LG 2002 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2002 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc. IAnnual Report 2002 I60 61

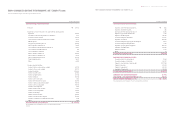

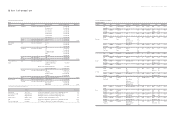

Estimated useful life (years)

Buildings 20 - 40

Structures 20 - 40

Machinery and equipment 5 - 10

Tools 5

Furniture and fixtures 5

Vehicles 5

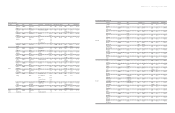

Routine maintenance and repairs are charged to expense as incurred. Expenditures which enhance the value or significantly extend the useful lives of the related

assets are capitalized.

Interest expense and other similar expenses incurred during the construction period of assets on funds borrowed to finance the construction are capitalized.

Capitalized financing costs for the nine-month period from April 1, 2002 to December 31, 2002 amounted to approximately

₩

3,663 million.

> Lease Transactions

Lease agreements that include a bargain purchase option, result in the transfer of ownership at the end of the lease term, have a term longer than 75 percent of the

estimated economic life of the leased property, or have a present value of the minimum lease payments at the beginning of the lease term amounting to more than 90

percent of the fair value of the leased property are accounted for as capital leases. Leases that do not meet these criteria are accounted for as operating leases, of

which the total minimum lease payments are charged to expense over the lease period on a straight-line basis.

> Research and Development Costs

Research costs are expensed as incurred. Development costs directly relating to a new technology or new products of which the estimated future benefits are probable

are recognized as intangible assets. Amortization of development costs is computed using the straight-line method over five years from the commencement of the

commercial production of the related products. Such costs are subject to continual analysis of recoverability. In the event that such amounts are estimated to be not

recoverable, they are written-down or written-off.

> Intangible Assets

Intangible assets are stated at cost, net of accumulated amortization. Amortization is computed using the straight-line method over the estimated useful lives ranging

from five to ten years.

> Discounts (Premiums) on Debentures

Discounts (premiums) on debentures are amortized using the effective interest rate method over the repayment period of the debentures. The amortized amount is

included in interest expense.

> Treasury Stock

Treasury stock are stated at cost and recorded as a capital adjustment in shareholders’ equity. Gain on disposal of treasury stock is recorded as capital surplus. Any

loss on disposal of treasury stock is offset against prior gains on disposal of treasury stock included in capital surplus. The remaining loss is offset against retained

earnings.

> Product Warranty Provision

The Company provides product warranties relating to product defects for a specified period of time after sale. Estimated costs of product warranties are charged to

current operations at the time of sale and are included in the accompanying balance sheet as a product warranty provision.

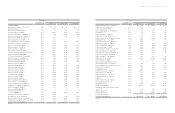

> Accrued Severance Benefits

Employees and directors with more than one year of service in the Company and LG Electronics Investment Ltd. (formerly LG Electronics Inc.) on an aggregate basis

are entitled to receive a lump-sum severance payment upon termination of their employment with the Company, based on their length of service and rate of pay at

the time of termination. Accrued severance benefits represent the amount which would be payable assuming all eligible employees and directors were to terminate

their employment as of the balance sheet date.

Contributions made under the National Pension Plan and severance insurance deposits are deducted from accrued severance benefits. Contributed amounts are

refunded from the National Pension Plan and the insurance companies to employees upon their retirement.

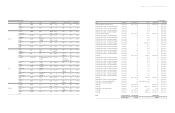

> Income Taxes

The Company recognizes deferred income taxes for anticipated future tax consequences resulting from temporary differences between amounts reported for financial

reporting and income tax purposes. Deferred income tax assets and liabilities are computed on such temporary differences by applying enacted statutory tax rates

applicable to the years when such differences are expected to be reversed. Deferred income tax assets are recognized to the extent that it is certain that such deferred

income tax assets will be realized. The total income tax provision includes current tax expense under applicable tax regulations and the change in the balance of

deferred income tax assets and liabilities.

Tax credits for investments and development of technology and manpower are accounted for using the flow-through method, whereby income taxes are reduced in

the period the assets giving rise to such credits are placed in service. To the extent such credits are not currently utilized, deferred income tax assets, subject to

realizability as stated above, are recognized for the carry-forward amount.

> Sale of Accounts and Notes Receivable

The Company sells certain accounts or notes receivable to financial institutions at a discount, and accounts for the transactions as a sale of the receivables if the rights

and obligations relating to the receivables are substantially transferred to the buyers. The gains and losses from the sale of the receivables are charged to operations

as incurred.

> Foreign Currency Translation

Monetary assets and liabilities denominated in foreign currencies are translated into Korean Won at the basic rates in effect at the balance sheet date, and resulting

translation gains and losses are recognized in current operations.

The exchange rate used to translate U.S. Dollar denominated monetary assets and liabilities as of December 31, 2002 is

₩

1,200.4: US$1.

> Derivative Financial Instruments

The Company utilizes several derivative financial instruments (“ derivatives” ) such as forward exchanges, swaps and option contracts to reduce its exposure resulting

from fluctuations in foreign currency and interest rates. The derivatives are carried at fair market value. Unrealized gains or losses on derivatives for trading or fair

value hedging purposes are recorded in current operations. Unrealized gains or losses on derivatives for cash flow hedging purposes are recorded in current operations

for the portion of the hedge that is not effective. For the portions of cash flow hedges which are effective, unrealized gains or losses are accounted for in the capital

adjustments account and recorded in operations in the period when the underlying transactions have an effect on operations.

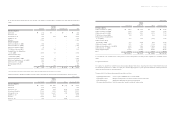

> Early Adoption of the Statements of Korean Financial Accounting Standards

On December 27, 2001, the Korean Accounting Standards Board (“ KASB” ) has published a series of Statements of Korean Financial Accounting Standards (“ SKFAS” ),

which will gradually replace the existing financial accounting standards established by the Korean Financial and Supervisory Board. SKFAS No. 2 through No. 9

became effective for the Company on January 1, 2003, and the Company plans to adopt these statements in its financial statements for the year ending December 31,

2003, except for SKFAS No. 6 on subsequent events, of which the Company made an early adoption for the nine-month period from April 1, 2002 to December 31,

2002, In accordance with the addendum of SKFAS No. 6. Accordingly, the dividends included in the appropriations of retained earnings (draft) were not recognized as

liabilities in the balance sheet as of December 31, 2002. The effect of this early adoption of SKFAS No. 6 was to decrease liabilities and increase retained earnings as

of December 31, 2002 by

₩

157,431 million.

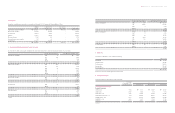

3. Restricted Financial Instruments:

As of December 31, 2002, long-term financial instruments amounting to

₩

8,300 million are deposited in connection with maintaining checking accounts, debt or

research and development projects funded by government. The withdrawal of these financial instruments is restricted (see Notes 10 and 11).

LG전자 - 본문 2003.4 .22 7:15 AM 페이지64