Navy Federal Credit Union 2008 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

23

2008 FINANCIAL SECTIONNAVY FEDERAL CREDIT UNION

22

Mortgage Loans Awaiting Sale (MLAS)

Mortgage loans awaiting sale are comprised of those loans that Navy Federal intends either to sell or to

securitize. Navy Federal sold loans in 2008, which resulted in an immaterial unrealized loss amount of

$0.1 million and started holding loans for sale again in December. Beginning in March, NFCU began

transferring loans in MLAS status to a GNMA securitization and then holding the resulting securities in the

AFS portfolio. Prior to sale or securitization, MLAS loans are carried at the lower of cost or market. As such,

MLAS loans are classified as Level 2 in the fair value hierarchy on a nonrecurring basis.

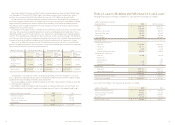

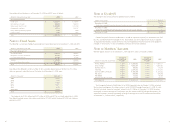

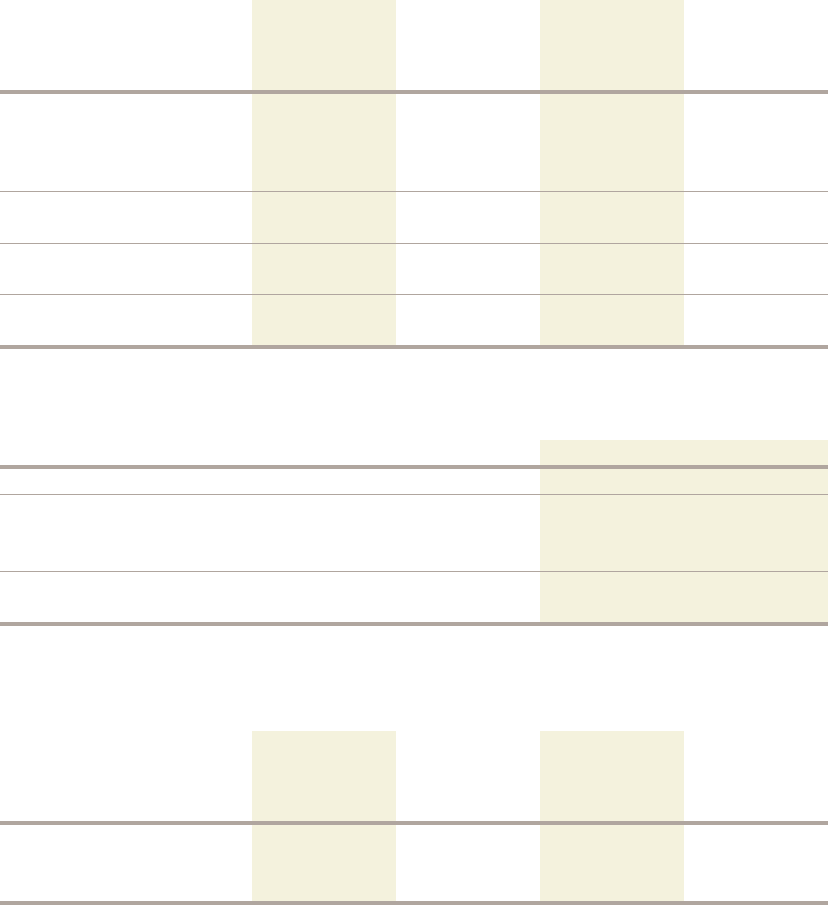

The table below presents the balances of the financial instruments measured at fair value on a recurring basis

as of December 31, 2008:

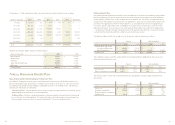

The following table summarizes the changes in fair value for all financial instruments measured at fair value

(Level 3) on a recurring basis using significant unobservable inputs:

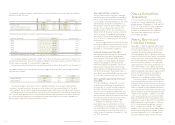

The table below presents the balances of the financial instruments measured at fair value on a nonrecurring

basis as of December 31, 2008:

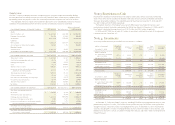

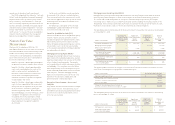

exceeds our risk based net worth requirement.

