LG 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

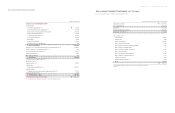

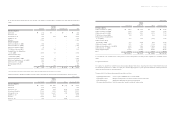

LG Electronics Inc. IAnnual Report 2002 I58 59

1. The Company:

LG Electronics Investment Ltd. (formerly LG Electronics Inc.) was incorporated in 1959 under the Commercial Code of the Republic of Korea to manufacture and sell

electronics products. In 1970, LG Electronics Investment Ltd. offered its shares for public ownership.

As discussed in Note 24 to the accompanying financial statements, the Company was spun off from LG Electronics Investment Ltd. (formerly LG Electronics Inc.) on

April 1, 2002, to engage in the manufacture and sale of electronic, and information and communication products.

As of December 31, 2002, the Company has its manufacturing facilities in Kuro, Pyeongtaek, Chougju, Gumi, Changwon, etc. The Company is a member of the LG

Group, which comprises affiliated companies under common management direction.

As of December 31, 2002, the Company has outstanding capital stock amounting to

₩

783,961 million, including non-voting preferred stock. The Company’s stock

was listed on the Korean Stock Exchange on April 22, 2002, and its depositary receipts (“ DRs” ) were listed on the London Stock Exchange in September 2002.

As of December 31, 2002, affiliated companies comprised of the LG Group including LG Electronics Investment Ltd. own a total of 36.1% of the Company’s common

stock, and financial institutions, foreign investors and others own the rest of the Company’s common stock.

2. Summary of Significant Accounting Policies:

The significant accounting policies followed by the Company in the preparation of its non-consolidated financial statements in accordance with Financial Accounting

Standards of the Republic of Korea are summarized below:

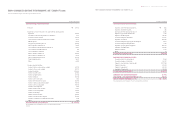

> Basis of Financial Statement Presentation

The Company maintains its official accounting records in Korean Won and prepares statutory non-consolidated financial statements in the Korean language in

conformity with financial accounting standards generally accepted in the Republic of Korea. The accompanying non-consolidated financial statements have been

condensed, restructured and translated into English from the Korean language non-consolidated financial statements. Certain accounting principles applied by the

Company that conform with financial accounting standards and accounting principles in the Republic of Korea may not conform with generally accepted accounting

principles in other countries. Accordingly, these non-consolidated financial statements are intended for use by those who are informed about Korean accounting

principles and practices. Certain information attached to the Korean language financial statements, but not required for a fair presentation of the Company’s financial

position and results of operations, is not presented in the accompanying non-consolidated financial statements.

The preparation of non-consolidated financial statements requires management to make estimates and assumptions that affect amounts reported therein. Due to the

inherent uncertainty involved in making estimates, actual results reported in future periods may differ from those estimates.

> Spin-Off Accounting

Upon a resolution of the shareholders of LG Electronics Investment Ltd. (formerly LG Electronics Inc.) on December 28, 2001, the Company was spun off from LG

Electronics Investment Ltd. on April 1, 2002. The significant accounting policies followed by the Company in the spin off are as follows:

Assets and liabilities are transferred based on the book value.

Capital adjustments including gain or loss on valuation of investment securities, which are directly related to assets and liabilities transferred to the Company, are

also transferred to the Company.

The difference between the Company’s net assets transferred from LG Electronics Investment Ltd. and capital, after adjustments arising from capital adjustments,

is credited to paid-in capital in excess of par value.

> Revenue Recognition

Sales of finished products and merchandise are recognized when delivered. Revenue from installation service contracts is recognized using the percentage-of-

completion method.

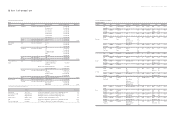

> Marketable Securities and Investments in Debt and Equity Securities

All marketable securities and investments in equity and debt securities are initially carried at cost determined by the weighted average method, including incidental

expenses. In the case of debt securities, cost includes the premium paid or discount received at the time of purchase. The following paragraphs describe the

subsequent accounting for securities by type of security.

Marketable securities and investments in marketable equity securities of non-controlled investees are carried at fair value. Temporary changes in fair value are

recorded in current operations for marketable securities and accounted for in the capital adjustments account, a component of shareholders’ equity, for investments in

marketable equity securities.

Investments in non-marketable equity securities of non-controlled investees are carried at cost, except for declines in the Company’s proportionate ownership of the

underlying book value of the investee which are anticipated to be permanent, which are recorded in current operations. Subsequent recoveries are also recorded in

current operations up to the original cost of the investment.

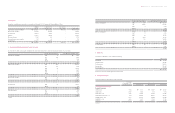

> Marketable Securities and Investments in Debt and Equity Securities,

Investments in equity securities of companies over which the Company exerts a significant control or influence (controlled investees) are recorded using the equity

method of accounting. Differences between the initial purchase price and the Company’s initial proportionate ownership of the net book value of the investee are

amortized over five years using the straight-line method. Under the equity method, the Company records changes in its proportionate ownership of the book value of

the investee in current operations, as capital adjustments or as adjustments to retained earnings, depending on the nature of the underlying change in book value of

the investee.

Unrealized profit arising from sales by the Company to the equity-method investees is fully eliminated. Unrealized profit arising from sales by the equity-method

investees to the Company or sales between equity-method investees is also eliminated considering the percentage of ownership.

Premiums and discounts on debt securities are amortized over the term of the debt using the effective interest rate method. Investments in debt securities which the

Company has the intent and ability to hold to maturity are generally carried at cost, adjusted for the amortization of discounts or premiums (amortized cost). Other

investments in debt securities are carried at fair value. Temporary differences between fair value and amortized cost are accounted for in the capital adjustments

account.

> Allowance for Doubtful Accounts

The Company provides an allowance for doubtful accounts and notes receivable based on the aggregate estimated collectibility of the accounts and notes receivable.

> Inventories

Inventories are stated at the lower of cost or market, with cost being determined using the weighted average method, except for inventory in-transit which is

determined using the specific identification method.

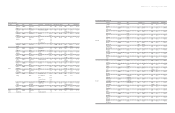

> Property, Plant and Equipment

Property, plant and equipment are recorded at cost, except for upward revaluation in accordance with the Korean Asset Revaluation Law. Such revaluation presents

land at the prevailing market price and buildings and other production facilities at their depreciated replacement cost as of the effective date of the revaluation.

Depreciation is computed using the straight-line method over the following estimated useful lives of the assets.

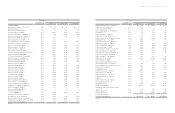

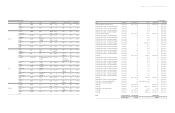

As of December 31, 2002 and for the nine-month period from April 1, 2002 (date of spin-off) to December 31, 2002

LG전자 - 본문 2003.4 .22 7:15 AM 페이지62