Navy Federal Credit Union 2008 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

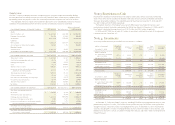

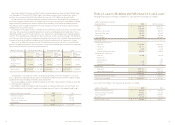

Note 11: Goodwill

The changes in the carrying amount of goodwill were as follows:

Goodwill acquired in business combinations is tested for impairment quarterly in accordance with SFAS

No. 142, Goodwill and Other Intangible Assets. Navy Federal uses the number of new accounts opened

at acquired office locations to estimate the fair value of the goodwill. The carrying value of the goodwill is

included in “Other assets” in the Consolidated Statements of Financial Condition.

Note 12: Members’ Accounts

Member deposit accounts as of December 31, 2008 and 2007, were summarized as follows:

The Emergency Economic Stabilization Act of 2008, signed into law on October 3, 2008, increased

the insurance coverage on all member accounts up to $250,000 through December 31, 2009. As such,

the total uninsured amount of members’ accounts was $1.3 billion at December 31, 2008. Based on

the original insurance coverage of $100,000 per non-IRA account and $250,000 per IRA account, the

amount of members’ accounts exceeding the original coverage limits was $3.8 billion and $4.0 billion

at December 31, 2008 and 2007, respectively.

17

2008 FINANCIAL SECTION

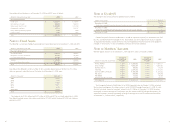

Unused commitment balances as of December 31, 2008 and 2007, were as follows:

Note 10: Fixed Assets

The following is a summary of property and equipment Navy Federal owned at December 31, 2008 and 2007:

Navy Federal has obligations under a number of non-cancelable operating leases for premises. The future

minimum payments under the terms of the leases as of December 31, 2008, were:

Rent expense was $18.2 million and $14.7 million in 2008 and 2007 (as restated), respectively. In 2008,

Navy Federal received income from sublease contracts of $73,000 while it received $71,000 from sublease

contracts in 2007.

NAVY FEDERAL CREDIT UNION

16

(dollars in thousands at year-end) 2008 2007

Unused Commitments

Credit cards $ 5,222,057 $ 4,750,474

NAVchek lines of credit 564,354 544,723

Home equity lines of credit 1,247,390 1,281,108

Preapproved auto loans 195,712 233,187

Utility deposit guarantee programs 3,146 3,030

Letter of credit 7,500 7,500

Total $ 7,240,159 $ 6,820,022

(dollars in thousands at year-end) 2008 2007

Property and Equipment

Land and buildings $ 554,339 $ 400,635

Equipment, furniture and fixtures 517,207 461,934

Leasehold improvements 107,200 87,280

Subtotal 1,178,746 949,849

Less: Accumulated depreciation (472,319) (410,874)

Total $ 706,427 $ 538,975

(dollars in thousands) Amount

2009 $ 14,621

2010 13,460

2011 12,633

2012 10,871

2013 9,133

Thereafter 22,053

Total $ 82,771

(dollars in thousands) Amount

December 31, 2006 $ 15,214

Reduction in goodwill related to decreased number of new accounts opened (289)

December 31, 2007 14,925

Reduction in goodwill related to decreased number of new accounts opened —

December 31, 2008 $ 14,925

(dollars in thousands at year-end)

Weighted

Average Rate

for 2008

2008

Weighted

Average Rate

for 2007

2007

Money Market 2.32% $ 4,260,542 4.63% $ 4,457,111

Share Savings 0.89% 4,826,346 1.38% 4,467,403

Member Escrow 0.56% 109,582 0.74% 95,849

Checking 0.43% 3,579,195 0.54% 3,181,833

Share and IRA Certificates 4.51% 11,470,990 4.51% 11,284,022

IRA shares 1.30% 364,409 1.66% 359,390

IRA MMSA 2.02% 52,422 4.49% 48,808

Investor custodial accounts 0.00% 62,029 0.00% 83,225

Total deposits $ 24,725,515 $ 23,977,641