INTL FCStone 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHIEF EXECUTIVE’S REPORT

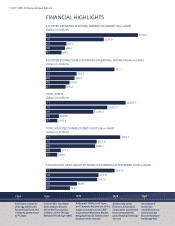

INTL FCStone achieved record nancial

performance in scal year 2011, with 51% growth

in adjusted operating revenue and 106% growth in

adjusted earnings, resulting in a return on average

adjusted stockholders’ equity of 11.6 %, among the

highest of any nancial services rm.

These results are in markedly positive contrast

to the overall nancial services industry. Market

conditions proved di cult throughout the year,

as we witnessed a series of credit crises in Europe

and the collapse of one of the largest Futures

Commission Merchants and a major competitor,

MF Global. The full eff ects of MF Global’s demise

are still to be seen, but they are likely to aff ect the

futures and risk-management industry for some

time.

In this uncertain environment, INTL FCStone

is one of the relatively few fi nancial services

organizations that is customer-oriented and

focused on middle-market customers. We

utilize our expertise, capital and technology

to provide a value-added service to help these

customers manage their risks and protect and

enhance operating performance. We serve as an

intermediary to facilitate fi nancial transactions for

our customers, whether on exchanges or over the

counter, and act either as a principal or a broker.

Unlike some fi rms, however, we do not take

speculative directional views on the market.

We believe that we bring a unique approach that

blends an unwavering commitment to customers

with multi-dimensional fi nancial capabilities,

which allows us to build deep and meaningful

customer relationships and earn suffi cient margin

to provide our shareholders with a fair return on

their capital.

Through successful acquisitions made over the

past two years, we have now assembled a broad

range of capabilities for our growing customer

base across the globe, including:

• Strategic risk-management advisory services

for our commercial customer base to protect

and enhance bottom-line earnings despite

volatile fi nancial and commodities markets;

• General corporate fi nance and investment

banking capabilities related to capital

transactions as well as mergers and

acquisitions, valuations, and other

transactions;

• Clearing, prime brokerage and execution

services for a wide range of exchanges around

the world in all commodity verticals;

• A full spectrum of foreign exchange, global

payments and treasury services;

• A full range of over-the-counter (“OTC”) and

structured products to provide more complex

and customized risk-management solutions

for our customers;

• Physical trading of precious and base metals

and select agricultural products, including

off -take from our customers and sourcing

product on their behalf;

• Customer execution in international and

domestic securities.

At the conclusion of our 2010 fi scal year, which

witnessed the integration of the September 30,

2009 merger between International Assets Holding

Corporation and FCStone, as well as a number

of signifi cant acquisitions, INTL FCStone senior

management made a strategic decision to focus

our eff orts in the coming year predominantly on

creating operating effi ciencies, consolidating our

recent acquisitions, and helping our customers

navigate an increasingly volatile global economic

environment.

At the same time, however, we are willing to make

strategic acquisitions when the right opportunity

presents itself. Most notably, following the end of

fi scal year 2011, we acquired virtually the entire

MF Global Metals Division team in the wake of

MF Global’s dissolution. This acquisition was

made possible by our earlier purchase of Ambrian

Commodities Ltd., the London Metal Exchange

(LME) subsidiary of Ambrian Capital Plc, which

provided us with an LME platform.

6 | 2011 INTL FCStone Annual Report

INTL FCStone achieved

record nancial performance

in scal year 2011.