INTL FCStone 2011 Annual Report Download

Download and view the complete annual report

Please find the complete 2011 INTL FCStone annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ANNUAL REPORT

Table of contents

-

Page 1

ANNUAL REPORT -

Page 2

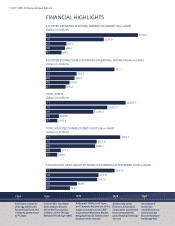

1 | 2011 INTL FCStone Annual Report FINANCIAL HIGHLIGHTS ADJUSTED OPERATING ...Chicago Mercantile Exchange (CME). 1978 A new entity called Farmers Commodities Corporation was formed to accommodate the grain hedging brokerage services. 1981 International Assets was established as an internationally... -

Page 3

... $18.5 million extraordinary gain related to the FCStone transaction. 1983 Farmers Commodities Corporation (FCC) became a clearing member of the Kansas City Board of Trade in 1983 and in 1985 purchased its ï¬rst seat on the Chicago Board of Trade. 1994 International Assets was listed on NASDAQ... -

Page 4

3 | 2011 INTL FCStone Annual Report Execution, Clearing and Advisory Services in COMMODITIES, CAPITAL MARKETS and CURRENCIES INTL FCStone Inc. is a Fortune 500 company, providing customers across the globe with execution and advisory services in commodities, capital markets, currencies, asset ... -

Page 5

... 2011 INTL FCStone Annual Report Fast Facts: • $301.7 Million ADJUSTED STOCKHOLDERSÂ'' EQUITY $301.7 million as of September 30, 2011. Ranked #51 on the 2011 Fortune 500 list of the largest U.S. corporations Executive management has signiï¬cant ownership 904 Employees as of September 30, 2011... -

Page 6

... | 2011 INTL FCStone Annual Report CHAIRMAN'S LETTER It is never an easy task to merge two companies that are roughly equivalent in size, have wideranging global operations, and possess long-standing and extensive customer relationships, as was the case with International Assets Holding Corporation... -

Page 7

... earnings despite volatile ï¬nancial and commodities markets; General corporate ï¬nance and investment banking capabilities related to capital transactions as well as mergers and acquisitions, valuations, and other transactions; Clearing, prime brokerage and execution services for a wide range of... -

Page 8

7 | 2011 INTL FCStone Annual Report Â""Our strategy is sound and our course is clear; we have no pressure or desire to deviate from this path.Â"" The MF team is a leading LME franchise with deep and diverse global relationships which, when combined with our existing and signiï¬cant physical metals... -

Page 9

8 | 2011 INTL FCStone Annual Report receivables from exchange-clearing organizations, counterparties and customers, and ï¬nancial instruments owned, at fair value. As of September 30, 2011, we had committed bank facilities of $375 million, of which $77.4 million was outstanding. Over a ï¬ve-year ... -

Page 10

9 | 2011 INTL FCStone Annual Report We use our expertise, technology and capital to reduce risk, protect and enhance our customers' bottom lines, and provide efficient solutions in more complex ï¬nancial markets. -

Page 11

10 | 2011 INTL FCStone Annual Report OUR LOCATIONS HEADQUARTERS New York (US) 708 Third Avenue, Suite 1500 New York, NY 10017, USA Tel: +1 212 485 3500 Fax: +1 212 485 3505 www.intlfcstone.com US Offices Kansas City (MO) +1 800 255 6381 West Des Moines (IA) +1 800 422 3087 Chicago (IL) +1 800 504... -

Page 12

... of ï¬ve non-executive directors. The Audit Committee meets the SEC requirement that at least one of its members should be a ï¬nancial expert. FINANCIAL REPORTING AND INTERNAL CONTROL The Company strives to present clear, accurate and timely ï¬nancial statements. Management has a system of... -

Page 13

...STATES SECURITIES AND EXCHANGE COMMISSION Washington, D.C. 20549 FORM 10 K ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(D) OF THE SECURITIES EXCHANGE ACT OF 1934 For the Fiscal Year Ended September 30, 2011 Commission File Number 000-23554 INTL FCSTONE INC. (Exact name of registrant as speciï¬ed in... -

Page 14

... Executive Officers and Corporate Governance...111 Executive Compensation...111 Security Ownership of Certain Beneï¬cial Owners and Management and Related Stockholder Matters...112 Certain Relationships and Related Transactions, and Director Independence...112 Principal Accountant Fees and Services... -

