Navy Federal Credit Union 2008 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2008 Navy Federal Credit Union annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

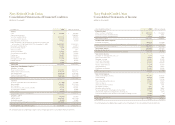

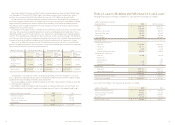

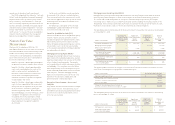

(dollars in thousands at year-end)

Consumer loans 2008 2007 (as restated)

Auto $ 5,975,114 $ 6,054,222

Other 2,110,468 2,017,148

NAVchek®lines of credit 264,724 250,773

Federal education loans 386,201 312,640

Vehicle leases 82,890 106,786

Credit card loans 4,159,310 3,425,403

Mortgage loans

Mortgage loan investments

Fixed rate 12,165,405 9,661,061

Variable rate 341,111 320,096

In process 2,779 7,419

Unamortized deferred income (63,408) (29,400)

Mortgage loans awaiting sale

Fixed rate 65,200 65,159

Variable rate ——

Unrealized losses —(95)

In process 1,323 2,923

Unamortized deferred income (1) (151)

Equity loans

Fixed equity 4,611,111 5,002,514

Home equity lines of credit 1,062,627 983,744

31,164,854 28,180,242

Less: Allowance for loan losses 512,479 256,277

Total loans to members $ 30,652,375 $ 27,923,965

NAVY FEDERAL CREDIT UNION

12 13

2008 FINANCIAL SECTION

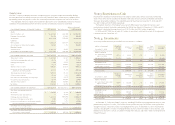

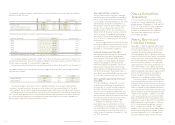

Navy Federal held $376.4 million and $224.3 million of Federal Home Loan Bank of Atlanta (FHLBA) stock

as of December 31, 2008 and 2007. FHLBA stock is a restricted investment and is carried at cost, which is

par value. As a member of the FHLBA, Navy Federal has access to a $10.7 billion line of credit facility.

All debt securities were reviewed individually to determine whether the unrealized losses associated with

them were caused by a decline other-than-temporary in the value of such investments. Navy Federal's method-

ology to determine whether these securities are other-than-temporary was based on the following factors:

Navy Federal's intent and ability to hold the security to recovery, the nature of the security, and the financial

condition of the issuer of the security.

Navy Federal has the ability to carry its available-for-sale and held-to-maturity investments until they recover

their value. These securities include both government securities issued by government corporations that are

explicitly backed by the full faith and credit of the U.S. Government, and also government-sponsored agency

securities. The unrealized losses associated with these investments are not a result of a change in the credit qual-

ity of the issuer: rather, the losses are reflective of changing market interest rates. Therefore, Navy Federal expects

to receive all contractual cash flows and believes that the current environment is not a permanent situation.

