LG 2002 Annual Report Download - page 24

Download and view the complete annual report

Please find page 24 of the 2002 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

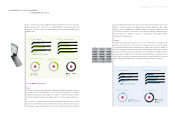

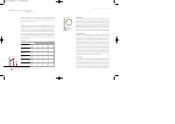

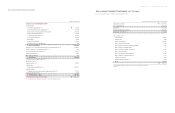

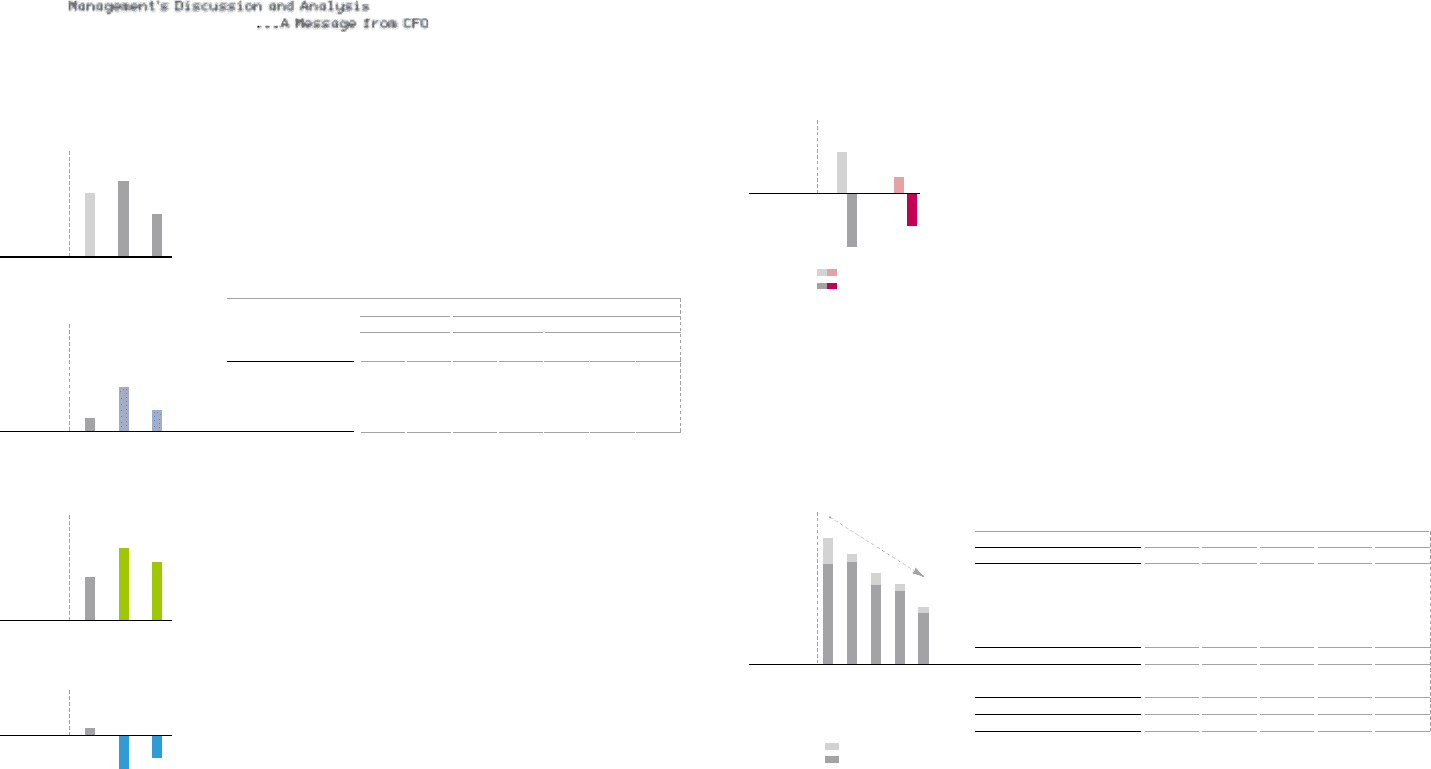

Financial Position

Interest-bearing Debt

Net Interest-bearing Debt

Liability-to-equity Ratio(%)

168.2 235.4 221.9 209.7 237.2

Debt-to-equity Ratio(% )

90.6 128.3 107.0 96.9 96.3

Interest-bearing Debt

02.3.31 02.4.1 02.6.30 02.9.30 02.12.31

3.6

3.2 3.1

2.9

3.5

4.0

3.5

3.1 3.0

2.8

(Trillions of Korean Won)

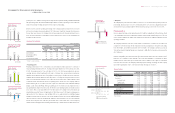

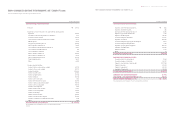

Digital Appliance

Operating Profit (margin)

(12.1%)

(10.0%)

602

604

(1.5% )

(3.2% )

100

258

(6.5% )

(9.7% )

157

343

(1.8% )

26

-74

(-8.2%)

(8.8% )

385

(2.4% )

141

(8.9% )

244

-35

(-4.7%)

(Billions of Korean Won)

01 02 02

01 02 02

April-December

01 02 02

April-December

01

02 02

April-December

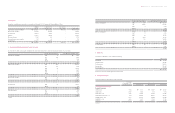

Total Assets 11,983 9,444 10,133 -1,850 689

Current Assets 3,342 2,609 2,963 -379 354

Fixed Assets 8,641 6,835 7,170 -1,471 335

Investment Assets 4,767 3,011 3,304 -1,463 293

Tangible Assets 2,843 2,793 2,893 50 100

Intangible Assets 1,031 1,031 973 -58 -58

Total Liabilities 7,515 6,628 7,128 -387 500

Current Liabilities 4,932 4,232 4,737 -195 505

Fixed Liabilities 2,583 2,396 2,391 -192 -5

Total Shareholders’ Equity 4,468 2,816 3,005 -1,463 189

Total Liabilities and Shareholders’ Equity 11,983 9,444 10,133 -1,850 689

2002.3(a) 2002.4.1(b) 2002.12(c) (c)-(a) (c)-(b)