Page 15

...Statements Certain statements in this report, other than purely historical information, including estimates, projections, statements relating to our business plans, objectives and expected operating results, and the assumptions upon which those statements...looking statements are...statements... statements ... -

Page 16

...in Paraguay, as well as additional locations in both Brazil and China to address the rapid growth in the demand for our services in those countries. In addition, we have expanded our product offering, speciï¬cally in our Commodity & Risk Management segment, in both our London and Singapore offices... -

Page 17

... reports on Form 8-K, statements of changes in beneï¬cial ownership and press releases are available in the Investor Relations section of this website. e Company's website also includes information regarding the Company's corporate governance, including the Company's Code of Ethics, which governs... -

Page 18

... of Commodity and Risk Management Services, Foreign Exchange, Securities, Clearing and Execution Services, and Other. Commodity and Risk Management Services ("C&RM") We serve our commercial customers by providing high value-addedservice that differentiates the Company from our competitors and... -

Page 19

... Trade, the Kansas City Board of Trade and the Minneapolis Grain Exchange ("MGEX"). As of September 30, 2011, FCStone, LLC was the second largest independent FCM in the United States, as measured by required customer segregated assets, not affiliated with a major ï¬nancial institution or commodity... -

Page 20

... 30, 2011. 6 INTL FCSTONE INC. Form 10 K Ambrian Commodities Limited In April, 2011, we agreed to acquire the issued share capital of Ambrian Commodities Limited ("Ambrian"), the London Metals Exchange brokerage subsidiary of Ambrian Capital Plc. On August 5, 2011, the Financial Services Authority... -

Page 21

... LLC and HGC Office Services, LLC Subsequent Acquisition On November 25, 2011, the Company arranged with the trustee of MF Global's UK operations to hire more than 50 professional staff from MF Global's metals trading business based in London. e Company anticipates that a substantial number of the... -

Page 22

...exchange clearing, internal risk controls, and reporting to government entities, corporate managers, risk managers and customers. Our futures and options back office system is maintained by a third-party service bureau located in Chicago, Illinois, with a disaster recovery site in New York City, New... -

Page 23

... and are designed to measure general ï¬nancial integrity and liquidity. Net capital and the related net capital requirement may ï¬,uctuate on a daily basis. FCStone, LLC currently maintains regulatory capital in excess of all applicable requirements. Compliance with minimum capital requirements may... -

Page 24

..., Brazil, Uruguay, Paraguay, Mexico, Nigeria, Dubai, China, Australia and Singapore. INTL has established wholly-owned subsidiaries in Mexico and Nigeria but does not have offices or employees in those countries. FCStone Commodity Services (Europe) Ltd. is domiciled in Ireland and subject to... -

Page 25

... monitor compliance with the established risk policy. Employees As of September 30, 2011, we employed 904 people globally: 660 in the U.S., 4 in Canada, 56 in Argentina, 68 in Brazil, 10 in Uruguay, 46 in the United Kingdom, 7 in Ireland, 16 in Dubai, 20 in Singapore, 4 in China and 13 in Australia... -

Page 26

... and employees or to achieve the anticipated beneï¬ts of the acquisition. Committed credit facilities ...FCStone, LLC, for short-term funding of margin to commodity exchanges, committed until June 18, 2012. • an $85.0 million facility available to the Company and INTL Global Currencies, for general... -

Page 27

... in or failures of our internal systems and controls for monitoring and quantifying the risk and contractual obligations associated with OTC derivative transactions and related transactions or for detecting human error, systems failure or management failure. OTC derivative transactions may... -

Page 28

... volumes in our Commodity & Risk Management Services and Clearing and Execution Services segments. Substantial changes in commodities prices may affect the levels of business in the precious and base metals product lines. On October 31, 2011 MF Global Holdings Ltd. ("MF Global"), the parent company... -

Page 29

... energy prices, new participants have entered the markets to address their growing risk-management needs or to take advantage of greater trading opportunities. Sustained periods of stability in the prices of commodities or generally lower prices could result in lower trading volumes and, potentially... -

Page 30

... depends, in large part, upon our management team who possess extensive knowledge and management skills with respect to securities, commodities and foreign exchange businesses operated by the Company. e unexpected loss of services of any of our executive officers could adversely affect our ability... -

