INTL FCStone 2011 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2011 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.receivables from exchange-clearing organizations,

counterparties and customers, and nancial

instruments owned, at fair value.

As of September 30, 2011, we had committed bank

facilities of $375 million, of which $77.4 million was

outstanding.

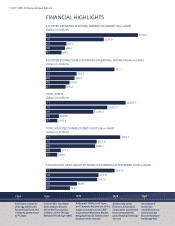

Over a ve-year period, management believes that

our strategy has delivered outstanding growth to

our shareholders both in absolute terms as well

as in terms of Compound Annual Growth (“CAG”).

Over the last ve years, adjusted results show

revenues up 500% (CAG 57%), net income from

continuing operations before tax up 288% (CAG

40%), shareholders’ equity up 450% (CAG 53%) and

net book value per share up 143% (CAG 25%).

A more detailed description of each of our

ve operating segments is included under the

Management Discussion and Analysis section of

the attached 10-K ling.

Looking Forward

The current global economic environment is

characterized by weak or negative growth;

continued uncertainty in the European

Community; growing opportunities and risks in

China, India, Brazil and smaller emerging markets;

and ongoing volatility in commodity prices.

Regardless of the prevailing economic winds

INTL FCStone always endeavors to maintain a

steady course characterized by providing value-

added solutions to our customers around the

world. Our strategy has been, and will remain,

straightforward: An unwavering focus on

providing high value-added service, using our

expertise, experience, technology and capital to

reduce risk, protect and enhance our customers’

bottom lines, and provide e cient solutions in

more-complex nancial markets.

We have two central challenges facing us in scal

2012 and thereafter. The rst is to continue to

weather the challenges of a di cult economic

environment by maintaining the focus on prudent

management of risk that has helped to drive our

growth. The second challenge — having now

assembled the key components and capabilities

for a much-larger franchise — is for management

to deliver the growth and returns we believe are

now possible.

Management has a simple, four-part strategy for

achieving these objectives:

• Expand the customer footprint and

relationships globally. There are huge markets

and large numbers of potential customers

available to us. Although our customer-

focused approach takes time and requires

patience, we have already established critical

beachheads in key markets.

• Leverage all of our capabilities into every

customer relationship and in so doing make

each relationship more valuable to us and

more meaningful for the customer.

• Internalize and maximize the margins on all

of our products. We have already proved the

power of internalizing margins on structured

products and see more opportunity to do this.

• Stringent control of overhead.

Members of the management team are signi cant

owners of the company and have their interests

aligned with those of our shareholders. The

management team is encouraged and excited

by the longer-term opportunities, as our clear

customer focus has now been validated with

strong nancial performance and potential for

signi cant growth.

We would like to thank all of our colleagues for

their contribution to this year’s performance, our

Board and advisors for their guidance, our bankers

for their nancial support and our shareholders for

entrusting their capital to us.

Sean M. O’Connor

Chief Executive O cer

8 | 2011 INTL FCStone Annual Report

Our clear customer focus

has now been validated with

strong nancial performance

and potential for signi cant

growth.