Navy Federal Credit Union 2008 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NAVY FEDERAL CREDIT UNION

2 3

2008 FINANCIAL SECTION

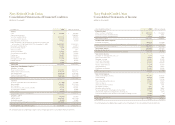

Navy Federal Credit Union

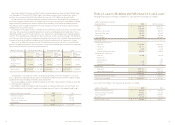

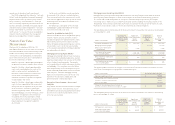

Consolidated Statements of Financial Condition

(dollars in thousands)

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.

December 31 2008 2007 (as restated)

ASSETS

Cash $ 534,400 $ 445,945

Short term investments 11,860,383

Securities available-for-sale 2,631,256 680,898

Securities held-to-maturity 225,179 821,598

Mortgage loans awaiting sale 66,522 67,836

Loans to members, net of allowance for loan losses of $512,479

at December 31, 2008 and $256,277 at December 31, 2007 30,585,853 27,856,129

Investment in FHLB-Atlanta 376,435 224,318

Interest-bearing deposits 31,626 1,039,190

Other investments 3,374 3,371

Accounts receivable 718,779 526,016

Accrued interest receivable 117,445 122,396

Fixed assets 706,427 538,975

NCUSIF deposit 204,965 193,118

Mortgage servicing rights 131,194 169,306

Prepaid expenses 17,137 95,698

Other assets 47,893 37,173

Total assets 36,398,486 34,682,350

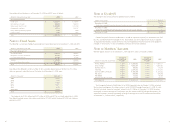

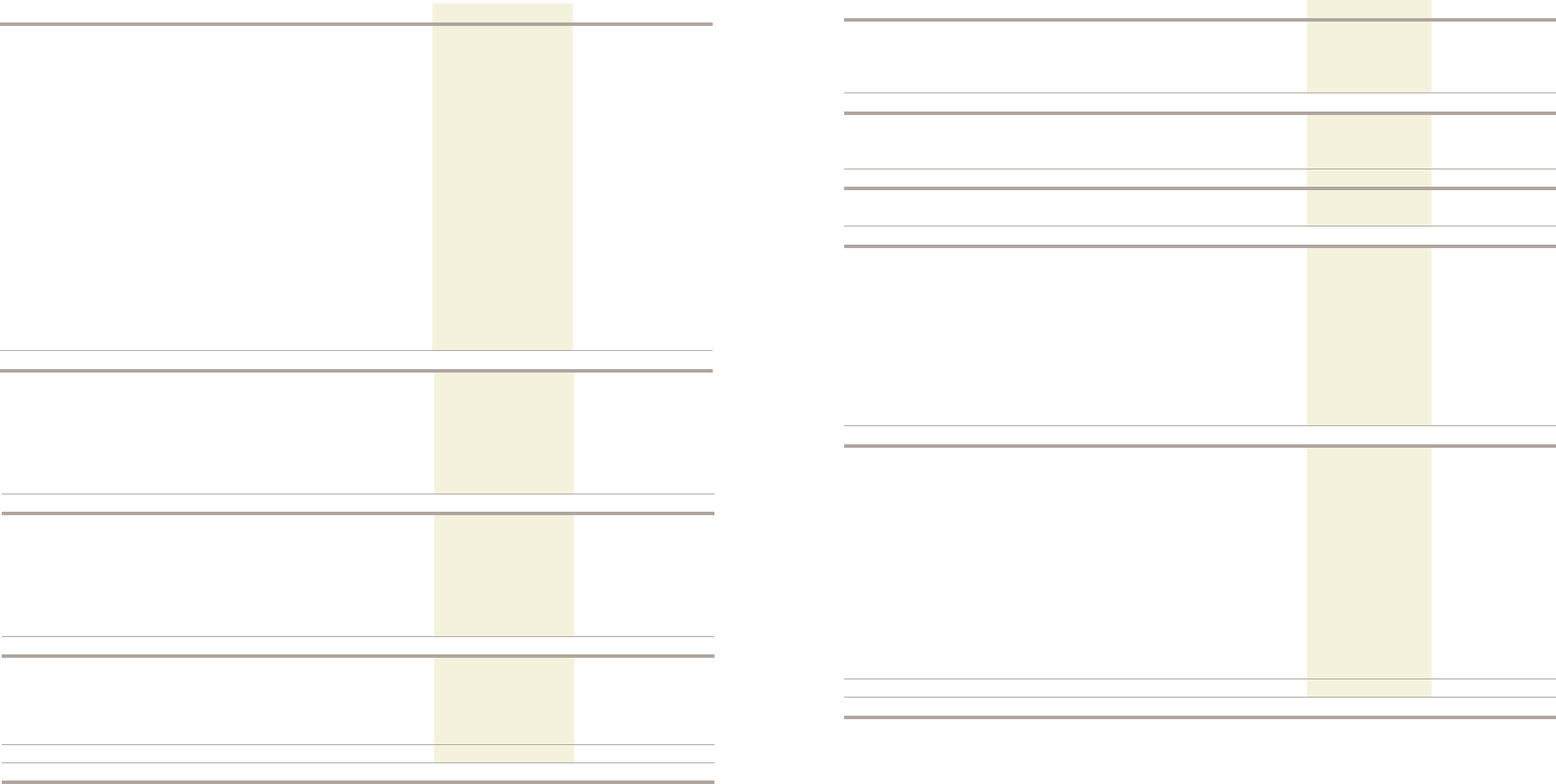

Years Ended December 31 2008 2007 (as restated)

Interest income

Interest on loans to members $ 2,085,317 $ 1,728,683

Interest on securities available-for-sale 68,582 6,931

Interest on securities held-to-maturity 73,672 213,921

Total interest income 2,227,571 1,949,535

Dividend and interest expense

Dividends to members 660,618 782,894

Interest on securities sold under repurchase agreements and notes payable 346,715 284,756

Total dividend and interest expense 1,007,333 1,067,650

Net interest income 1,220,238 881,885

Provision for loan losses (654,822) (283,902)

Net interest income after provision for loan losses 565,416 597,983

Non-interest income

(Loss)/gain on mortgage loan sales, net 5,735 11,331

Gain on investment sales 20,797 1,007

