Microsoft 2005 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2005 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

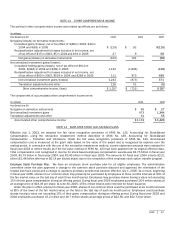

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

PAGE 56

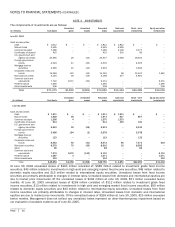

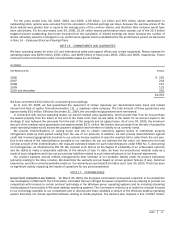

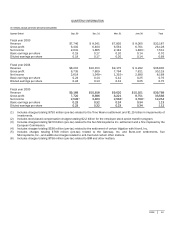

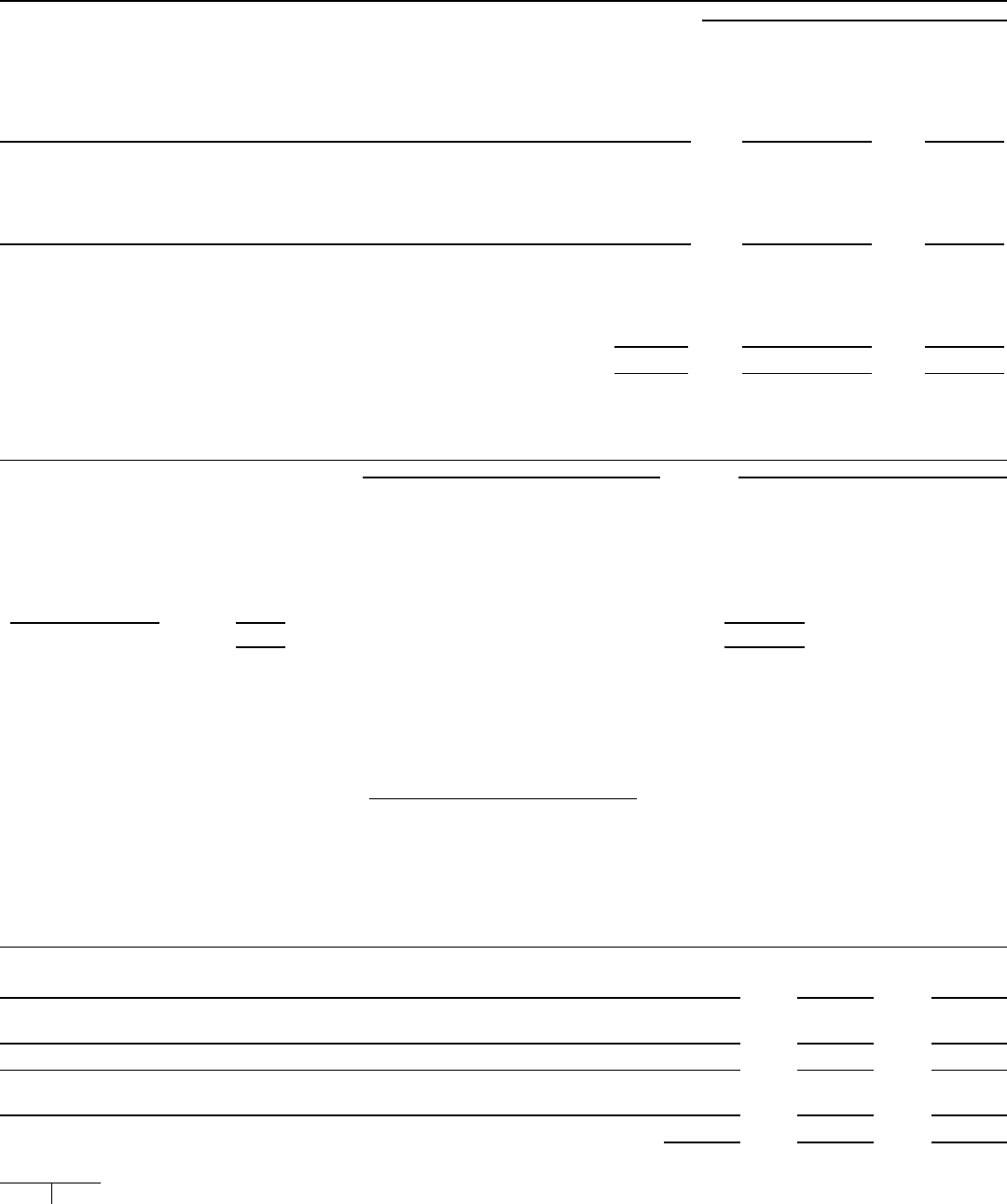

Employee stock options outstanding are as follows:

