Navy Federal Credit Union 2008 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

2008 FINANCIAL SECTION

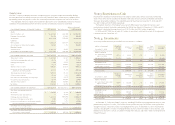

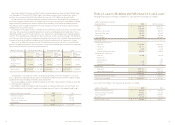

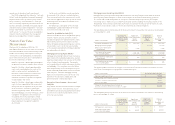

The weighted-average assumptions used to determine the net periodic benefit cost for the pension and other

postretirement benefits were:

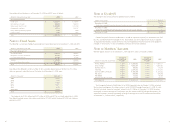

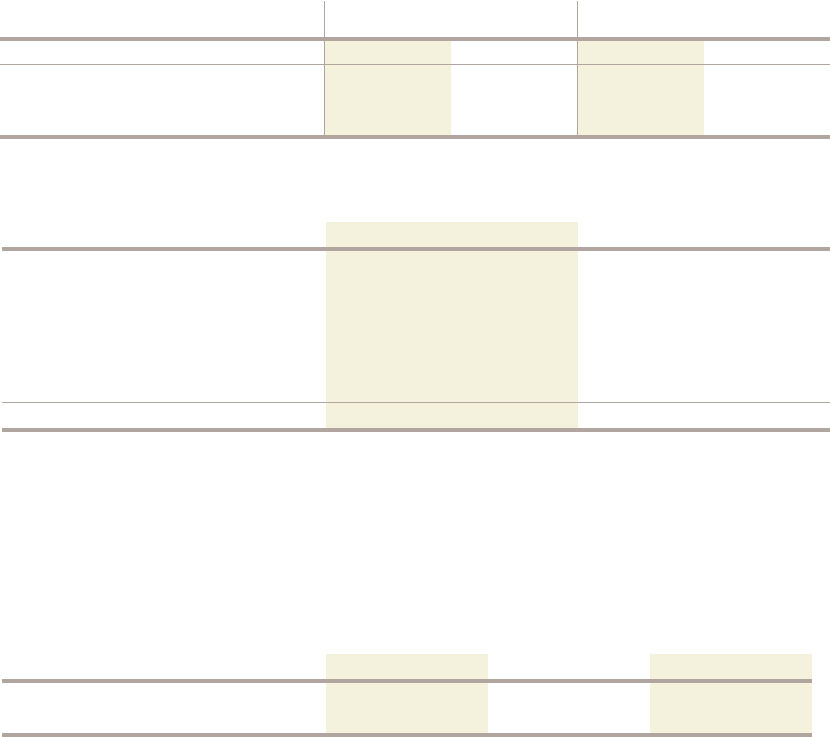

The following table discloses the benefits expected to be paid in the next ten years:

The anticipated employer contribution in 2009 is $25.0 million for the pension plan and $1.2 million for the

postretirement benefit plan. The accumulated benefit obligation for the pension plan was $401.0 million and

$350.9 million at December 31, 2008 and 2007, respectively.

The measurement date for the pension and postretirement benefit plan in 2008 and 2007 was December 31.

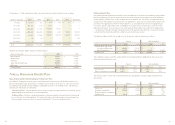

Navy Federal’s pension plan asset allocations by asset category for 2008 and 2007 and the target allocations

for 2009 were as follows:

Navy Federal employs a total return investment approach whereby a mix of equities and fixed income

investments are used to maximize the long-term return of plan assets for a prudent level of risk. The intent

of this strategy is to minimize plan expenses by outperforming plan liabilities over the long run. Risk tolerance

is established through careful consideration of plan liabilities, plan funded status, and corporate financial con di-

tion. The investment portfolio contains a diversified blend of equity and fixed income investments. Investment

risk is measured and monitored on an ongoing basis through annual liability measurements, periodic asset/

liability studies, and quarterly investment portfolio reviews.

NAVY FEDERAL CREDIT UNION

20

Navy Federal 401(k) Savings Plan

The Navy Federal 401(k) savings plan is a defined

contribution plan where employees can contribute

pre-tax money to a 401(k) retirement account and

receive employer matching contributions. The match-

ing contributions are based on participation in a

defined benefit retirement plan. Employees partici-

pating in the Cash Balance Plan receive a 100%

employer match on the first 6% of pay they con-

tribute to their 401(k) account and are vested after

the first two years. The employees participating in

the Traditional Plan receive an employer match of

50% on the first 6% of pay they contribute to their

401(k) account.