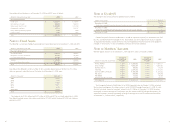

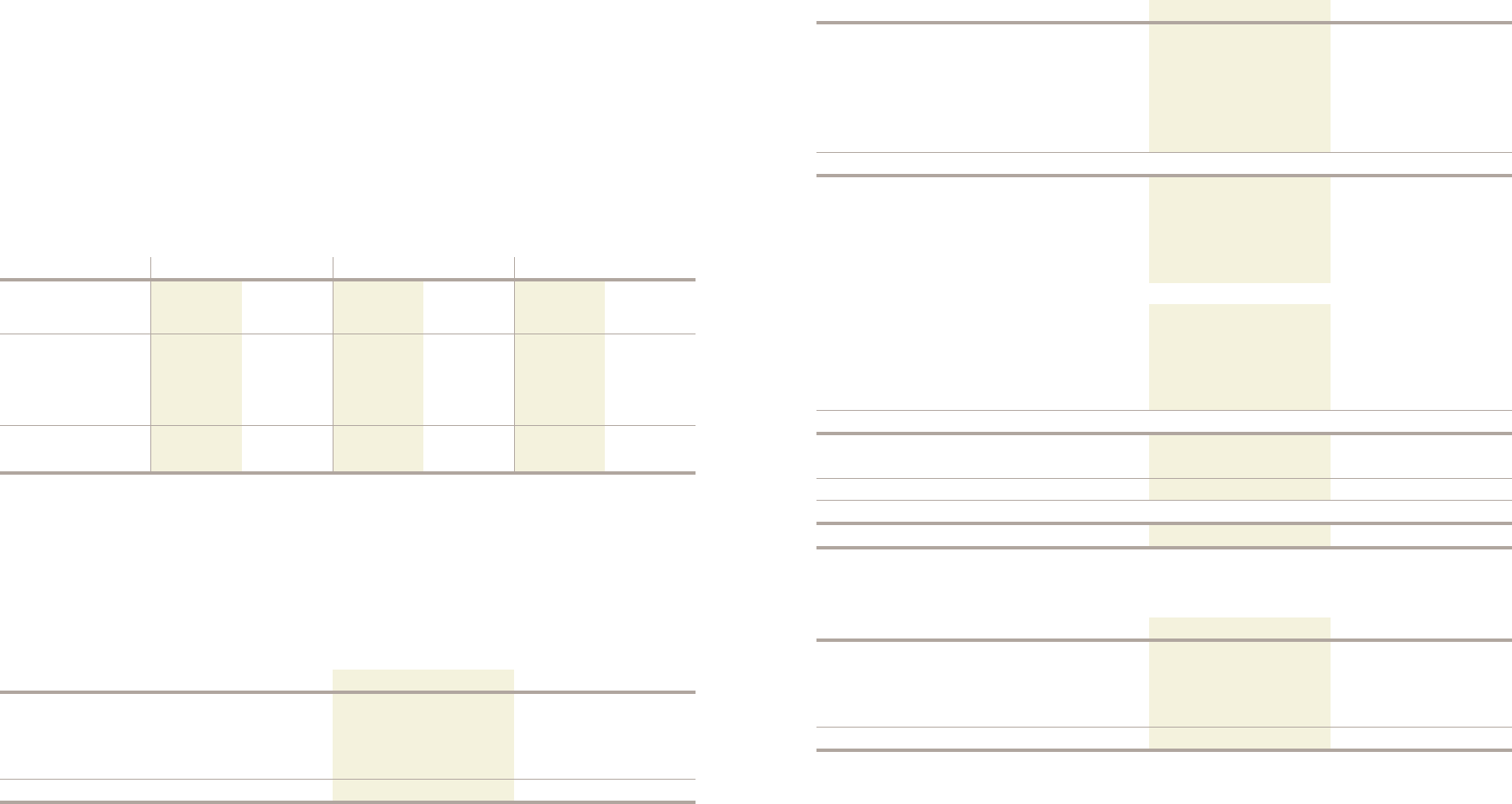

There are 67 available-for-sale securities and 37 held-to-maturity securities that are in an unrealized loss

position. The table below presents these investments’ fair value and associated gross unrealized losses separated

by the amount of time the investments have carried the loss.

At December 31, 2008 and 2007, there was no decline considered “other-than-temporary” in the value

of U.S. Government and federal agency securities owned by Navy Federal. Other Investments represent capital

required to maintain partnerships with credit union organizations.

Investments pledged as collateral for borrowed funds were $359.2 million and $871.6 million at December

31, 2008 and 2007, respectively.

Navy Federal's certificates of deposits and share deposits in corporate credit unions are fully insured. The

following table shows Navy Federal’s deposits and membership capital shares in the corporate credit unions:

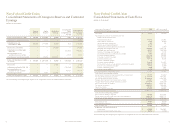

(dollars in thousands at year-end) 2008 2007

Certificates of deposit $ 2,000 $ 1,636,811

Overnight investments — 330,000

Membership, capital shares 28,286 50,889

Share deposits 1 1

Total $ 30,287 $ 2,017,701

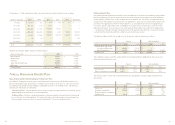

(dollars in thousands) 2008 2007

Balance, beginning of the year $ 256,277 $ 176,326

Provision charged to operations 654,822 283,902

Loans charged off (442,011) (230,877)

Recoveries 43,391 26,926

Balance, end of the year $ 512,479 $ 256,277

(dollars in thousands) Less than 12 months 12 months or longer Total

December 31, 2008 Fair value

Gross

unrealized

losses Fair value

Gross

unrealized

losses Fair value

Gross

unrealized

losses

Available-for-sale

securities $ 1,441,279 $ (61,250) $ 418,632 $ (19,906) $1,859,911 $ (81,156)

Held-to-maturity

securities 153,264 (4,489) 40,396 (1,811) 193,660 (6,300)

Total securities $ 1,594,543 $ (65,739) $ 459,028 $ (21,717) $ 2,053,571 $ (87,456)

A summary of the changes in the allowance for loan losses is as follows:

Note 5: Loans to Members and Allowance for Loan Losses

The composition of loans to members at December 31, 2008 and 2007 (as restated), was as follows: