Microsoft 2005 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2005 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

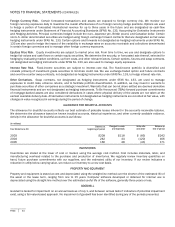

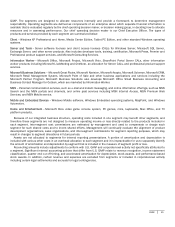

NOTES TO FINANCIAL STATEMENTS (CONTINUED)

PAGE 54

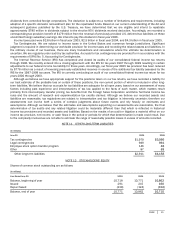

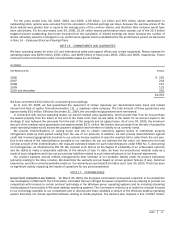

Savings Plan. We have a savings plan in the United States, that qualifies under Section 401(k) of the Internal Revenue Code,

and a number of savings plans in international locations. Participating U.S. employees may contribute up to 50% of their pretax

salary, but not more than statutory limits. We contribute fifty cents for each dollar a participant contributes in this plan, with a

maximum contribution of 3% of a participant’s earnings. Matching contributions for all plans were $118 million, $141 million,

and $154 million in fiscal years 2003, 2004, and 2005. Matching contributions are invested proportionate to each participant’s

voluntary contributions in the investment options provided under the plan. Investment options in the U.S. plan include Microsoft

common stock, but neither participant nor our matching contributions are required to be invested in Microsoft common stock.

Stock Plans.

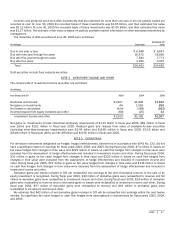

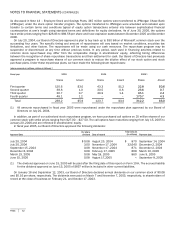

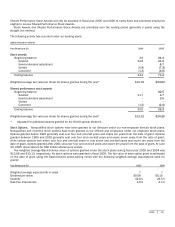

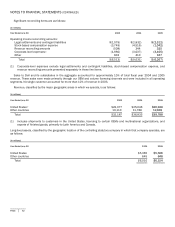

In fiscal year 2004, we began granting employees stock awards instead of stock options. The stock award program offers

employees the opportunity to earn shares of our stock over time, rather than options that give employees the right to purchase

stock at a set price. We also completed an employee stock option transfer program in the second quarter of fiscal year 2004

whereby employees could elect to transfer all of their vested and unvested stock options with a strike price of $33 or higher

(“eligible options”) to JPMorgan. The unvested eligible options that were transferred to JPMorgan became vested upon the

transfer.

Under the terms of the program, JPMorgan paid us $382 million for the 345 million options transferred. We made an initial

payment of $219 million to participating employees for the transferred options, with a remaining portion to be paid in one or

more payments that are subject to participating employees’ continued employment over the two or three years following the

transfer. The options that were transferred to JPMorgan resulted in stock-based compensation expense of $2.21 billion ($1.48

billion after-tax or $0.14 per diluted share) which was recorded in the second quarter of fiscal year 2004. The contingent

payments applicable to eligible options that are subject to continued employment of participating employees will be recognized

as compensation expense over the vesting period of the contingent payments.

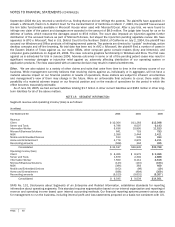

The stock option transfer program also resulted in a decrease to our long-term deferred tax assets due to the excess of

recorded compensation expense for these options over the related tax deduction reported on our tax return. For fiscal year

2004, deferred tax assets were reduced by approximately $2.01 billion with an offsetting reduction in paid-in capital, reflecting

the reduction of previously recorded deductions reported on our tax return in excess of stock based compensation expense. A

description of our stock plans follows.

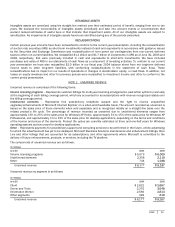

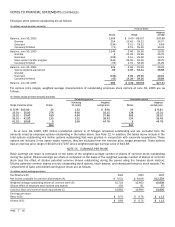

We have stock plans for directors and for officers, employees, consultants and advisors. The plans provide for awards of

stock options and stock awards. At June 30, 2005, an aggregate of 816 million shares were available for future grant under our

stock plans. Our plans under which awards may be issued do not contain separate limitations on the number of stock awards;

all 816 million shares remaining available for grant at June 30, 2005 could be awarded as stock awards. In addition, awards

that expire or are cancelled without delivery of shares generally become available for issuance under the plans. The options

transferred to JPMorgan have been removed from our plans; any options transferred to JPMorgan that expire without being

exercised will not become available for grant under any of our plans.

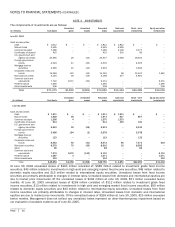

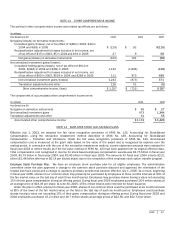

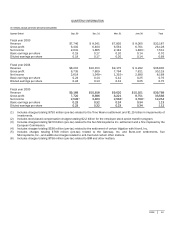

On November 9, 2004, our shareholders approved amendments to the stock plans that allowed our Board of Directors to

adjust eligible options, unvested stock awards, and shared performance stock awards to maintain their pre-dividend value after

the $3.00 special dividend. Additional awards were granted for options, stock awards, and shared performance stock awards by

the ratio of post- and pre-special dividend stock price as of the ex-dividend date. Strike prices for options were decreased by the

same ratio. Stock-based compensation was not affected by this adjustment. As a result of this approval and payment of the

$3.00 special dividend on December 2, 2004, an adjustment to the prices and number of shares of existing awards was made

resulting in a total of 96 million options and 6.7 million stock awards being issued to adjust the outstanding awards. In addition,

the target shared performance stock awards were increased by 3.5 million shares.

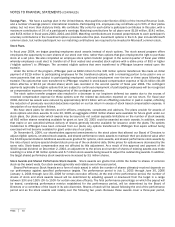

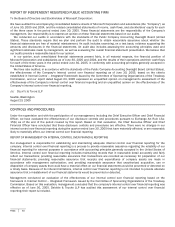

Stock Awards and Shared Performance Stock Awards. Stock awards are grants that entitle the holder to shares of common

stock as the award vests. Our stock awards generally vest ratably over a five-year period.

Shared Performance Stock Awards are a form of stock award in which the number of shares ultimately received depends on

our performance against specified performance targets. The performance period is July 1, 2003 through June 30, 2006

(January 1, 2004 through June 30, 2006 for certain executive officers). At the end of the performance period, the number of

shares of stock and stock awards issued will be determined by adjusting upward or downward from the target in a range

between 33% and 150% (0% to 150% for certain executive officers). The final performance percentage on which the payout will

be based, considering performance metrics established for the performance period, will be determined by the Board of

Directors or a committee of the board in its sole discretion. Shares of stock will be issued following the end of the performance

period and as the stock awards vest ratably over the following two years. Because these awards cover a three-year period,