INTL FCStone 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

CHAIRMAN’S LETTER

It is never an easy task to merge two companies that are roughly equivalent in size, have wide-

ranging global operations, and possess long-standing and extensive customer relationships, as was

the case with International Assets Holding Corporation and FCStone approximately two years ago.

Yet management from both companies have worked to seamlessly blend the organizations while

eff ecting synergies and creating organic growth. INTL FCStone has completed a truly impressive array

of strategic acquisitions in a relatively short period of time following the merger. All of this has left

INTL FCStone in a stronger position than ever before, and has created a tremendous sense of optimism

among management, members of the board and the entire employee team.

While the last year has not been without its challenges, the fi nal result was a solid fi nancial

performance in what has been a very volatile industry. Shareholder returns have improved each of

the last two years, with a combined share price increase over this period of 26%, among the best in the

industry. This is a testament, I believe, to the quality and professionalism of INTL FCStone’s employees.

I have been given the opportunity to serve as Chairman of the Board in INTL FCStone’s second full

year following the merger. It has been an exceptionally rewarding experience to work with a group of

directors and a management team that have contributed fresh perspectives and new capabilities to the

combined company.

As a result of these new strategic capabilities and accomplishments, I have a high level of optimism

for the future. In an industry that has otherwise been marked by continued consolidation, strategic

retreats and other diffi culties, the future is bright for an organization that, like INTL FCStone, possesses

a clear vision, a strong balance sheet and solid fi nancial performance.

I would like to thank all of our shareholders for your support. Your Board of Directors has spent a

great deal of time identifying risks and opportunities, and establishing policies to protect and grow

your investment. You may be assured that your directors will, as always, continue to work in your best

interests.

JACK FRIEDMAN

Non-Executive Chairman

5 | 2011 INTL FCStone Annual Report

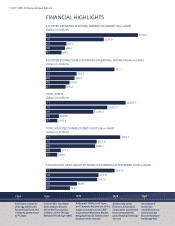

• Adjusted operating revenues 57%

• Adjusted income from continuing

operations, before tax 40%

Compound Growth 2007-2011:

• Adjusted shareholders’ equity 53%

• Adjusted net book value per share 25%