Microsoft 2005 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2005 Microsoft annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

PAGE 35

commitments includes an analysis of all known contracts exceeding $5 million in the aggregate and all known open

purchase orders. We expect to fund these commitments with existing cash and cash flows from operations.

(5) We have excluded unearned revenue of $1.67 billion from other long-term liabilities presented above as these will not be

settled in cash.

RECENTLY ISSUED ACCOUNTING STANDARDS

In November 2004, the Financial Accounting Standards Board (FASB) issued SFAS No. 151, Inventory Costs, which clarifies the

accounting for abnormal amounts of idle facility expense, freight, handling costs, and wasted material. SFAS No. 151 will be

effective for inventory costs incurred during fiscal years beginning after June 15, 2005. We do not believe the adoption of SFAS

No. 151 will have a material impact on our financial statements.

In December 2004, the FASB issued SFAS No. 153, Exchanges of Nonmonetary Assets, which eliminates the exception for

nonmonetary exchanges of similar productive assets and replaces it with a general exception for exchanges of nonmonetary

assets that do not have commercial substance. SFAS No. 153 will be effective for nonmonetary asset exchanges occurring in

fiscal periods beginning after June 15, 2005. We do not believe the adoption of SFAS No. 153 will have a material impact on

our financial statements.

In December 2004, the FASB issued SFAS No. 123(R), Share-Based Payment, which establishes standards for transactions

in which an entity exchanges its equity instruments for goods or services. This standard requires an issuer to measure the cost

of employee services received in exchange for an award of equity instruments based on the grant-date fair value of the award.

This eliminates the exception to account for such awards using the intrinsic method previously allowable under Accounting

Principles Board (APB) Opinion No. 25. In March 2005, the SEC released Staff Accounting Bulletin (SAB) 107, Share-Based

Payment, which expresses views of the SEC Staff about the application of SFAS No. 123(R). In April 2005 the SEC issued a rule

that SFAS No. 123(R) will be effective for annual reporting periods beginning on or after June 15, 2005. We previously adopted

the fair value recognition provisions of SFAS No. 123, Accounting for Stock-Based Compensation, on July 1, 2003 and restated

previous periods at that time for all awards granted to employees after July 1, 1995. Accordingly we believe SFAS No. 123(R)

will not have a material impact on our financial statements; however, we continue to assess the potential impact that the

adoption of SFAS No. 123(R) will have on the classification of tax deductions for stock-based compensation in our statements of

cash flows.

APPLICATION OF CRITICAL ACCOUNTING POLICIES

Our financial statements and accompanying notes are prepared in accordance with U.S. GAAP. Preparing financial statements

requires management to make estimates and assumptions that affect the reported amounts of assets, liabilities, revenue, and

expenses. These estimates and assumptions are affected by management’s application of accounting policies. Critical

accounting policies for us include revenue recognition, impairment of investment securities, impairment of goodwill, accounting

for research and development costs, accounting for legal contingencies, accounting for income taxes, and accounting for stock-

based compensation.

We account for the licensing of software in accordance with American Institute of Certified Public Accountants (AICPA)

Statement of Position (SOP) 97-2, Software Revenue Recognition. The application of SOP 97-2 requires judgment, including

whether a software arrangement includes multiple elements, and if so, whether vendor-specific objective evidence (VSOE) of fair

value exists for those elements. Customers receive certain elements of our products over a period of time. These elements

include free post-delivery telephone support and the right to receive unspecified upgrades/enhancements of Microsoft Internet

Explorer on a when-and-if-available basis, the fair value of which is recognized over the product’s estimated life cycle. Changes

to the elements in a software arrangement, the ability to identify VSOE for those elements, the fair value of the respective

elements, and changes to a product’s estimated life cycle could materially impact the amount of earned and unearned revenue.

Judgment is also required to assess whether future releases of certain software represent new products or upgrades and

enhancements to existing products.

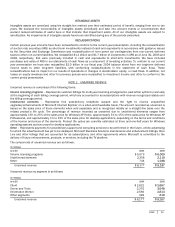

SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities, and SEC SAB 59, Accounting for Noncurrent

Marketable Equity Securities, provide guidance on determining when an investment is other-than-temporarily impaired.

Investments are reviewed quarterly for indicators of other-than-temporary impairment. This determination requires significant

judgment. In making this judgment, we employ a systematic methodology quarterly that considers available quantitative and

qualitative evidence in evaluating potential impairment of our investments. If the cost of an investment exceeds its fair value,

we evaluate, among other factors, general market conditions, the duration and extent to which the fair value is less than cost,

and our intent and ability to hold the investment. We also consider specific adverse conditions related to the financial health of