Navy Federal Credit Union 2008 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

11

2008 FINANCIAL SECTIONNAVY FEDERAL CREDIT UNION

10

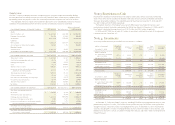

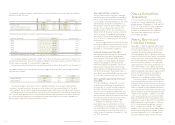

Note 3: Restrictions on Cash

Navy Federal is required to maintain balances with corporate credit unions that are classified as membership

shares. These shares are not insured by the National Credit Union Share Insurance Fund (NCUSIF) and require a

three-year notice before withdrawal. The required balance for Navy Federal at December 31, 2008 and 2007

was $28.3 million and $50.9 million, respectively.

The Board of Governors of the Federal Reserve System (FRB) requires Navy Federal to maintain a cash

reserve balance to cover transactions processed by the FRB for Navy Federal. At December 31, 2008 and 2007,

Navy Federal's clearing balance requirement was $100.0 million and $50.0 million, respectively.

In 2008 and 2007, NFFG has set aside $1.0 million as non-current restricted cash as part of the agreement

it entered into with Charlie Mac, LLC.

Note 4: Investments

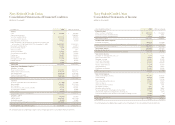

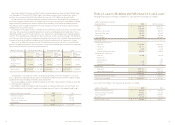

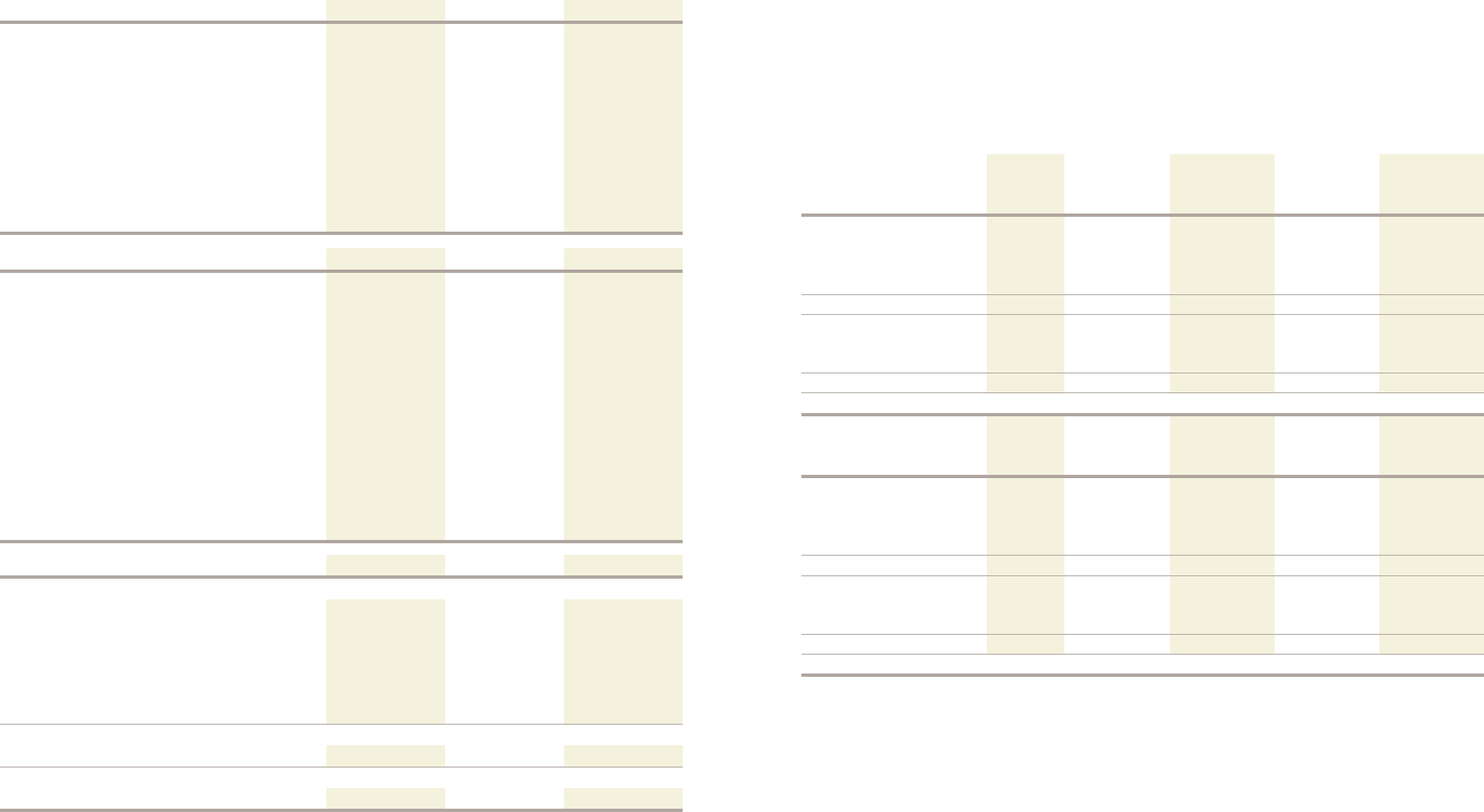

A summary of held-to-maturity and available-for-sale securities is as follows:

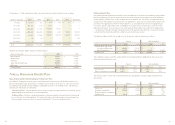

Property Leases

SFAS No. 13 requires a company to account for operating leases using the straight-line method by dividing

the total contractual rent due by the total lease term. Navy Federal has been accounting for its property leases

by recording annual rent payments rather than amortizing the contractual expense over the life of the lease.

