LG 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

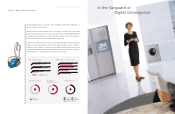

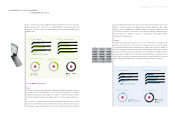

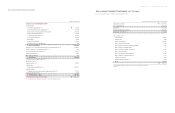

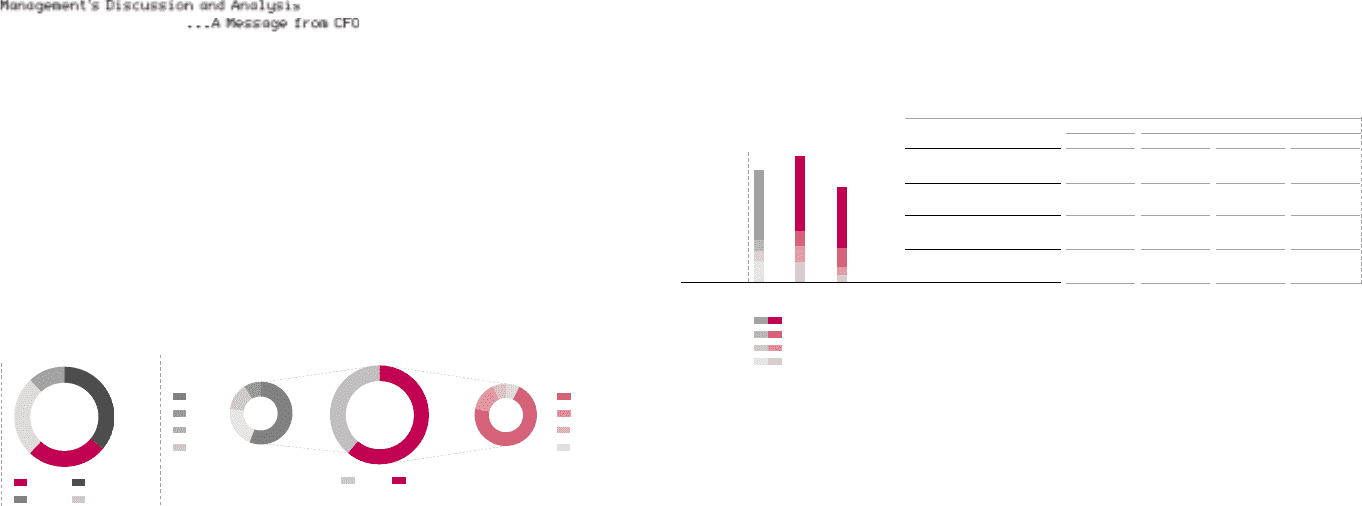

(Billions of Korean Won)

Profit

3,686

796

574

507

Gross Profit

Operating Profit

Recurring Profit

Net Profit

3,174

662

399

278

4,349

1,029

675

498

01 02 02

April-December

Profit

Gross Profit 3,686 4,349 3,174 18.0

Profit Margin 22.2% 23.4% 22.8%

Operating Profit 796 1,029 662 29.2

Profit Margin 4.8% 5.5% 4.8%

Recurring Profit 574 675 399 17.7

Profit Margin 3.5% 3.6% 2.9%

Net Profit 507 498 278 -1.9

Profit Margin 3.1% 2.7% 2.0%

2001 2002 Change(%)

(Billions of Korean Won)

LG Electronics Inc. IAnnual Report 2002 I42 43

January-December Pro forma April-December

* Change % is year-on-year basis.

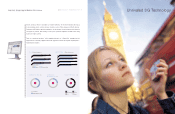

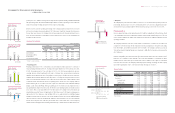

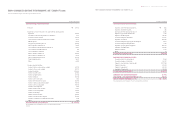

(%)

(%)

Domestic Sales Breakdown

of Mobile Handset

LG Telecom

KTF

SK Telecom

Direct Distribution

GSM CDMA

12

36

26

Exports Breakdown of Mobile Handset

26 22

56

21

71

15 77

14 9

78

China

Europe

Russia

Others

North America

Latin America

China

Others

(%)

the Company climbed four places to rank 6th in the global mobile handset market in 2002. Of total

shipments, CDMA handsets accounted for 83.5% with approximately 13.3 million units while GSM handsets

represented the remaining 16.5%. In the domestic market, sales of units to local service providers SK

Telecom, LG Telecom and KTF accounted for 36% , 26% and 26% respectively. The remaining 12% were sold

through direct distribution channels. In terms of export volume in 2002, CDMA handsets were again

dominant with a 78% share, while GSM handsets accounted for 22%. Of CDMA handset sales to foreign

countries, North America, mainly through Verizon and Sprint, accounted for 71% , followed by Latin America

with 15% and China with 7%. In the case of GSM handset sales to foreign nations, China represented 56%,

well ahead of Europe at 21% and Russia at 14%. With GSM handsets in particular, the Company successfully

penetrated Southern European markets with sales through operators such as Orange, Wind, and Telefonica.