The cost recognized for the 401(k) Plan including

matching contributions and administrative costs was

$12.5 million and $10.1 million for the years ended

December 31, 2008 and 2007, respectively.

Deferred Compensation Plan (457)

The deferred compensation plan is a non-qualified

deferred compensation plan as allowed under

Internal Revenue Code Section 457(b). This plan

offers a before-tax savings opportunity to highly-

compensated employees in the Executive and

Professional compensation programs. The annual

deferral amount allowed mirrors the 401(k) plan

and contributions are held by Navy Federal and earn

monthly interest based on Navy Federal’s gross in-

come for the month divided by the average earnings

on assets (loans and investments) for the month.

Non-Qualified Supplemental Retirement

Plan (SERP)

This non-qualified plan is designed to “make up”

for benefits not paid through the defined benefit

retirement plan as a result of limitations imposed

by the IRS. The Internal Revenue Code Section

401(a)(17) limits the amount of compensation that

can be used in the defined benefit retirement plan’s

annuity calculation and Internal Revenue Code Section

415 limits the amount of monthly annuity that can

be paid by the defined benefit retirement plan.

All benefits are paid from the plan trust.

Navy Federal makes all contributions to the trust

in accordance with the company’s funding policy

and in compliance with all federal laws and regula-

tions. Navy Federal accrued $3.0 million and $11.1

million to cover this expense at December 31, 2008

and 2007, respectively.

Note 14: Related Party

Transactions

In the normal course of business, Navy Federal

extends loans to credit union officials. The total

principal amount at December 31, 2008 and 2007,

was $32.8 million and $30.0 million, respectively.

Credit union officials are defined as volunteer

members of the Board of Directors and board

committees, and employees with the title of

Vice President and above.

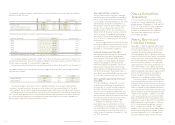

Note 15: Reserves and

Undivided Earnings

Navy Federal is subject to regulatory capital require-

ments administered by the NCUA. Failure to meet

minimum capital requirements can initiate certain

mandatory and possibly additional discretionary

actions by regulators that, if undertaken, could have

a direct material effect on Navy Federal’s consolidated

financial statements. Under capital adequacy regula-

tions and the regulatory framework for prompt

corrective action, Navy Federal must meet specific

capital requirements that involve quantitative meas-

ures of Navy Federal’s assets, liabilities and certain

commitments as calculated under generally accepted

accounting principles. Navy Federal’s capital amounts

and net worth classification are also subject to

qualitative judgments by the regulators about

components, risk weightings and other factors.

Quantitative measures established by regulation

to ensure capital adequacy require Navy Federal to

maintain minimum amounts and ratios of net worth

to total assets. Credit unions are also required to cal-

culate a risk-based net worth (RBNW) requirement

that establishes whether the credit union will be con-

sidered “complex” under the regulatory framework.

A credit union is defined as “complex” if the credit

union's quarter-end total assets exceed ten million

dollars ($10,000,000) and its risk-based net worth

requirement exceeds six percent (6%). Navy Federal’s

RBNW requirement as of December 31, 2008, was

6.23%, which exceeds the regulatory threshold

of 6% and places Navy Federal in the “complex”

category. There is no impact to Navy Federal based

on the complex designation because our statutory

net worth ratio qualifies us as “well capitalized”

by NCUA standards and our statutory net worth

Pension Retiree Medical

2008 2007 2008 2007

Discount rate 6.30% 5.95% 6.30% 5.95%

Expected return on plan assets 8.25% 8.25% N/A N/A

Rate of compensation increase 5.00% 5.00% N/A N/A

(dollars in thousands) Pension Retiree Medical

2009 $ 17,386 $ 1,222

2010 18,742 1,489

2011 20,576 1,719

2012 22,633 1,908

2013 24,881 2,004

2014–2018 166,854 10,827

Total benefits expected, next 10 years $ 271,072 $ 19,169

2009 (target) 2008 2007

Equity securities 70% 58% 69%

Debt securities 30% 42% 31%