 FINANCIAL SECTION

Loans on which the accrual of interest has been discontinued totaled $264.6 million and $134.1 million at

December 31, 2008 and 2007, respectively. If interest on those loans had been accrued at original contracted

rates, interest income would have been approximately $9.3 million and $5.0 million higher for 2008 and

2007, respectively.

Navy Federal originates mortgage loans both for sale and for its own portfolio. Navy Federal originated

$5.7 billion and $5.1 billion of first mortgage loans for its members in 2008 and 2007, respectively, of which

$0.2 billion and $1.6 billion loans were sold in 2008 and 2007, respectively. At December 31, $26.3 billion and

$23.2 billion of originated mortgages were being serviced by Navy Federal in 2008 and 2007, respectively.

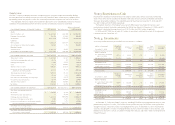

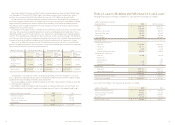

Note 6: Mortgage Servicing Rights

Navy Federal capitalizes Mortgage Servicing Rights (MSRs) when mortgage loans are sold and Navy Federal

retains the right to service the loans. Navy Federal adopted SFAS No. 156 in 2006 and elected to record MSRs

at fair value and discontinued amortizing servicing assets and also stopped assessing impairment adjustments

related to the servicing assets.

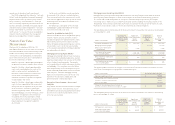

The changes in fair value of MSRs during 2008 and 2007 (as restated) were as follows:

Navy Federal obtains the fair value of its MSRs from a third-party service organization. The service organiza-

tion determines the fair value by discounting projected net servicing cash flows of the remaining servicing

portfolio. The valuation model used by the service organization considers market loan prepayment predictions

and other economic factors. The fair value of MSRs is mostly affected by changes in mortgage interest rates

since rate changes cause the loan prepayment acceleration factors to increase or decrease.

Navy Federal received mortgage loan servicing fees of $45.9 million and $47.5 million in 2008 and 2007

(as restated), respectively. Related late charges and miscellaneous fees totaled $1.1 million in both 2008 and

2007 (as restated).

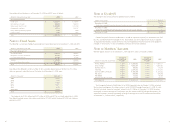

The key economic assumptions used in determining the fair value of MSRs at December 31, 2008

and 2007, were as follows:

NAVY FEDERAL CREDIT UNION

14

(dollars in thousands) 2008 2007 (as restated)

Balance, beginning of period $ 169,306 $ 181,525

Originations 28,211 13,516

(Loss) on changes in value of MSRs (66,323) (25,735)

Balance, end of period $ 131,194 $ 169,306

(at year-end) 2008 2007

Weighted average life (years) 4.97 6.32

Prepayment speed 16.34% 12.82%

Yield to maturity discount rate 9.83% 9.39%

Note 7: Derivative

Instruments and Economic

Hedging Activities

Navy Federal is an active participant in the production

of mortgage loans which are sold to investors in the

secondary market. This mortgage banking activity

involves making mortgage loan commitments to

members at specified interest rates. Navy Federal

is exposed to changes in the value of its mortgage

loan commitments as interest rates may change

between the time that it enters into a mortgage loan

commitment and the time that it ultimately delivers

mortgage loans to investors. To protect against this

interest rate risk, Navy Federal enters into forward

sales contracts at specified prices to deliver mortgage

loans to investors. These forward sales commitments

act as an economic hedge against the risk of changes

in the value of both the mortgage loan commitments

and mortgage loans awaiting sale. As required by

SFAS No. 133, Accounting for Derivative Instruments

and Hedging Activities, Navy Federal accounts for

both the mortgage loan commitments and the

forward sales contracts as derivative instruments on

its Consolidated Statements of Financial Condition

at fair value with changes in fair value included in

current earnings. These derivative instruments are

economic hedges to which Navy Federal does not

receive hedge accounting treatment.

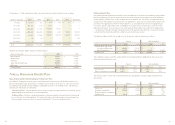

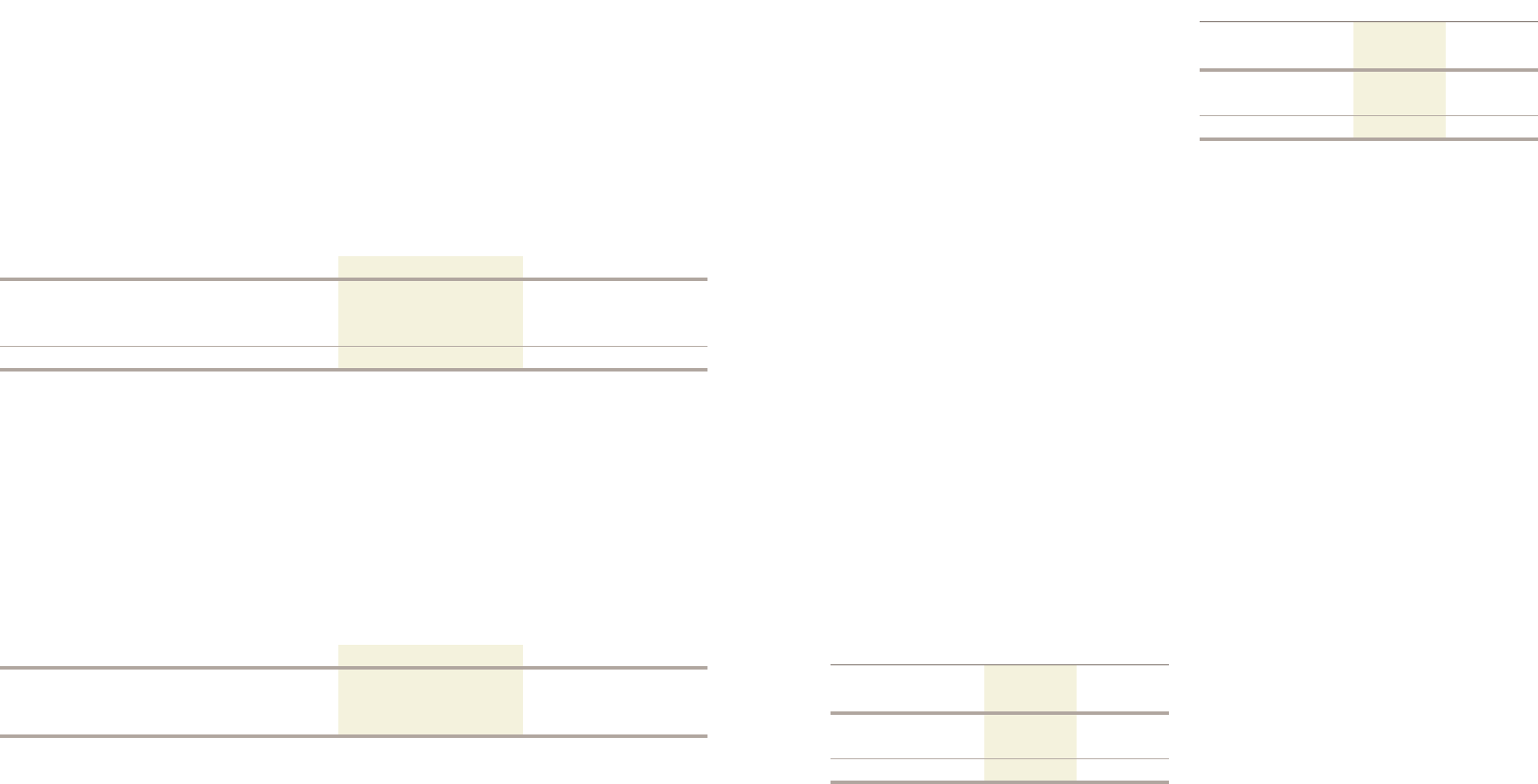

The notional value of the mortgage loan

commitments totaled $240.9 million and $43.8

million, respectively, as of December 31, 2008 and

2007. A gross gain and gross loss on these deriva-

tives at December 31, 2008 and 2007 were reported

as follows:

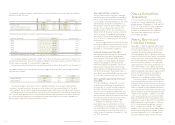

The notional value of the forward sales contracts

was $132.5 million and $109.5 million, respectively,

as of December 31, 2008 and 2007. A gross gain

and gross loss on these derivatives at December 31,

2008 and 2007, were reported as follows:

Navy Federal recognized the net gain of $5.3 million

and the net loss of $79,000 in the fair value of these

derivative instruments during 2008 and 2007, re-

spectively, and included it in earnings as “Unrealized

loss from derivative and economic hedging activities”

in the Consolidated Statements of Operations.

Note 8: Legal Contingencies

Navy Federal is a party to various legal actions

normally associated with financial institutions, the

aggregate effect of which, in management’s and

legal counsel’s opinion, would not be material

to the financial condition or results of operations

of Navy Federal.

Note 9: Commitments

Navy Federal is a party to conditional commitments

to lend funds in the normal course of business to

meet the financing needs of its members. Unused

commitments for loans to members are amounts

which Navy Federal has agreed to lend a member

as long as the member does not default on existing

loans or violate any condition of the loan agreement.

Commitments generally have fixed expiration dates

or other termination clauses. Since many of the

commitments are expected to expire without being

drawn upon, the total commitment amounts do

not necessarily represent future cash requirements.

Navy Federal uses the same credit policies in making

commitments as it does for all loans to members

and, accordingly, at December 31, 2008, the credit

risk related to these commitments was similar to

that on its existing loans.

(dollars in thousands at year-end)

Mortgage

loan commitments 2008 2007

Gain $ 5,229 $ 202

Loss — (119)

Net $ 5,229 83

(dollars in thousands at year-end)

Forward sales

contracts 2008 2007

Gain $ 151 $ 90

Loss (445) (547)

Net $ (294) (457)