In China, the Company sold over 1.5 million GSM handsets through companies including Legend, Eastcom

and Bodao, and over 0.6 million LG-branded CDMA handsets through China Unicom in the second half of the

year.

> Telecommunication System

In contrast to the Company’s three other divisions, which recorded double-digits sales growth, the

Telecommunication System Division performed poorly in 2002. Sales declined 39.5% to 903.8 billion won. As

a result, the proportion of the Division’s sales to the Company’s total sales fell to 4.9% in 2002 from 9.4% in

2001. The main factor behind the disappointing result was a sharp decline in domestic sales, which inevitably

suffered from a decrease in overall capital expenditure by telecommunications operators. In addition, strategic

withdrawal from non-profitable businesses such as network solutions and data networks, led to a decline in

the Division's sales. In 2002, the Division focused on improvement of profitability and building the basis of

3G. In addition, the Division achieved some notable successes, including the right to provide WCDMA

equipment to KTiCOM, and was chosen as one of the co-developers for Softswitch with Korea Telecom.

Backed by the Division’s vigorous restructuring, profitability improved toward the end of the fiscal year.

Income

Operating profit increased 29.2% to 1.03 trillion won on the back of robust sales growth and increasing

weight of high-end products. Recurring profit rose 17.1% to 675.2 billion won while net profit dipped 1.9%

to 497.6 billion won.

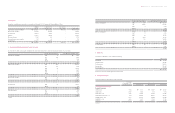

> Gross profit

Gross profit rose 18.0% to 4.35 trillion won in 2002 from 3.69 trillion won in 2001 on the back of robust

sales increases. Gross profit margin improved 1.2%p from 22.2% in 2001 to 23.4% in 2002. Overall, the

high portion of high-end products such as digital TVs and handsets brought about the improvement. By

division, the Mobile Handset Division became the most profitable division with a 30.1% gross profit margin in

2002 compared to 26.9% in 2001. The Digital Appliance Division lost its top position since its gross margin,

albeit still high, fell slightly to 28.9% in 2002 from 31.0% in 2001. Boosted by the strong demand for high-

priced products such as digital TVs, A/V equipment and CD-RWs, the Digital Display and Media Division

enjoyed the biggest gain in gross profit margin improving to 16.2% in 2002 from 12.6% in 2001. On the

other hand, the Telecommunication System Division, which experienced a sharp decline in sales, failed to

show improvement in profitability. Gross profit margin of the Division fell to 23.3% in 2002 from 26.4% in 2001.

> Operating profit

The effect of improving gross profit margin trickled down to operating profitability since there was no

significant impact on operating profit margin from SG&A expenses. Operating profit margin improved to 5.5%

in 2002 compared to the previous year’s 4.8%. Thus the Company's operating profit increased 29.2% to 1.03

trillion won, passing one trillion won for the first time in 2002, from 796.0 billion won in 2001. By division, the

Digital Appliance Division remained the most profitable with operating profit margin of 10.0% . Although this

was a slight drop from the previous year’s 12.1%, due mainly to the strong Korean won and a rise in

marketing expenses, increasing demand for high-end products such as Kimchi refrigerators and drum washing

machines maintained the overall high margin. The most significant improvement in terms of profitability,

however, was achieved by the Handset Division. Operating profit margin from this Division improved by 3.2%p

to 9.7% in 2002 posting 342.7 billion won of operating profit in 2002, 117.9% higher from a year earlier.

Given that the Division contributed 18.9% to the Company’s revenue, but accounted for 30.3% to total

operating profit in 2002, it was the driving force for the structural change. On the other hand, the Digital

Display and Media Division, which generated 42.7% of the Company’s operating revenue, continued to exhibit

low profitability. However, the operating profit margin of the Division improved to 3.2%, higher than the

LG전자 - 본문 2003.4 .22 7:15 AM 페이지46