Page 31

... the October 31, 2011 bankruptcy ï¬ling of MF Global and its notiï¬cation...relating to trade execution, trade reporting, surveillance, record keeping and data reporting obligations, compliance and back-up and disaster recovery plans designed to meet the requirements of the regulators. INTL FCSTONE... -

Page 32

...of registration by the SEC and suspension or expulsion by FINRA and other regulatory bodies. e CFTC and various other self-regulatory organizations require our futures commission merchant subsidiary, FCStone, LLC, to 18 INTL FCSTONE INC. Form 10 K Low short-term interest rates negatively impact our... -

Page 33

...to decreasing interest rates in the U.S., which generally lead to a decrease in short-term interest rates. In the ...commodities risk management services. e commodity risk management industry is very competitive and we expect competition to continue to intensify in the future. Our primary competitors... -

Page 34

... the management of this risk and we have provided them with recommended hedging strategies, they may no longer continue paying monthly fees for these services. In addition, the bankruptcy ï¬ling of MF Global and its disclosure of a potential deï¬ciency in customer segregated futures accounts may... -

Page 35

...scal year 2011 that remain unresolved. ITEM 2 Properties e Company maintains offices in New York, New York; Winter Park, Florida; West Des Moines, Iowa; Chicago, Illinois; Kansas City, Missouri; St. Louis, Missouri; Omaha, Nebraska; Minneapolis, Minnesota; Bloomington, Illinois; Miami, Florida; New... -

Page 36

PART I ITEM 3 Legal Proceedings Porto Alegre, Brazil; Asuncion, Paraguay; Montevideo, Uruguay; London, United Kingdom; Dublin, Ireland; Dubai, United Arab Emirates; Singapore, Singapore; Beijing and Shanghai, China; and Sydney, Australia. All of our offices and other principal business properties ... -

Page 37

... associated with the energy trading account, which occurred prior to the Company's acquisition of FCStone on September 30, 2009. During the quarters ended March 31, 2011 and June 30, 2011, certain employees of the Company testiï¬ed before the SEC in connection with this investigation. e Company is... -

Page 38

... the discovery phase of the litigation. On January 21, 2011 the bankruptcy trustee of Sentinel ï¬led a motion for summary judgment against FCStone, LLC on various counts in the adversary proceedings ï¬led in August 2008 against FCStone, LLC and a number of other FCMs. e motion has since been fully... -

Page 39

... over 5 years of $100 invested on September 30, 2006 in each of the company's stock (« INTL »), S&P 500 Index and AMEX securities Broker/Dealer Index 140 120 100 80 60 40 20 2006 INTL 2007 S&P 500 Index 2008 2009 AMEX Securities Broker/Dealer Index 2010 2011 INTL FCSTONE INC. Form 10 K 25 -

Page 40

...read in conjunction with Management's Discussion and Analysis of Financial Condition and Results of Operations, included in Item 7 and our Consolidated Financial Statements included in Item 8. e consolidated income statement data for 2010 and 2011 reï¬,ects the results of FCStone, which was acquired... -

Page 41

... (in millions, except Employees) 2011 $ $ $ $ ...rate of 37.5% Adjusted net income attributable to INTL FCStone...errors related to the FCStone...related to the FCStone transaction. (c) The number of employees listed in 2009 includes the number of employees of FCStone as of September 30, 2009. INTL FCSTONE... -

Page 42

... of Operations e following discussion should be read together with the Consolidated Financial Statements and Notes thereto appearing elsewhere in this Annual Report on Form 10-K. Certain statements in "Management's Discussion and Analysis of Financial Condition and Results of Operations" are forward... -

Page 43

... professional staff based in London, New York, Hong Kong and Sydney from MF Global's metals trading business based in London. e Company anticipates that a substantial number of the customers of this metals trading business, which serves institutional investors and ï¬nancial services ï¬rms in the... -

Page 44

... $7.0 million of extraordinary loss, related to purchase accounting adjustments and the correction of immaterial errors, and $18.5 million of extraordinary income for 2010 and 2009, respectively, related to the FCStone acquisition. e extraordinary income, also deï¬ned as negative goodwill, was... -

Page 45

... Only the Commodity and Risk Management Services ("C&RM") segment...2011 increased primarily as a result of higher volumes in the global payments business and higher commercial hedging activity, most notably in Brazil, as well as increased trading activity in both our speculative customer INTL FCSTONE... -