(In millions, except per share amounts)

Price per Share

Shares

Range Weighted

average

Balance, June 30, 2002

1,604

$ 0.40 – $59.57 $26.88

Granted

254

21.42 – 29.12

24.27

Exercised

(234

)

0.51 – 28.22

6.89

Canceled/forfeited

(75

)

2.13 – 59.56

34.33

Balance, June 30, 2003

1,549

0.40 – 59.56

29.30

Granted

2

25.46 – 29.96

26.76

Exercised

(198

)

0.51 – 29.38

12.21

Stock option transfer program

(345

)

33.03 – 59.56

38.70

Canceled/forfeited

(59

)

2.31 – 58.28

31.29

Balance, June 30, 2004

949

0.40 – 59.56

29.26

Special dividend adjustment

96

0.36 – 53.61

26.68

Granted

–

–

–

Exercised

(138

)

3.39 – 29.56

20.42

Canceled/forfeited

(43

)

14.29 – 58.28

28.89

Balance, June 30, 2005

864

$ 0.36 – $59.56 $27.41

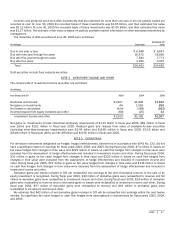

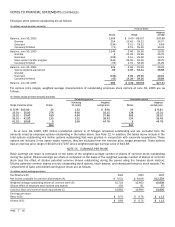

For various price ranges, weighted average characteristics of outstanding employee stock options at June 30, 2005 are as

follows:

(In millions, except per share amounts and years)

Outstanding options

Exercisable options

Range of exercise prices Shares

Remainin

g

life (years)

Weighted

average price

Shares Weighted

average price

$ 0.36 – $15.00 24 1.50

$

8.81

24

$

8.81

15.01 – 25.00 276 6.56

22.15

136

22.31

25.01 – 33.00 430 4.64

27.88

369

28.10

33.01 – 41.00 125 3.22

39.42

124

39.43

41.01 – 59.56 9 2.58

44.78

9

44.78

864

662

As of June 30, 2005, 345 million transferred options to JP Morgan remained outstanding and are excluded from the

amounts noted as employee options outstanding in the tables above. See Note 12. In addition, the tables above include in the

total options outstanding 4.3 million options outstanding that were granted in conjunction with corporate acquisitions. These

options are included in the option totals; however, they are excluded from the exercise price ranges presented. These options

had an exercise price range of $0.00 to $170.87 and a weighted average exercise price of $13.68.

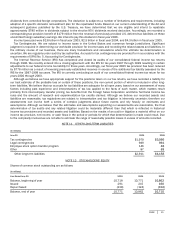

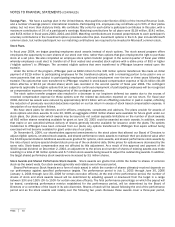

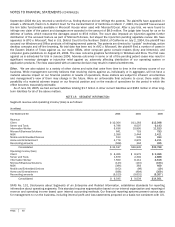

NOTE 15 EARNINGS PER SHARE

Basic earnings per share is computed on the basis of the weighted average number of shares of common stock outstanding

during the period. Diluted earnings per share is computed on the basis of the weighted average number of shares of common

stock plus the effect of dilutive potential common shares outstanding during the period using the treasury stock method.

Dilutive potential common shares include outstanding stock options, stock awards, and shared performance stock awards. The

components of basic and diluted earnings per share are as follows:

(In millions, except earnings per share)

Y

ear Ended June 30

2003

2004

2005

Net income available for common shareholders (A)

$

7,531

$ 8,168

$12,254

Weighted average outs

t

anding shares of common stock (B)

10,723

10,803

10,839

Dilutive effect of employee stock options and awards

159

91

67

Common stock and common stock equivalents (C)

10,882

10,894

10,906

Earnings per share:

Basic (A

/

B)

$

0.70

$ 0.76

$

1.13

Diluted (A/C)

$

0.69

$ 0.75

$

1.12