Mortgage servicing 45,931 47,470

Credit card interchange 106,159 98,196

Check card interchange 123,192 109,882

Payment protection plan 53,330 42,926

ATM convenience 14,695 16,457

Overdrawn checking fee 115,447 95,428

Other 59,112 35,629

Total non-interest income 544,398 458,326

Non-interest expense

Salaries and employee benefits 477,797 436,172

Office operating 142,850 120,992

Loan servicing 143,775 128,316

Professional and outside services 66,056 53,377

Office occupancy 67,635 48,958

Loan protection life insurance 904 1,931

Life savings insurance 1,021 851

Education and marketing 24,290 19,809

Fair value adjustment of mortgage servicing rights 66,323 25,735

Unrealized loss/(gain) on mortgage loans awaiting sale 866 (537)

Unrealized (gain)/loss from derivative and economic hedging activities (5,309) 79

Other 41,973 (9,430)

Total non-interest expense 1,028,181 826,253

Net income $ 81,633 $ 230,056

LIABILITIES AND MEMBERS’ EQUITY

Members’ accounts

Share savings accounts 4,997,956 4,646,477

Money market savings accounts 4,260,542 4,457,111

Checking accounts 3,579,195 3,181,833

Share certificate accounts 8,820,188 8,875,496

Individual retirement accounts 3,067,634 2,816,724

Total members’ accounts 24,725,515 23,977,641

Liabilities

Securities sold under repurchase agreements 311,500 873,002

Notes payable 7,809,672 6,127,835

Drafts payable 133,543 156,487

Accrued expenses and accounts payable 175,616 162,021

Accrued interest payable 33,187 23,045

Other liabilities 68,423 56,096

Total members’ accounts and liabilities 33,257,456 31,376,127

Members’ Equity

Regular reserve 349,808 349,808

Capital reserve 3,092,787 3,011,154

Undivided earnings 50,000 50,000

Accumulated other comprehensive income (351,565) (104,739)

Total members’ equity 3,141,030 3,306,223

Total liabilities and members’ equity $ 36,398,486 $ 34,682,350

Navy Federal Credit Union

Consolidated Statements of Income

(dollars in thousands)

The accompanying notes (beginning on page 6) are an integral part of these consolidated financial statements.