Navy Federal Credit Union 2008 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

2008 FINANCIAL SECTION

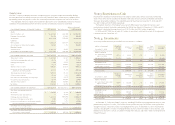

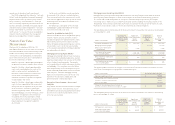

The tables below show the key assumptions used and the effect of a ten percent (10%) and twenty percent

(20%) adverse change to the constant prepayment rate (CPR) and discount factor. The adverse change reflects

the potential impact to the fair value of the securitizations if these changes occurred. However, the sensitivities

in the table below are hypothetical and may not be indicative of actual results. The effect of a variation in a

particular assumption on the fair value is calculated independently of changes in other assumptions. Further,

changes in fair value based on variations in assumptions generally cannot be extrapolated because the

relationship of the change in assumption on the fair value may not be linear.

(1) CPR is based on the average of the CPR for all of the GNMA securities.

(2) Ginnie Mae securities are explicitly backed by the federal government, therefore there are no anticipated credit losses.

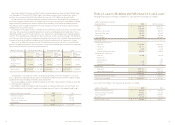

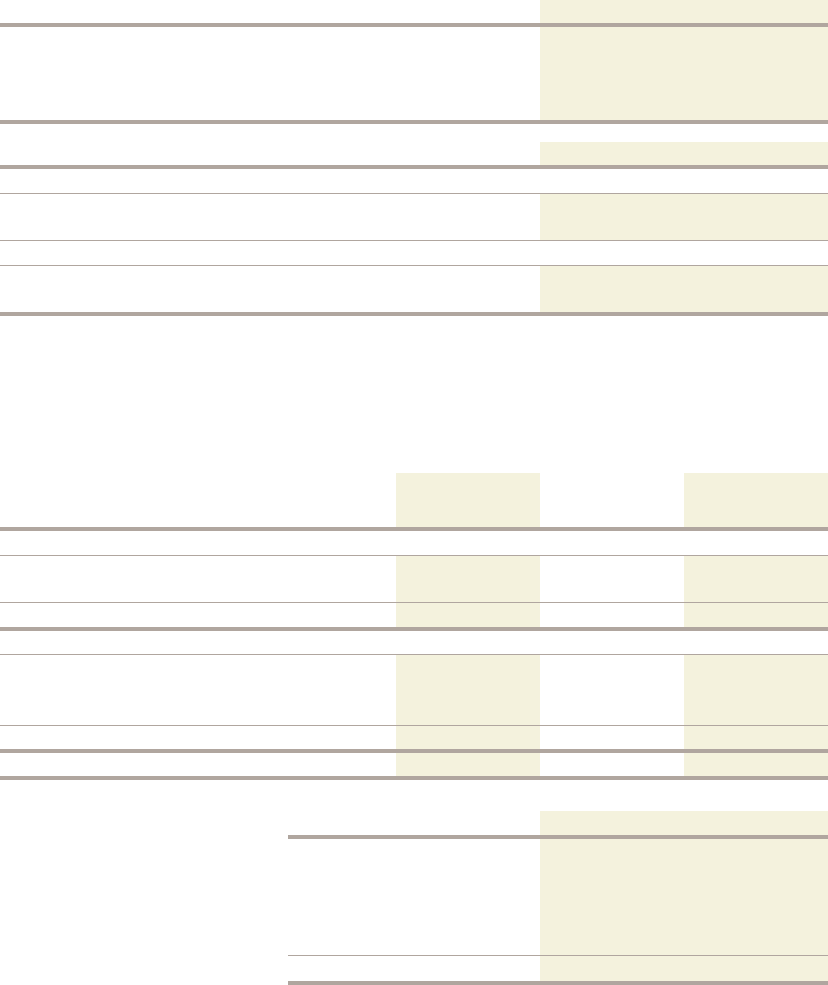

Note 19: Borrowed Funds

The following table displays Navy Federal’s short-term and long-term borrowings as of December 31, 2008:

The following table displays the

amount of long-term maturities

for each of the next five years

as of December 31, 2008:

NAVY FEDERAL CREDIT UNION

26

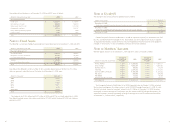

Note 20: Recently Issued

Accounting Standards

Not Yet Adopted

In February 2008, the FASB issued FASB Staff Position

(FSP) No. 157-2, Effective Date of FASB Statement

No. 157. FSP 157-2 delays the effective date of SFAS

No. 157, Fair Value Measurements, for non-financial

assets and liabilities. Navy Federal elected to defer

the application of SFAS No. 157 to certain non-

financial assets and liabilities, which are not measured

at fair value on a recurring basis, until January 1,

2009. Navy Federal is currently evaluating the impact

adoption may have on its financial statements.

