Microsoft 2005 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2005 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 55

Shared Performance Stock Awards will only be awarded in fiscal year 2005 and 2006 to newly hired and promoted employees

eligible to receive Shared Performance Stock Awards.

Stock Awards and Shared Performance Stock Awards are amortized over the vesting period (generally 5 years) using the

straight line method.

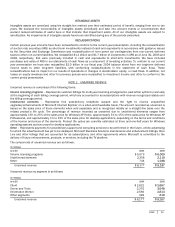

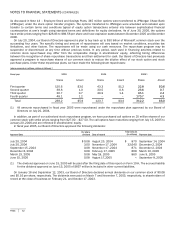

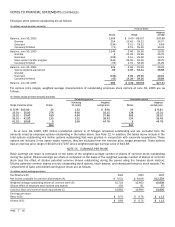

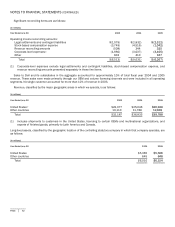

The following activity has occurred under our existing plans:

(share amounts in millions)

Y

ear Ended June 30

2004

2005

Stock awards

Beginning balance 3.9

34.4

Granted 32.6

41.0

Special dividend adjustment –

6.7

Vested (0.8)

(7.3)

Cancelled (1.3)

(3.5)

Ending balance 34.4

71.3

Weighted-average fair value per share for shares granted during the year*

$24.09 $24.03

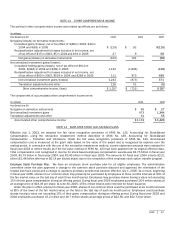

Shared performance stock awards

Beginning balance –

30.5

Granted 31.7

3.7

Special dividend adjustment –

3.5

Vested –

–

Cancelled (1.2)

(2.4)

Ending balance 30.5

35.3

Weighted-average fair value per share for shares granted during the year*

$23.62 $24.35

* Adjusted for additional awards granted for the $3.00 special dividend.

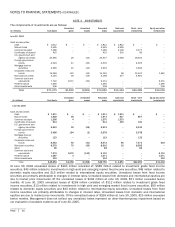

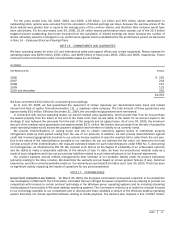

Stock Options. Nonqualified stock options have been granted to our directors under our non-employee director stock plans.

Nonqualified and incentive stock options have been granted to our officers and employees under our employee stock plans.

Options granted before 1995 generally vest over four and one-half years and expire ten years from the date of grant. Options

granted between 1995 and 2001 generally vest over four and one-half years and expire seven years from the date of grant,

while certain options vest either over four and one-half years or over seven and one-half years and expire ten years from the

date of grant. Options granted after 2001 vest over four and one-half years and expire ten years from the date of grant. At June

30, 2005, stock options for 662 million shares were vested.

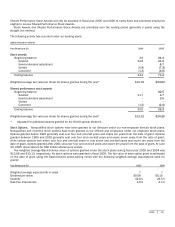

The weighted average Black-Scholes value of options granted under the stock plans during fiscal year 2003 and 2004 was

$12.08 and $10.13, respectively. No stock options were granted in fiscal 2005. The fair value of each option grant is estimated

on the date of grant using the Black-Scholes option-pricing model with the following weighted average assumptions used for

grants:

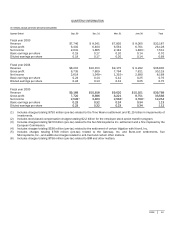

Y

ear Ended June 30

2003

2004

Weighted average expected life in years 7

7

Dividend per share $0.08

$0.16

Volatility 42.0%

29.5%

Risk-free interest rate 3.9%

4.1%