INTL FCStone 2011 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2011 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The MF team is a leading LME franchise with

deep and diverse global relationships which,

when combined with our existing and signi cant

physical metals, structured OTC products and

corporate nance advisory services, creates a

unique global metals capability. Concurrently

with this acquisition, INTL FCStone also received

approval from the London Metal Exchange to

upgrade its LME Category Two membership to LME

Category One ring dealing membership.

Our strategy is sound and our course is clear;

we have no pressure or desire to deviate from

this path. Indeed, in our view, our strategy and

service model has become increasingly relevant

and useful to our predominantly middle-market

commercial customer base. These customers

are facing, almost without exception, an

unprecedented set of operating challenges

characterized by a di cult lending environment,

uncertain capital markets, volatile commodity

prices, weak consumer demand and a lingering

global recession. At the same time, many nancial

services organizations, ranging from banks to

FCMs, lack the resources, the capabilities or the

long-term commitment to assist middle-market

companies in dealing with these operating

challenges.

I am grati ed to note that by the end of the 2011

scal year, we had managed to make substantial

progress toward integrating our acquisitions and

expanding our capabilities while, at the same time,

coming close to achieving all of our own nancial

objectives established two years ago. As a result,

we nd ourselves at the start of the 2012 scal year

in a stronger position than ever before to help our

customers meet their bottom-line goals, gain new

business in new markets worldwide, and deliver

positive nancial results.

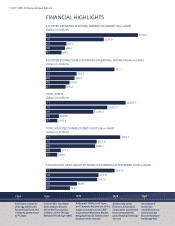

Our Financial Performance

Management believes that the best way to assess

our nancial performance is on a fully marked-

to-market basis. Our Form 10-K, included in this

Annual Report, provides a detailed reconciliation

of these numbers.

During scal 2011, we began to reap the bene ts

of the acquisitions and upgrades we made during

the past two scal years. While we are encouraged

by the results to date, we anticipate even further

growth in the new scal year as a result of the

cross-selling opportunities and synergies created

by our recently acquired operating units.

Fiscal 2011 adjusted operating revenues, marked-

to-market, were $414.8 million. This number

represents not only a 51% increase over the prior

year, but the culmination of an unbroken pattern

of revenue growth since 2006, augmented in scal

2010 and thereafter by the merger with FCStone.

Adjusted net income attributable to INTL FCStone

common stockholders grew to $32.1 million, also a

new record and a $23.0 million, or 253%, increase

over scal 2010.

INTL FCStone’s return on average adjusted

stockholders’ equity (“ROE”), one of our key

nancial metrics, was 11.6%, a result that we

consider to be favorable, though not yet in line

with our corporate objectives. In the coming

years, it is our goal and intention to achieve an ROE

of 15% to 20% or more.

At $352.4 million, our non-interest expenses

increased signi cantly, due primarily to our post-

merger acquisitions and the associated o ce,

personnel, IT and other infrastructure costs. As we

continue to consolidate our recent acquisitions,

we will place continued emphasis on managing

and minimizing expenses where possible. Interest

expense for scal 2011 was $11.3 million.

At the end of scal 2011, INTL FCStone had

18.6 million shares outstanding, with a market

capitalization of $387.0 million. Book value per

outstanding share on an adjusted basis was

$16.17, up 13% from last year’s value of $14.31 and

up 14% from the value of two years ago of $14.16.

We concluded the year with adjusted shareholders’

equity of $301.7 million, and total assets of $2.6

billion, compared to $2.0 billion the previous year.

We remain very liquid, with approximately 83%

of the company’s assets in cash; and deposits and

7 | 2011 INTL FCStone Annual Report

Our strategy is sound and

our course is clear; we have

no pressure or desire to

deviate from this path.