Microsoft 2005 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 2005 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF

FINANCIAL CONDITION AND RESULTS OF OPERATIONS (CONTINUED)

PAGE 24

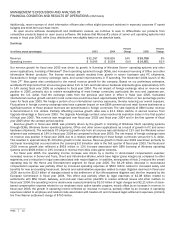

Client

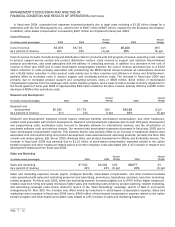

(In millions, except percentages) 2003 2004

Percent

Change 2005

Percent

Change

Revenue

$

10,394

$

11,546

11% $12,234

6%

Operating income

$

7,960

$

8,654

9% $ 9,442

9%

Client includes revenue from Windows XP Professional and Home, Media Center Edition, Tablet PC Edition, and other standard

Windows operating systems. Client revenue growth is correlated with the growth of corporate and consumer purchases of PCs

from OEMs that pre-install versions of Windows operating systems because the OEM channel accounts for over 80% of total

Client revenue. The operating results for all periods presented have been restated to reflect the reorganization of the Windows

Security group from Server and Tools to Client.

Client revenue increased in fiscal year 2005 driven by 12% growth in OEM license units and $886 million or 10% growth in

OEM revenue from increased PC unit shipments, partially offset by a $198 million or 9% decrease in revenue from commercial

and retail licensing of Windows operating systems. This channel-mix shift reflects our customers’ continued preference for

upgrading their PC operating systems through the OEM channel when they replace their PCs versus the purchase of a multi-year

licensing agreement. The mix of OEM Windows operating systems licensed with premium edition operating systems as a

percentage of total OEM Windows operating systems licensed during the year remained flat at 50% of total OEM Windows

operating systems as compared to the previous year. Revenue earned from Upgrade Advantage declined by $99 million in fiscal

year 2005 contributing to the decrease in commercial and retail licensing revenue. The differences between unit growth rates

and revenue growth rates from year to year are affected by the mix of premium versions of operating systems licensed during

the year, changes in the geographical mix, the channel mix of products sold by large, multi-national OEMs versus those sold by

local and regional system builders, and previous changes to deferral rates and product lives for undelivered elements of

unearned revenue. Client revenue increase in fiscal year 2004 was driven by 14% growth in OEM licenses and 16% growth in

OEM revenue on increased consumer PC unit shipments in the first half of the fiscal year and growth in business PC unit

shipments in the second half of fiscal year 2004.

Client operating income increased in fiscal year 2005 primarily due to an increase in OEM revenue and a decrease in stock-

based compensation expense. These factors were partially offset by an increase in sales and marketing expenses associated

with “Start Something,” a globally launched advertising campaign, marketing for security initiatives, and an increase in salary

and benefits for new and existing headcount. The additional headcount for research and development was primarily devoted to

the continued development of the Windows Client next-generation operating system. The operating income for fiscal year 2004

has been restated for a reclassification of legal settlement charges totaling $700 million from Client to corporate expenses to

conform to the current year presentation. Client operating income increased for fiscal year 2004 compared to fiscal year 2003

mainly due to growth in revenue, partially offset by increased operating expenses primarily related to stock-based compensation

expense from the employee stock option transfer program in the second quarter of fiscal year 2004.

We anticipate that worldwide PC shipments will grow at approximately 7% to 9% in fiscal year 2006, continuing to influence

our growth in Client revenue. In addition, we estimate that increasing shipments of laptops as a percentage of total PC systems

will continue to positively influence Client revenue growth due to shorter replacement cycles for laptops. The time between

operating system releases may affect our ability to close some multi-year licensing agreements. We expect growth rates in

emerging markets to continue to outpace mature market growth rates. Piracy continues to be a challenge in both emerging and

mature markets. We intend to focus on growing OEM licenses faster than the overall market by reducing piracy, particularly in

the mature markets, through initiatives such as Windows Genuine Advantage. Client commercial and retail licensing revenues

are expected to continue to lag behind overall Client revenue growth, but we expect to see improvements in these channels in

fiscal year 2006 compared to fiscal year 2005. We anticipate a modest increase in our premium product mix in fiscal year

2006, although we anticipate shipments of the premium-priced Media Center Edition will grow as a percentage of the total

operating system shipments. Major investments in fiscal year 2006 will focus on development of Windows Vista, the next-

generation PC operating system, and will include marketing initiatives such as the global “Start Something” campaign.