LG 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

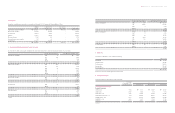

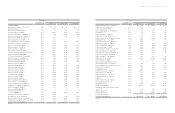

LG Electronics Inc. IAnnual Report 2002 I56 57

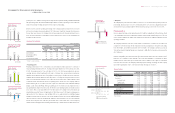

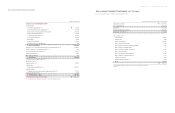

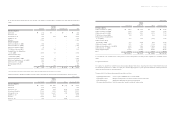

(In millions of Korean Won)

The accompanying notes are an integral part of these non-consolidated financial statements.

The accompanying notes are an integral part of these non-consolidated financial statements.

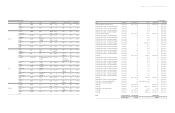

Continued;

(In millions of Korean Won)

CASH FLOWS FROM OPERATING ACTIVITIES:

Net income

₩

277,716

Adjustments to reconcile net income to net cash provided by operating activities:

Depreciation 447,809

Amortization of discounts and premiums on on debentures 3,031

Provision for severance benefits 102,618

Loss from transfer of trade accounts and notes receivable 72,121

Bad debt expense 85,719

Foreign currency translation gains, net (29,283)

Gain on disposal of investments, net (2,955)

Loss on disposal of property, plant and equipment, net 58,451

Loss on disposal of intangible assets, net 379

Loss on redemption of debentures 1,302

Equity in earnings of affiliates, net (26,666)

Gain on valuation of derivatives, net (1,576)

Gain on derivatives transactions, net (11,716)

Product warranty provision 38,979

Others (5,455)

Changes in assets and liabilities:

Increase in trade accounts and notes receivable (67,074)

Increase in other accounts receivable (33,711)

Increase in inventories (325,609)

Increase in accrued income (61,431)

Increase in prepaid expenses (19,112)

Increase in advances (44,012)

Increase in other current assets (671)

Increase in deferred income tax assets (47,297)

Increase in trade accounts and notes payable 394,742

Increase in other accounts payable 593,967

Decrease in accrued expenses (585)

Increase in advances from customers 57,031

Increase in income taxes payable 156,609

Increase in withholdings 13,653

Payment of severance benefits (86,363)

Increase in severance insurance deposits (36,170)

Decrease in contributions to the National Pension Fund 3,048

Others (265)

Net cash provided by operating activities

₩₩

1,507,224

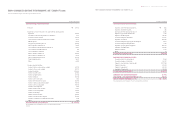

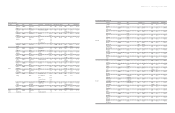

CASH FLOWS FROM INVESTING ACTIVITIES:

Acquisition of short-term financial instruments

₩

(436)

Acquisition of marketable securities (48)

Decrease in short-term and long-term loans, net 24,398

Disposal of long-term financial instruments 5,374

Disposal of refundable deposits (38,041)

Proceeds from disposal of investments 315,505

Acquisition of investments (678,612)

Proceeds from disposal of property, plant and equipment 15,917

Proceeds from disposal of intangible assets 3,188

Acquisition of property, plant and equipment (472,001)

Acquisition of intangible assets (95,832)

Disposal of derivatives 11,716

Others 96

Net cash used in investing activities (908,776)

CASH FLOWS FROM FINANCING ACTIVITIES:

Proceeds from short-term borrowings, net 23,694

Proceeds from issuance of debentures 696,702

Payment of current maturities of long-term debt (1,311,748)

Payment of debentures (41,302)

Payment of long-term debt (45,079)

Acquisition of treasury stock (12,514)

Net cash used in financing activities (690,247)

DECREASE IN CASH AND CASH EQUIVALENTS (91,799)

CASH AT APRIL 1, 2002 (DATE OF SPIN-OFF) (Note 25) 108,975

CASH AT THE END OF THE PERIOD (Note 25)

₩₩

17,176

For the nine-month period from April 1, 2002 (date of spin-off) to December 31, 2002

LG전자 - 본문 2003.4 .22 7:15 AM 페이지60