The NCUA categorized Navy Federal as “well capi-

talized” under the regulatory framework for prompt

corrective action with a net worth to assets ratio of

9.60% and 9.83% as of December 31, 2008 and

2007 (as restated), respectively. Net worth for this cal-

culation is defined as undivided earnings plus regular

and capital reserves. To be categorized as “well capi-

talized,” Navy Federal must maintain a minimum net

worth ratio of 7% of assets. There are no conditions

or events since that notification that management

believes have changed the institution’s category.

Note 16: Fair Value

Measurement

Effective with the adoption of SFAS No. 157,

Navy Federal determines the fair values of its financial

instruments based on the fair value hierarchy estab-

lished in that standard, which requires an entity to

maximize the use of quoted prices and observable

inputs when measuring fair value. A description of

the fair value hierarchy is as follows:

4Level 1—Valuation is based upon quoted prices

for identical instruments traded in active markets.

4Level 2—Valuation is based upon observable

inputs such as quoted prices for similar instru-

ments in active markets, quoted prices for

identical or similar instruments in markets that

are not active, and model-based valuation

techniques for which all significant assumptions

are observable in the market.

4Level 3—Valuation is based upon unobservable

inputs that are supported by little or no market

activity and that are significant to the fair value

of the instrument. Valuation is typically per-

formed using pricing models, discounted cash

flow methodologies, or similar techniques, which

incorporate management’s own estimates of

assumptions that market participants would

use in pricing the instrument or valuations that

require significant management judgment

or estimation.

Certain assets and liabilities may be required to

be measured at fair value on a nonrecurring basis.

These nonrecurring fair value measurements usually

result from the application of lower of cost or market

accounting or the write-down of individual assets

due to impairment.

The following is a description of the valuation

methodologies used by Navy Federal for financial

instruments measured at fair value:

Securities Available for Sale (AFS)

Securities available for sale are composed of agency

securities. Agency securities are bullet securities

issued by the government sponsored entities. Navy

Federal receives pricing for these bullet securities

from a third-party pricing provider. Agency securities

are classified as Level 2 in the fair value hierarchy

as the valuation provided by the third-party provider

uses observable market data.

Mortgage Servicing Rights (MSRs)

Mortgage Servicing Rights do not trade in an active,

open market with readily observable prices. Accord-

ingly, Navy Federal obtains the fair value of the MSRs

using a third-party pricing provider. The provider

uses a combination of market and income valuation

methodologies. All assumptions are market driven.

Once the preliminary results are complete, they are

further calibrated to observable market transactions,

when they exist. Therefore, Mortgage Servicing

Rights are classified within Level 3 of the fair value

hierarchy as the valuation is model driven and

primarily based on unobservable inputs.

Derivative Commitments—Assets and

Liabilities

Navy Federal uses derivative commitments to hedge

against interest rate risk. These derivatives (assets

and liabilities) are valued using quoted market prices

of similar assets and are classified within Level 2

of the fair value hierarchy.

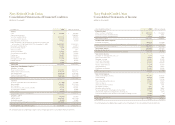

(dollars in thousands)

Quoted prices

in Active Markets

for Identical Assets

(Level 1)

Significant

Other Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance

as of

December 31,

2008

Mortgage loans awaiting sale $—$ 68,371 $—$ 68,731

Total assets at fair value

on a nonrecurring basis $—$ 68,371 $—$ 68,731

(dollars in thousands)

Quoted prices

in Active Markets

for Identical Assets

(Level 1)

Significant

Other Observable

Inputs

(Level 2)

Significant

Unobservable

Inputs

(Level 3)

Balance

as of

December 31,

2008

Securities available-for-sale $—$ 2,631,256 $—$ 2,631,256

Mortgage servicing rights — — 131,194 131,194

Other assets—Derivative

commitments —5,380 —5,380

Total assets at fair value

on a recurring basis — 2,636, 636 131,194 2,767,830

Other liabilities—Derivative

commitments —445 —445

Total liabilities at fair value

on a recurring basis $—$445 $—$445

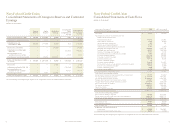

(dollars in thousands) Mortgage servicing rights

Balance, beginning of year $ 169,306

Total gains/(losses) included in earnings (66,323)

Purchases, issuances and settlements 28,211

Balance YTD 2008 131,194

Change in unrealized gains/(losses) related to

financial instruments still held at December 31, 2008 $ (53,094)