Navy Federal Credit Union 2008 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

2008 FINANCIAL SECTION

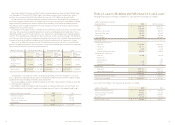

Note 17: Fair Values of

Financial Instruments

SFAS No. 107, Disclosures about Fair Value of

Financial Instruments, requires the disclosure of the

estimated fair value of the financial instruments

including those financial instruments for which

Navy Federal did not elect to fair value. The financial

instruments that are accounted for under SFAS

No. 157 are disclosed separately on Note 16.

Navy Federal discloses fair value information for

its financial instruments, whether the fair value is

recognized in the Consolidated Statements of

Financial Condition or not, for which it is practicable

to estimate that value. In cases where quoted market

prices are not available, fair values are based on

estimates using present value or other valuation

techniques. Those techniques are significantly

affected by the assumptions used, including the

discount rate and estimates of future cash flows.

In that regard, the derived fair value cannot be

substantiated by comparison to independent markets

and, in many cases, could not be realized in immedi-

ate settlement of the instrument. Certain financial

instruments and all non-financial instruments are

excluded from disclosure requirements. Accordingly,

the aggregate fair value amounts presented do

not necessarily represent the underlying fair value

of Navy Federal. The following methods and

assumptions were used in estimating the fair

value disclosures for financial instruments:

Loans to Members

For certain residential mortgages, fair value is

estimated using the quoted market prices for securi-

ties backed by similar loans. The fair value of other

types of loans, such as consumer and equity loans,

is estimated by discounting the future cash flows

using the current market rates at which similar loans

would be made to borrowers with similar credit

ratings and for the same remaining maturities.

Investments, including Mortgage-backed

Securities

Fair value is based on quoted market price, if

available. If a quoted market price is not available,

fair value is estimated using quoted market prices

for similar securities. For resale and repurchase agree-

ments, due to their short-term nature, the carrying

amount is a reasonable estimate of fair value.

Cash and Cash Equivalents

Cash and cash equivalents include cash and balances

due from banks and credit unions, all of which

mature within ninety days. The carrying amount

reported approximates fair value for vault cash and

demand balances from other financial institutions.

Fair value for short-term securities is based on quoted

market prices.

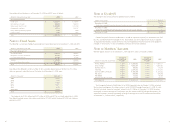

Members’ Accounts

The fair value of Share Savings, Money Market

Savings, Checking and Individual Retirement Account

(IRA) share accounts is the amount payable on

demand at the reporting date. For IRA Certificate

and Share Certificate accounts, fair value is estimated

using the discounted value of future cash flows based

upon market interest rates and remaining maturity.

Derivative Instruments and Hedging

Activities

Navy Federal does not receive loan commitment

fees. The fair value of loan commitments is based

upon differences between the contracted rate and

the current market rate of comparable mortgage

loans. The fair value of forward contracts is based

on the quoted market price of contracts with similar

characteristics. It is the established practice of Navy

Federal to only purchase forward contracts to cover

mortgage loans in process which are anticipated

to close for delivery into these forward contracts.

Accordingly, the cost to terminate existing contracts,

which is based on current market prices, is not

material to Navy Federal.

NAVY FEDERAL CREDIT UNION

24

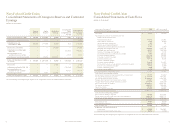

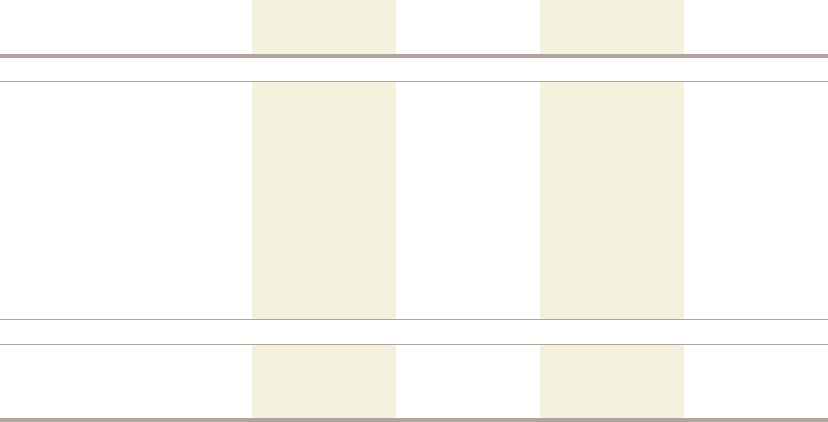

The estimated fair values of financial instruments at December 31, 2008 and 2007, were:

SFAS No. 107 also requires the disclosure of all significant concentrations of credit risk arising from financial

liabilities, whether from an individual counterparty or groups of counterparties. Navy Federal has assessed the

counterparty credit risk on the financial liabilities and has determined that there is no material impact on the

financial statements.

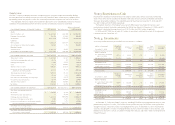

Note 18: Loan Securitizations

Navy Federal started securitizing GNMA mortgage loans, which were classified as mortgage loans awaiting sale

(MLAS) in the first quarter of 2008. Navy Federal retains servicing rights for these loans and holds the resulting

security in its available-for-sale (AFS) portfolio. The securities are carried at fair value with changes recorded in

Other Comprehensive Income (OCI).

Navy Federal used a third party to value its securities, which used a single cash flow stream model and mar-

ket prices to value the securities. The fair value of Navy Federal’s on-balance sheet securitizations at December

31, 2008, was $320.0 million.

The unpaid principal balance of the securitized loans was $310.0 million. The delinquent loans associated

with the securitized asset totaled $0.6 million and no securitized loans were charged-off. The fair value

of the mortgage servicing rights associated with the securitized loans was $4.3 million.

Key Assumptions at December 31, 2008

As required by SFAS No. 140, the effect of two negative changes in each of the key assumptions used to deter-

mine the fair value must be disclosed. The negative effect of each change must be calculated independently,

holding all other assumptions constant.

(dollars in thousands at year-end)

2008

Carrying Amount 2008 Fair Value

2007 (as restated)

Carrying Amount 2007 Fair Value

Financial Assets:

Cash and cash equivalents $ 534,401 534,401 $ 2,306,328 $ 2,306,328

Securities available-for-sale 2,631,256 2,631,256 680,898 680,898

Securities held-to-maturity 225,179 219,154 821,598 820,673

Interest-bearing deposits 31,626 31,626 1,039,190 1,039,190

Other investments 3,374 3,374 3,371 3,371

Investment in FHLB-Atlanta 376,435 376,435 224,318 224,318

Mortgage servicing rights 131,194 131,194 169,306 169,306

Mortgage loans awaiting sale 66,522 68,731 67,836 68,940

Loans, net of allowance

for loan losses 30,585,853 31,027,296 27,856,129 25,964,244

Financial liabilities and equity:

Securities sold under

repurchase agreements 311,500 311,500 873,002 873,002

Members’ accounts $ 24,725,515 $ 23,771,295 $ 23,977,641 $ 24,094,118