Page 46

...2010. For the year ended August 31, 2009, FCStone reported total revenues of $248.9 million. ere were increases in operating revenues of 576% in the C&RM segment and 57% in the Foreign Exchange 32 INTL FCSTONE INC. Form 10 K 2011 Interest expense vs. 2010 Interest expense Interest expense: Interest... -

Page 47

...e number of employees increased 24% from 729 at the end of ï¬scal 2010 to 904 at the end of ï¬scal 2011, primarily as a result of acquisitions of the Provident Group, Hencorp Futures, Ambrian Commodities Limited, as well as certain assets purchased from Hudson Capital Energy, LLC. INTL FCSTONE INC... -

Page 48

... and expansion of our offices in Australia, London, Singapore and South America, employee travel expenses increased $2.1 million in 2011 as compared to the prior year. Provision for Taxes: e effective income tax rate on a U.S. GAAP basis was 38%, in 2011, compared with 36% in 2010. e effective... -

Page 49

... cleared by FCStone, generating a deï¬cit in the customer's trading account. e customer lacked the ï¬nancial capacity to cover the account deï¬cit. In addition, in Q4 2010, the Company recorded a $2.5 million provision against a receivable from a Dubai customer to whom INTL Commodities DMCC had... -

Page 50

... reports its operating segments based on services provided to customers. concerning the Company's principal business segments. e following table shows information (in millions) 2011 Year Ended September 30, % % Change 2010 Change 2009 SEGMENT RESULTS Commodity and Risk Management Services... -

Page 51

..., business development, professional fees, bad debt expense, trade errors and direct marketing expenses. Commodity and Risk Management Services - Operating revenues under U.S. GAAP increased from $129.8 million in 2010 to $252.6 million in 2011. Adjusted operating revenues increased by 80% from $135... -

Page 52

..., and an increase in the number of ounces traded as compared to the prior year period as business activity increased globally, particularly in the Singapore and Dubai markets. Base metals operating revenues increased from $8.6 million in 2010 to $20.2 million in 2011. Base metals adjusted operating... -

Page 53

... the effect of a $2.3 million bad debt provision related to a disputed trade that was "given-up" to FCStone by another futures commission merchant for a customer that held an account with us, while 2011 includes a $1.3 million recovery of bad debt expense related to the settlement of the "given-up... -

Page 54

... compensation and beneï¬ts, operational employee compensation and beneï¬ts, communication and data services, business development, professional fees, bad debt expense, trade errors and direct marketing expenses. Commodity and Risk Management Services - Operating revenues under U.S. GAAP increased... -

Page 55

... investments in funds or proprietary accounts managed either by the Company's investment managers or by independent investment managers. With the acquisition of FCStone, the Other segment's revenues now include interest income and fees earned in relation to commodity ï¬nancing transactions as well... -

Page 56

... of $8.2 million, offset by recoveries of $3.7 million. e provision increases during 2011 were primarily related to credit losses recognized on consigned gold transactions within the C&RM segment, and a clearing customer deï¬cit account within the CES segment. A portion of the loss on consigned... -

Page 57

...agreed to sell and later repurchase such commodities from FCStone Financial, Inc. • An uncommitted forward contract for commodities agreement established on June 23, 2011, under which the Company's subsidiary, FCStone Merchant Services, LLC ("FCStone Merchant Services") is entitled to borrow up to... -

Page 58

... subsidiary in the United Kingdom, INTL Global Currencies Limited, agreed to acquire the issued share capital of Ambrian Commodities Limited ("Ambrian"), the London Metals Exchange brokerage subsidiary of Ambrian Capital Plc. In August 2011, the Financial Services Authority granted its approval of... -

Page 59

...generally offset the customer's transaction simultaneously with one of our trading counterparties INTL FCSTONE...merchant and from its market-making and proprietary trading in the foreign exchange and commodities... statements at September 30, 2011 and September 30, 2010, at fair value of the related ... -

Page 60

... foreign currencies purchased or sold for our account. Realized Critical Accounting Policies e preparation of consolidated ï¬nancial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure... -

Page 61

... assumptions. Our estimate of the fair value of each of the reporting units were in excess of their respective carrying values at the time of their annual goodwill impairment tests for 2011. Intangible assets are reviewed for impairment whenever events or changes in circumstances indicate that the... -

