INTL FCStone 2011 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2011 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Products and

Services Off ered:

Fast Facts:

• Ranked #51 on the 2011 Fortune

500 list of the largest U.S.

corporations

• Executive management has

signifi cant ownership

• 904 Employees as of September 30,

2011

• More than 20.000 customers in

more than 100 countries through

a network of 32 offi ces around the

world

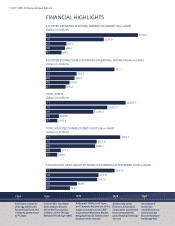

• Fiscal 2011 adjusted operating

revenues were a record $414.8

million, up 51% and adjusted net

income attributable to common

stockholders from continuing

operations was a record $31.9

million, up 106%

ADJUSTED

STOCKHOLDERS

EQUITY $301.7 million

as of September 30, 2011.

Million

$301.7

TOTAL ASSETS

$2.6 billion as of

September 30, 2011.

Billion

$2.6

in more than100 countries

20,000 customers

4 | 2011 INTL FCStone Annual Report

• Risk Management Advisory Services

• Futures/Clearing/Brokerage

• OTC and Structured Products

• Physical Trading in Select

Commodities

• Global Payments and Treasury

Services

• Securities Execution and Trading

• Investment Banking and Advisory

Services

• Foreign Exchange Trading

• Market Research

• Asset Management

INTL FCStone acquired the

futures division of Hencorp,

coff ee, cocoa and sugar

specialists, creating INTL

Hencorp.

Acquired the business

of Provident Group

creating the investment

banking and advisory

division.

International Assets

Holding Corporation

Changes Name to INTL

FCStone Inc.

Ambrian Commodities

Limited (“ACL”), was

acquired to provide

commodities execution

capabilities in the key LME

market.

Acquired the business of the Metals Division

of MF Global and upgraded to LME Category

One ring dealing membership.

October 2010September 2010 March 2011 August 2011 November 2011