In February 2007, the FASB issued SFAS No. 159,

The Fair Value Option for Financial Assets and

Financial Liabilities. SFAS No. 159 permits entities to

choose to measure many financial instruments and

certain other items at fair value. The objective of

this statement is to improve financial reporting by

providing entities with the opportunity to mitigate

volatility in reported earnings caused by measuring

related assets and liabilities differently without having

to apply complex hedge accounting provisions.

This statement is effective for fiscal years beginning

November 15, 2007. Early adoption is permitted.

Navy Federal is currently evaluating the impact

adoption may have on its financial statements.

In December 2007, the FASB issued SFAS

No. 141(R), Business Combinations. This statement

requires greater use of fair values in financial report-

ing and increases transparency through expanded

disclosures. SFAS No. 141(R) changes how business

acquisitions are accounted for and impacts financial

statements at the acquisition date and in subsequent

periods. Additionally, SFAS No. 141(R) affects the

goodwill impairment assessment testing that is

associated with acquisitions that closed before and

after the effective date of the statement. SFAS No.

141(R) is effective for fiscal years beginning on or

after December 15, 2008. Earlier application is

prohibited. Navy Federal is currently evaluating

the impact adoption may have on its financial

condition, results of operations and cash flows.

In December 2007, the FASB issued SFAS No.

160, Non-Controlling Interests in Consolidated

Financial Statements. The objective of this statement

is to improve the relevance, comparability, and trans-

parency of the financial information that a reporting

entity provides in its consolidated financial state-

ments. SFAS No. 160 will introduce significant

changes in the accounting and reporting for non-

controlling interest in a subsidiary. This statement

will also affect the accounting for and reporting for

the deconsolidation of a subsidiary. SFAS No. 160

is effective for fiscal years beginning on or after

December 15, 2008. Early adoption is prohibited.

Navy Federal is currently evaluating the effect

adoption may have on its financial statements.

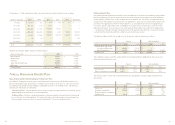

Note 21: Subsequent Events

On January 29, 2009, the National Credit Union

Administration (NCUA) issued Letter No.: 09-CU-02

entitled Corporate Credit Union System Strategy (the

Letter). The purpose of the Letter was to inform the

credit union industry of liquidity and capital issues

within the corporate credit union system. To enhance

liquidity and improve the capital position of the cor-

porate credit unions, NCUA provided for a $1.0 billion

capital infusion to U.S. Central Federal Credit Union

(U.S. Central) from the National Credit Union Share

Insurance Fund (NCUSIF). NCUA also proposed in

the Letter that all deposits in corporate credit unions

be fully insured through a guarantee backed by the

NCUSIF. NCUA estimated the impact to the NCUSIF

of a guarantee would be $3.7 billion, but requested

an independent study to assess the estimated losses.

On March 20, 2009, the NCUA issued Letter

No.: 09-CU-06 entitled Corporate Stabilization

Program—Conservatorship of U.S. Central FCU and

Western Corporate FCU. This letter noted that the

NCUA had placed U.S. Central and Western Corpo-

rate into conservatorship and revised its estimate

of the NCUSIF guarantee from $3.7 billion to $4.9

billion. This letter also stated that the NCUA is con-

sidering other alternatives that would not require

the use of the NCUSIF fund.

These actions are treated as Type 2 subsequent

events, and accordingly, no adjustment has been

made in these financial statements. As of December

31, 2008, Navy Federal has an asset of $205.0

million related to its NCUSIF deposit and has invest-

ments in Western Corporate of $10.1 million.

2008

Discount factor 0.45–1.00

Constant prepayment rate(1) 14.43%

Anticipated credit losses(2) 0

Weighted average life 5.11 years

(dollars in thousands) 2008

Discount factor

Adverse change of 10% $ (31,996)

Adverse change of 20% (63,992)

Constant prepayment rate

Adverse change of 10% $ (2,805)

Adverse change of 20% (5,356)

(dollars in thousands) Maturities Outstanding

Weighted

Average Rate

Short term

FHLB Short-Term Borrowings 2009 $ 358,622 0.46%

FHLB Borrowings for purpose of positive arbitrage 2009 647,000 0.65%

Total short-term borrowings $ 1,005,622

Long term

FHLB Match-Funding Borrowings 2009–2018 $ 5,086,400 4.63%

FHLB Other Long-Term Borrowings 2009–2021 1,717,650 3.28%

Securities sold under agreements to repurchase 2010 311,500 3.13%

Total long-term borrowings $ 7,115,550

Total borrowed funds $ 8,121,172

(dollars in thousands) Amount

2009 $ 1,390,900

2010 999,500

2011 317,000

2012 213,500

Thereafter 4,194,650

Total $ 7,115,550