Microsoft 2005 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2005 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

PAGE 52

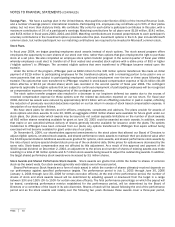

As discussed in Note 14 – Employee Stock and Savings Plans, 345 million options were transferred to JPMorgan Chase Bank

(JPMorgan) under the stock option transfer program. The options transferred to JPMorgan were amended and restated upon

transfer to contain terms and conditions typical of equity option transactions entered into between sophisticated financial

counterparties at arm’s length using standard terms and definitions for equity derivatives. As of June 30, 2005, the options

have strike prices ranging from $28.83 to $89.58 per share and have expiration dates between December 2005 and December

2006.

On July 20, 2004, our Board of Directors approved a plan to buy back up to $30 billion of Microsoft common stock over the

succeeding four years. The specific timing and amount of repurchases will vary based on market conditions, securities law

limitations, and other factors. The repurchases will be made using our cash resources. The repurchase program may be

suspended or discontinued at any time without previous notice. In any period, cash used in financing activities related to

common stock repurchased may differ from the comparable change in stockholders’ equity, reflecting timing differences

between the recognition of share repurchase transactions and their settlement for cash. Our Board of Directors had previously

approved a program to repurchase shares of our common stock to reduce the dilutive effect of our stock option and stock

purchase plans. Under these repurchase plans, we have made the following share repurchases:

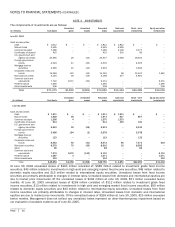

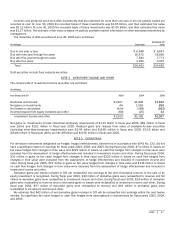

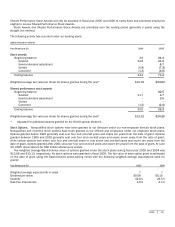

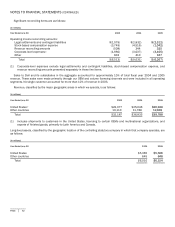

(share amounts in millions, dollars in billions)(1)

Fiscal year

2003

2004

2005(1)

Shares Amoun

t

Shares Amount Shares Amount

First quarter 120.6 $3.0

43.3

$1.2 22.8

$0.6

Second quarter 38.8 1.0

30.5

0.8 23.6

0.7

Third quarter 30.7 0.7

49.9

1.4 95.1

2.4

Fourth quarter 48.1 1.2

–

– 170.7

4.3

Total 238.2 $5.9

123.7

$3.4 312.2

$8.0

(1) All amounts repurchased in fiscal year 2005 were repurchased under the repurchase plan approved by our Board of

Directors on July 20, 2004.

In addition, as part of our authorized stock repurchase program, we have purchased call options on 25 million shares of our

common stock with strike prices ranging from $27.00 – $27.50. The call options have maturities ranging from July 15, 2005 to

January 20, 2006 and are reflected in stockholders’ equity.

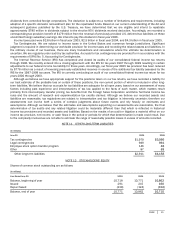

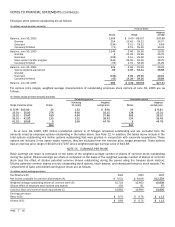

In fiscal year 2005, our Board of Directors approved the following dividends:

Approval Date Per

share

dividend Date of record

Total amoun

t

(in millions) Payment date

July 20, 2004

$

0.08

August

25,

2004

$ 870

September

14,

2004

July 20, 2004

3.00

November

17,

2004

32,640

December 2, 2004

September 15, 2004

0.08

November 17, 2004

871

December 2, 2004

December 8, 2004

0.08

February 17, 2005

868

March 10, 2005

March 23, 2005

0.08

May 18, 2005

860

June 9, 2005

June 15, 2005

0.08

August 17,2005

(1)

September 8, 2005

(1) The dividend approved on June 15, 2005 will be paid after the filing date of this report on Form 10-K. The accrued liability

for the dividend approved on June 15, 2005 of $857 million is included in other current liabilities.

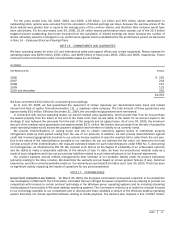

On January 16 and September 12, 2003, our Board of Directors declared annual dividends on our common stock of $0.08

and $0.16 per share, respectively. The dividends were paid on March 7 and November 7, 2003, respectively, to shareholders of

record at the close of business on February 21, and October 17, 2003.