LG 2002 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2002 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. IAnnual Report 2002 I52 53

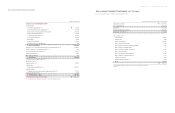

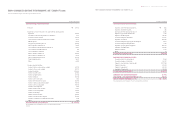

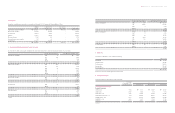

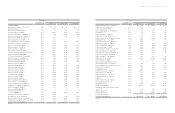

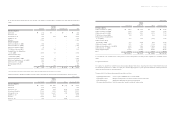

(In millions of Korean Won except for earnings per share amounts)

The accompanying notes are an integral part of these non-consolidated financial statements.

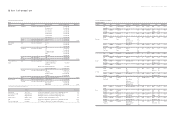

Continued;

(In millions of Korean Won)

The accompanying notes are an integral part of these non-consolidated financial statements.

LIABILITIES AND SHAREHOLDERS’ EQUITY

Current liabilities:

Short-term borrowings (Note 10)

₩

42,393

Current maturities of long-term debt (Note 10) 703,018

Trade accounts and notes payable (Notes 5 and 22) 1,954,039

Other accounts payable (Note 5) 1,051,833

Income taxes payable (Note 19) 156,609

Accrued expenses (Note 5) 585,433

Withholdings 45,352

Advances from customers 197,428

Derivatives transaction credit (Note 14) 534

Total current liabilities 4,736,639

Debentures, net of current maturities and discounts on debentures (Note 11) 2,143,841

Long-term debt, net of current maturities (Note 11) 4,720

Accrued severance benefits, net (Note 13) 162,960

Product warranty provision 79,200

Other long-term liabilities 166

Total liabilities 7,127,526

Commitments and contingencies (Note 14)

Shareholders’ equity:

Capital stock (Note 15) 783,961

Capital surplus:

Additional paid-in capital (Note 16) 1,876,153

Retained earnings:

Unappropriated retained earnings before appropriations (Note 17) 277,716

Capital adjustments (Note 18) 67,222

Total shareholders’ equity 3,005,052

Total liabilities and shareholders’ equity

₩₩

10,132,578

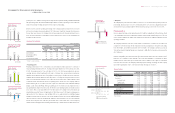

Sales (Notes 22 and 23)

₩

13,905,098

Cost of sales (Note 22) 10,731,086

Gross profit 3,174,012

Selling and administrative expenses 2,512,339

Operating income (Note 23) 661,673

Non-operating income:

Interest income 35,506

Rental income 6,648

Foreign exchange gains 235,662

Gain on disposal of investments 10,403

Gain on disposal of property, plant and equipment 1,364

Gain on disposal of intangible assets 60

Equity in earnings of affiliates, net (Note 7) 26,666

Gain on business transfer 579

Gain on derivatives transactions (Note 14) 23,222

Gain on valuation of derivatives (Note 14) 2,110

Refund of income taxes 2,493

Reversal of bad debt allowance 6,302

Others 122,695

₩

473,710

For the nine-month period from April 1, 2002 (date of spin-off) to December 31, 2002

LG전자 - 본문 2003.4 .22 7:15 AM 페이지56