* Day of demerger

(Billions of Korean Won)

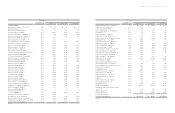

Non-operating

Income & Expenses

2,145

2,367

720

1,074

01 02

(Billions of Korean Won)

Non-operating Income

Non-operating Expenses

LG Electronics Inc. IAnnual Report 2002 I44 45

Operating Profit by Division

Digital Appliance 602 12.1% 604 10.0% 385 8.8% 0.3

Digital Display & Media 100 1.5% 258 3.2% 141 2.4% 157.4

Mobile Handset 157 6.5% 343 9.7% 244 8.9% 117.9

Telecommunication System 26 1.8% -74 -8.2% -35 -4.7% N/A

Operating Margin Operating M argin Operating Margin

Profit Profit Profit

2001 2002 Change(%)

(Billions of Korean Won)

January-December Pro forma April-December

* Change % is year-on-year basis.

Digital Display & Media

Operating Profit (margin)

(Billions of Korean Won)

Mobile Handset

Operating Profit (margin)

(Billions of Korean Won)

Telecommunication System

Operating Profit (margin)

(Billions of Korean Won)

April-December

previous year’s 1.5% thanks to robust growth of newly introduced products including combination DVD/VCRs

and optical storage units. The Telecommunication System Division recorded an operating loss of 73.9 billion, its

largest ever, mainly due to falling sales and the effects of vigorous restructuring.

Of note, however, is that the operating profit margin of the Company would have improved to 6.3% had it

not been for performance bonuses amounting to 145.1 billion won. Usually the Company reflects bonuses in

the next fiscal year. However, the Company reflected bonus payments in the financial statements twice in

2002: once in the first quarter for performance bonuses in fiscal year 2001 and once in the fourth quarter for

performance bonuses in 2002.

> Recurring profit

Recurring profit increased 17.7% to 675.2 billion won in 2002 from 573.7 billion won in 2001 on the back of

robust operating performance. Moreover, recurring profit margin remained close to the previous year’s level.

In 2002, the margin was up by 0.1%p on the figure for 2001 to 3.6%. Both non-operating income and non-

operating expenses declined significantly in the wake of demerger since non-operating accounting was

simplified. Non-operating income fell to 720.2 billion won in 2002 from 2.15 trillion won in 2001 while non-

operating expenses declined sharply from 2.37 trillion won to 1.07 trillion won during the same period. As a

result, net non-operating loss widened by 131.1 billion won to 353.4 billion won. A large reduction in gains

on business transfer was behind the fall in non-operating income. In June 2001, the Company realized a

business transfer gain of 1.36 trillion won when it spun off its CRT business and established LG.Philips

Displays, a joint venture with Philips. Although a further gain of 139.3 billion won was realized in 2002, it

was significantly less than in the previous year. The decline in non-operating expenses, meanwhile, was due

to two factors. First, loss on equity method of 901.5 billion won in 2001, arising from losses by Dacom, LG

Industrial Systems and LG Telecom, fell significantly to 143.4 billion won in 2002. Despite realizing gains on

equity method of 183.4 billion won from LG.Philips LCD, loss on equity method from LG.Philips Displays

totaling 394.4 billion won was reflected on the income statement. Most of the loss from LG.Philips Displays

came from disposal of property and equipment during the restructuring carried out to boost profitability.

Second, interest expenses were reduced by 149.8 billion won to 242.7 billion won in 2002, helped by

reduction in interest-bearing debt. Interest-bearing debt decreased by 1.16 trillion won to 2.89 trillion won in 2002.

> Net profit

The Company’s net profit totaled 497.6 billion won in 2002, a 1.9% decrease from the previous year. The net

profit margin, which stood at 3.1% in 2001, deteriorated a little to 2.7% in 2002 as adjustments in income

and expenses for tax accounting brought the effective income tax rate up to 26.3% from 11.6% in 2001.

Financial position

Here we compare the balance sheet ending December 2002 with that ending March 2002 and that as of April

1, the initial balance sheet of the Company after demerger, instead of that ending December 2001. This is in

order to analyze separately the changes in the balance sheet caused by the Company’s financial policy and

operating performance.

The company’s total assets at the end of 2002 totaled 10.13 trillion won, a reduction of 1.85 trillion won

compared to 11.98 trillion won at the end of March in 2002. This was mainly due to the split of assets arising

from the demerger, as investment assets which were not related to the Company’s operation, such as LG

Telecom, Dacom and LG Industrial Systems, were transferred to LGEI. After the demerger, assets increased by

689.1 billion won.

Likewise, total liabilities were reduced by 387.3 billion won during the same period, but increased by 499.7

billion won to 7.13 trillion won after demerger. The increase was attributable to a big change in current

liabilities. However, debt declined by 718.7 billion won from 3.61 trillion won as of April 1 to 2.89 trillion

won at the end of 2002 since the Company continuously repaid borrowings. Accordingly, the debt-to-equity

ratio declined significantly to 96.3% at the end of 2002 from the initial ratio of 128.3%.

LG전자 - 본문 2003.4 .22 7:15 AM 페이지48