INTL FCStone 2011 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2011 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 | 2011 INTL FCStone Annual Report

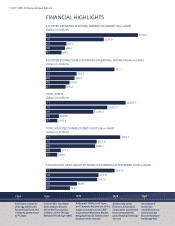

FISCAL 2007 to 2011

Note: The unaudited data (non-GAAP) has been adjusted for unrealized gains in commodities inventory, which is stated at the lower of cost

or market value under GAAP, and unrealized values of forward commitments to purchase and sell commodities. For a reconciliation of the

unaudited adjusted nancial data (non-GAAP) to audited data (GAAP), see Item 6. Selected Financial Data in the Companys Annual

Report on Form 10-K for the year ended September 30, 2011, which is included as part of this Annual Report to Shareholders.

(a) Return on average equity for 2010 excludes $7.0 million extraordinary loss resulting from purchase price adjustments related to the

FCStone transaction. Return on average equity for 2009 excludes $18.5 million extraordinary gain related to the FCStone transaction.

FISCAL YEAR ENDED SEPTEMBER 30

(in millions, except share and per share numbers)

INCOME STATEMENT 2011 2010 2009 2008 2007

Operating revenues

Interest expense

Non-interest expenses

Income (loss) from operations, before tax and discontinued operations

Income tax expense (bene t)

Income (loss) from discontinued operations, net of tax

Income (loss) before extraordinary (loss) income

Extraordinary (loss) income

Net income (loss)

Add: Net (loss) income attributable to noncontrolling interests

Net income (loss) attributable to INTL FCStone common stockholders

Diluted earnings (loss) per share

Average diluted shares outstanding

BALANCE SHEET

Total assets

Total shareholders’ equity

Common shares outstanding at September 30

UNAUDITED ADJUSTED FINANCIAL DATA NonGAAP) - SEE NOTE BELOW

Adjusted operating revenues, marked-to-market

Adjusted income from continuing operations, before tax

Adjusted net income attributable to INTL FCStone common stockholders

Total adjusted shareholders’ equity

Adjusted net asset value per share outstanding at September 30

Change in adjusted operating revenues from prior year

Adjusted net income to adjusted operating revenues

Increase in adjusted shareholders’ equity from prior year

Return on average adjusted shareholders’ equity (a)

$45.7

9.3

46.6

(10.2)

(3.4)

1.7

(5.1)

-

(5.1)

0.6

$(4.5)

$(0.56)

8,086,837

$361.2

$35.6

8,253,508

$114.9

11.2

61.4

42.3

16.2

1.0

27.1

-

27.1

0.7

$27.8

$2.95

9,901,706

$438.0

$74.8

8,928,711

$90.6

8.0

69.3

13.3

2.6

(1.1)

9.6

18.5

28.1

(0.5)

$27.6

$2.80

10,182,586

$1,555.7

$238.8

17,350,727

$269.0

9.9

241.2

17.9

6.4

0.6

12.1

(7.0)

5.1

0.3

$5.4

$0.30

17,883,233

$2,021.7

$241.3

17,601,535

$69.1

$13.2

$10.1

$54.9

$6.65

62%

15%

42%

21.6%

$88.0

$15.4

$11.0

$77.3

$8.66

27%

13%

41%

16.6%

$97.5

$20.2

$32.0

$245.7

$14.16

11%

33%

218%

16.0%

$275.0

$23.9

$9.1

$251.9

$14.31

182%

3%

3%

6.5%

$423.2

11.3

352.4

59.5

22.5

0.2

37.2

-

37.2

0.1

$37.3

$1.96

18,567,454

$2,635.7

$296.3

18,642,407

$414.8

$51.1

$32.1

$301.7

$16.17

51%

8%

20%

11.6%

1983

Farmers Commodities

Corporation (FCC) became a

clearing member of the Kansas

City Board of Trade in 1983 and

in 1985 purchased its fi rst seat

on the Chicago Board of Trade.

1994

International

Assets was listed

on NASDAQ.

2000

FCC acquired Saul

Stone and Company

to become one of

the nation’s largest

commercial grain

brokerage fi rms.

2004

International Assets

acquired global

payments business

Global Currencies,

thereby establishing a

London offi ce.

2007

International Assets

acquired Gainvest

group in South America,

specializing in asset

management and asset

backed securities.

2007

FCStone acquired

Chicago-based

Downes-O’Neill,

dairy specialists.