Microsoft 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 27

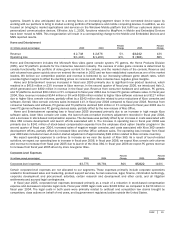

Microsoft Business Solutions operating loss declined in fiscal year 2005 primarily due to a decline in stock-based

compensation expense, an increase in product revenue, and a decline in acquisition intangibles amortization. The reduction in

operating loss was partially offset by a net increase in sales and marketing expense driven by incremental headcount and

marketing costs in the SMS&P organization. In addition, there has been an increase in marketing and product development

investments in our portfolio of business solutions. The operating loss for fiscal year 2004 increased from fiscal year 2003 due

to an increase in stock-based compensation expense from the employee stock option transfer program in the second quarter of

fiscal year 2004, partially offset by an increase in revenue and lower operating expenses including $42 million of lower

intangibles amortization costs.

Microsoft Business Solutions expects continued revenue growth through its portfolio of business solutions and related

product releases, including newer applications such as Microsoft Office Small Business Accounting and Microsoft CRM.

Continued investment in the next generation of solutions, broader geographical coverage, and plans for facilitating our partners

to provide customized vertical solutions should result in improved business performance for Microsoft Business Solutions in

fiscal year 2006.

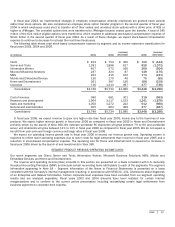

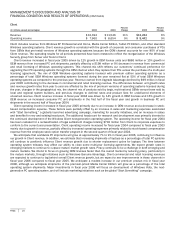

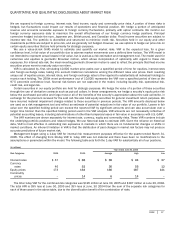

MSN

(In millions, except percentages) 2003 2004

Percent

Change 2005

Percent

Change

Revenue $1,953

$2,216

13%

$2,274

3%

Operating income (loss) $

(573)

$

87

115%

$ 405

366%

MSN includes personal communications services, such as e-mail and instant messaging, and online information offerings, such

as MSN Search and the MSN portals and channels around the world. MSN also provides a variety of online paid services in

addition to MSN Internet Access and MSN Premium Web Services. Revenue is derived primarily from advertisers on MSN, from

consumers and partners through subscriptions and transactions generated from online paid services, and from subscribers to

MSN Narrowband Internet Access. In fiscal year 2005, we launched a new version of our MSN Search engine, which is based on

our own technology. This change will help provide the ability to innovate more quickly and the opportunity to develop a long-term

competitive advantage in search. In addition to the launch of MSN Search, we introduced many new products and product

enhancements in fiscal year 2005, including a new version of the MSN home page which provides a richer user experience,

quicker load times, higher levels of end user customization, and fewer advertisements and links. MSN launched the clarity in

advertising program in fiscal year 2005, which removed paid advertising from inclusion in search results and resulted in a

reduced number of advertisements that are returned with search results.

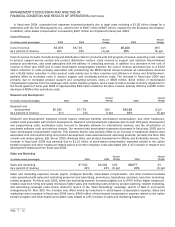

In fiscal year 2005, MSN advertising revenue increased $193 million or 16% primarily as a result of industry and market

growth, and continued growth of MSN display advertising revenue, tempered by the search clarity in advertising program and

the impact of the home page redesign. Revenue from subscription and transaction services other than Internet Access

increased $84 million or 88% in fiscal year 2005 as a result of growth in the number of MSN Premium subscribers through our

carrier partnerships. Offsetting the overall revenue growth was a decline of $219 million or 24% in Internet Access revenue,

driven by the continued migration of Internet Access subscribers to broadband or other competitively priced Internet service

providers. At the end of the current fiscal year, MSN had 2.7 million internet access subscribers and 9.1 million total

subscribers compared to 4.3 million and 8.8 million at the end of the previous year. In addition, MSN has over 420 million

unique users monthly, over 205 million active Hotmail accounts, and over 175 million active Messenger accounts. In fiscal year

2004, MSN advertising revenue increased $360 million or 43% as a result of growth in paid search and growth in the overall

Internet advertising market. This increase was partially offset by a decline of $168 million or 15% in Internet Access revenue.

Revenue from subscription and transaction services other than Internet Access increased $71 million.

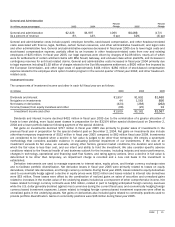

In fiscal year 2005, MSN operating income increased mainly due to a decrease in stock-based compensation expense,

reduced online operations and bandwidth costs associated with the Internet Access business as the number of subscribers

declines, and increased advertising and subscription revenue. The operating income increase was partially offset by an increase

in headcount-related costs from increased hiring and increases in salary and benefits, and a $48 million tax benefit recorded in

the first quarter of fiscal year 2004. MSN reached profitability in the first quarter of fiscal year 2004 and was profitable for fiscal

year 2004. The improvement in profitability in fiscal year 2004 was primarily driven by an increase in revenue, a decline in

customer acquisition costs and other expenses related to the Internet Access business, efficiency gains in the operations of the

advertising and subscription businesses, and a $48 million refund of previous year taxes, partially offset by an increase in stock-

based compensation expense.

MSN expects increased growth in advertising revenue as it benefits from improvements to its advertising platform and

search engine and continued increases in Internet spending. We expect revenue from narrowband Internet Access to continue