LG 2002 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2002 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. IAnnual Report 2002 I86 87

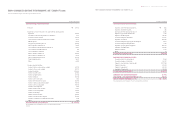

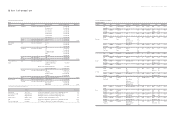

Type Issued Date Issued Amount Interest Outstanding Due Date

(Unit : Billion KRW, %)

237th Convertible bond, foreign currency 1997-07-08 US$ 75,000 0.25 US$ 55,670 2007-12-31

259th Debenture, private, non-guaranteed payable 1998-01-03 30 16.5 30 2004-01-05

287th Debenture, public, non-guaranteed payable 1999-11-22 5 8.00 5 2002-11-22

288th Debenture, public, non-guaranteed payable 1999-12-20 5 8.00 5 2002-12-20

289th Debenture, public, non-guaranteed payable 2000-01-25 10 9.00 10 2003-01-25

Debenture, floating note(FRN) 2000-04-25 US$ 100,000 L+ 1.40 US$ 100,000 2002-04-25

290th Debenture, public, non-guaranteed payable 2000-06-29 20 8.00 20 2002-06-29

291th Debenture, private, non-guaranteed payable 2000-07-12 10 7.30 10 2002-07-12

292th Debenture, public, non-guaranteed payable 2000-08-03 10 8.00 10 2002-08-03

293th Debenture, private, non-guaranteed payable 2000-08-08 5 8.00 50 2002-08-08

294th Debenture, private, non-guaranteed payable 2000-08-24 5 3M CD+1.5 5 2002-08-24

295th Debenture, public, non-guaranteed payable 2000-09-06 20 8.00 20 2002-09-06

299th Debenture, private, non-guaranteed payable 1997-12-31 5 16.50 5 2004-01-05

305th Debenture, private, non-guaranteed payable 1999-04-16 5 8.29 5 2002-04-16

306th Debenture, public, non-guaranteed payable 1999-06-17 4.5 7.00 4.5 2002-06-17

307th Debenture, public, non-guaranteed payable 2000-04-10 10 9.00 10 2003-04-10

308th Debenture, public, non-guaranteed payable 2000-04-24 10 9.00 10 2003-04-24

310th FRN 2000-06-28 US$ 121,000 6M L+1.2 US$ 121,000 2002-06-28

311th Debenture, private, non-guaranteed payable 2000-07-31 1.5 8.67 1.5 2002-01-31

312th Debenture, private, non-guaranteed payable 2000-07-31 1.5 8.87 1.5 2002-07-31

313th Debenture, private, non-guaranteed payable 2000-10-12 10 8.00 10 2003-10-12

314th Debenture, public, non-guaranteed payable 2000-12-18 11 8.00 11 2003-12-18

315th Debenture, public, non-guaranteed payable 2001-02-08 15 6.00 15 2004-02-08

316th Debenture, private, non-guaranteed payable 2001-02-27 10 7.65 10 2006-02-26

317th Debenture, private, non-guaranteed payable 2001-04-03 10 7.90 10 2004-04-02

318th Debenture, public, non-guaranteed payable 2001-04-12 20 7.00 20 2004-04-12

319th Debenture, public, non-guaranteed payable 2001-05-11 10 7.00 10 2003-05-11

320th Debenture, public, non-guaranteed payable 2001-05-31 15 7.00 15 2006-05-31

321th Debenture, public, non-guaranteed payable 2001-06-25 12 7.00 12 2004-06-25

322th FRN 2001-08-28 US$ 100,000 6M L+1.6 US$ 100,000 2003-08-28

323th Debenture, public, non-guaranteed payable 2001-09-12 30 6.00 30 2006-09-12

324th Public, non-guaranteed payable(FRN) 2001-10-18 20 Nation debt 3 years+0.4 20 2004-10-18

325th Public, non-guaranteed payable 2001-10-31 20 5.00 20 2006-10-31

326th FRN 2001-11-14 US$ 100,000 US$ 100,000 2006-11-14

327th FRN 2002-05-31 US$ 200,000 6ML+ 0.66 US$ 200,000 2005-05-31

328th Public, non-guranteed payable 2002-09-17 2,000 5.00 2,000 2005-09-19

329th FRN 2002-10-17 US$ 100,000 6ML+0.6 US$ 100,000 2004-10-17

330th FRN 2002-10-17 US$ 100,000 6ML+0.5 US$ 100,000 2005-10-17

Total Foreign currency US$ 600,000 US$600,000

Won currency 22,100 21,400

Overseas Sales and Other Functions

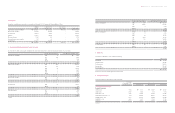

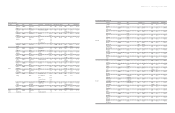

Location Names Type Capital(1000) Investment type Established

Greece LGEHS Sales EUR 5,000 LGE 100% 02.10

Athens

Austria LGEAG Sales EUR 100 LGE 100% 02.07

Vienna

S. Africa LGESA Sales RAND 18,500 LGE 100% 96.10

Johanesburg (US$ 4,000)

Moroco LGEMC Sales MAD 31,521 LGE 100% 98.08

Casablanca SVC

M. Asia U.A.E. LGEGF Shipping & DHS 11,000 LGE 100% 96.10

Dubai handling (US$ 3,014)

U.A.E. LGEME SVC US$ 600 LGE 100% 91.04

Dubai

Egypt LGEEC Sales US$ 3,500 LGE 100% 01.01

Cairo

India LGSI R & D INR 112,042 LGE 88% 98.04

Bangalow S/W AIG 12%

Singapore SLD SVC US$ 18,450 Joint 44% 01.01

Kepel SKT & etc. 56%

Singapore EIC Property Building management US$ 34,170 LGE 38% 00.12

company LG Chemical 9%

LG International 53%

China LGECH holding US$ 50,800 LGE 100% 96.07

Beijing company

China LGEHK Shipping & US$ 3,683 LGE 100% 95.03

Asia Hong Kong handling

Japan HLDS Sales JPY 1,500,000 LGE 49% 00.11

Tokyo Hitachi 51%

Malasia LGEML Shipping & US$ 10 LGE 100% 00.02

Kuala Lumpur handling

Japan LGEJP Sales US$ 1,380,000 LGE 100% 81.01

Tokyo

Taiwan LGETT Sales US$ 5,500 LGE 67% 01.10

Taipai Others 33%

Austrailia LGEAP Sales A$ 2,685 LGE 100% 94.07

Sydney (US$ 2,000)

Oceania Russia LGERI SVC US$ 526 LGE 95% 96.01

CIS Moscow ALINA 5%

Ukraine LGEUR SVC US$ 800 LGE 100% 98.06

Kiev

LG전자 - 본문 2003.4 .22 7:15 AM 페이지80