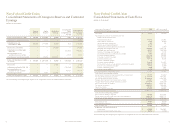

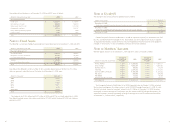

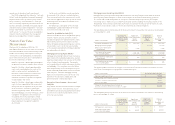

The table below shows the impact of the restatement adjustments to the Consolidated Statement of Financial

Condition, the Consolidated Statement of Income and the Consolidated Statement of Cash Flows:

(dollars in thousands)

Consolidated Statement of Financial Condition 2007-reported Total adjustments 2007-restated

Assets

Loans to members, net $ 26,231,035 $ 1,692,930 $ 27,923,965

Mortgage Servicing Rights 191,806 (22,500) 169,306

Total Assets 33,011,920 1,670,430 34,682,350

Liabilities

Notes payable 4,498,258 1,629,577 6,127,835

Accrued expenses and accounts payable 160,609 1,412 162,021

Member’s Equity

Capital Reserves 2,971,713 39,441 3,011,154

Total liabilities and member’s equity $ 33,011,920 $ 1,670,430 $ 34,682,350

Consolidated Statement of Cash Flows 2007-reported Total adjustments 2007-restated

Cash flows from operating activities:

Net income $ 236,206 $ (6,150) $ 230,056

Amortization of loan origination fees — 22,914 22,914

Mortgage loan sales proceeds 1,559,928 (464,250) 1,095,678

Decrease in mortgage servicing rights 6,901 5,317 12,218

Increase in accrued expenses and accounts payable 66,097 1,412 67,509

Net cash provided by operating activities 576,360 (440,757) 135,603

Cash flows from investing activities:

Net increase in loans to members (6,056,280) (19,477) (6,075,757)

Cash flows from financing activities:

Net increase in notes payable $ 3,480,190 $ 460,234 $ 3,940,424

Consolidated Statement of Income 2007-reported Total adjustments 2007-restated

Total interest income $ 1,882,308 $ 67,227 $ 1,949,535

Gain/(Loss) on mortgage loan sales, net 10,554 777 11,331

Mortgage Servicing Fees 51,293 (3,823) 47,470

Other 65,234 (29,605) 35,629

Total non-interest income 490,977 (32,651) 458,326

Interest on securities sold under repurchase

agreements and notes payable 193,621 91,135 284,756

Total dividend and interest expense 976,515 91,135 1,067,650

Office occupancy expense 47,546 1,412 48,958

FMV Adjustment of Mortgage Servicing Rights 28,252 (2,517) 25,735

Miscellaneous operating expense 39,874 (49,304) (9,430)

Total non-interest expense 876,662 (50,409) 826,253

Net income $ 236,206 $ (6,150) $ 230,056

At December 31, 2008, Navy Federal’s securities, excluding $2.5 billion in mortgage-backed securities, were

predominantly long-term in nature; $18.0 million maturing within one year, $38.9 million maturing from one

through three years, and $739.5 million maturing beyond three years. At December 31, 2007, Navy Federal's

securities, excluding $910.3 million in mortgage-backed securities and $418.7 million in other securities, were

predominantly short-term in nature; $3.2 billion maturing within one year, and $100.1 million maturing from one

through three years.

December 31, 2007

Weighted

Average

Yield

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses)

Estimated

Fair Value

Held-to-maturity

U.S. Government and federal

agency securities 4.06% $ 592,296 $ 212 $ (655) $ 591,853

Mortgage-backed securities 5.44% 229,302 647 (1,129) 228,820

Total held-to-maturity 821,598 859 (1,784) 820,673

Available-for-sale

CMO floaters 5.58% 680,975 235 (3,222) 677,988

Mutual Funds 4.46% 3,000 — (90) 2,910

Total available-for-sale 683,975 235 (3,312) 680,898

Total securities $ 1,505,573 $ 1,094 $ (5,096) $ 1,501,571

(dollars in thousands)

December 31, 2008

Weighted

Average

Yield

Amortized

Cost

Gross

Unrealized

Gains

Gross

Unrealized

(Losses)

Estimated

Fair Value

Held-to-maturity

U.S. Government and federal

agency securities 4.41% $ 25,219 $ 275 $—$ 25,494

Mortgage-backed securities 1.44% 199,960 — (6,300) 193,660

Total held-to-maturity 225,179 275 (6,300) 219,154

Available-for-sale

Mortgage-backed securities 2.40% 2,323,169 15,632 (81,156) 2,257,645

Federal agency securities 3.45% 359,701 13,910 — 373,611

Total available-for-sale 2,682,870 29,542 (81,156) 2,631,256

Total securities $ 2,908,049 $ 29,817 $ (87,456) $ 2,850,410