Page 62

...be fully sustained upon review by the relevant tax authorities. Income taxes are accounted for under the asset...management techniques. e graph below summarizes volatility of the Company's daily revenue, determined on a marked-to-market basis, during the year ended September 30, 2011. 48 INTL FCSTONE... -

Page 63

... Consolidated Financial Statements for information on the interest rate swap transactions. e debt instruments are carried at their unpaid principal balance which approximates fair value. All of the Company's outstanding debt as of September 30, 2011, has a variable interest rate. INTL FCSTONE INC... -

Page 64

... 8 Consolidated Financial Statements and Supplementary Data Report of Independent Registered Public Accounting Firm e Board of Directors and Stockholders INTL FCStone Inc.: We have audited INTL FCStone Inc.'s (the Company) internal control over ï¬nancial reporting as of September 30, 2011, based on... -

Page 65

... opinion on the effectiveness of the Company's internal control over ï¬nancial reporting. /s/ KPMG LLP Kansas City, Missouri December 14, 2011 Report of Independent Registered Public Accounting Firm To the Board of Directors and Stockholders of INTL FCStone Inc.: We have audited the accompanying... -

Page 66

... AND EQUITY Liabilities: Accounts payable and other accrued liabilities (including $22.3 and $32.3 at fair value at September 30, 2011 and September 30, ...2011 and 11,257 shares at September 30, 2010 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total INTL FCStone... -

Page 67

... and management fees Interest income Other income Total revenues Cost of sales of physical commodities Operating revenues Interest expense Net revenues Non-interest expenses: Compensation and beneï¬ts Clearing and related expenses Introducing broker commissions Communication and data services... -

Page 68

... Statements and Supplementary Data Consolidated Cash Flows Statements (in millions) Year Ended September 30, 2011 2010...INTL Consilium managed funds Loss on disposition of INTL Consilium Extraordinary loss (gain) on acquisition of FCStone Impairment of INTL...commodities inventory Other assets Accounts... -

Page 69

...related to acquisitions Issuance of common stock related to acquisitions See accompanying notes to consolidated financial statements. Year Ended September 30, 2011... 62.8 60.5 8.8 8.3 0.1 $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ $ 1,178.9 (1,020.5) 1.6 160.0 0.7 - 135.5 INTL FCSTONE INC. Form 10 K 55 -

Page 70

... consolidation Disposition or de-consolidation Stock held in...BALANCES AS OF SEPTEMBER 30, 2011 Common Treasury Stock Stock $... $ 1.7 (0.3) $ 242.9 37.2 (0.4) 1.0 (2.9) (0.6) 34.3 (0.2) 1.4 2.3 16.9 $ 297.6 See accompanying notes to consolidated financial statements. 56 INTL FCSTONE INC. Form 10 K -

Page 71

...cant Accounting Policies • Securities • Clearing and Execution Services ("CES") • Other To conform to the current segment presentation, the Company has restated certain segment information for the year ended September 30, 2009 (see Note 22). INTL FCStone Inc., formerly known as International... -

Page 72

... of Estimates e preparation of consolidated ï¬nancial statements in conformity with accounting principles generally accepted in the United States of America ("U.S. GAAP") requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, disclosure of... -

Page 73

....2 million and $998.1 million as of September 30, 2011 and 2010, respectively. Management has considered guidance required by the Transfers and Servicing Topic of the ASC as it relates to securities pledged by customers to margin their accounts. Based on a review of the agreements with the customer... -

Page 74

...-clearing organizations. Customer accounts with credit or positive balances are reported gross of customer deï¬cit accounts, except where a right of offset exists. Payables to customers for regulated accounts are for transactions facilitated by FCStone, a futures commission merchants ("FCM"), with... -

Page 75

... with no impact on the consolidated income statements. e Company utilizes derivative instruments to manage exposures to foreign currency, commodity price and interest rate risks for the Company and its customers. e Company's objectives for holding derivatives include reducing, eliminating, and... -

Page 76

... LME. 62 INTL FCSTONE INC. Form 10 K Business Combinations Acquisitions during ï¬scal 2011 and 2010 are accounted for as business combinations in accordance with the provisions of the Business Combinations Topic of the ASC. Under the new accounting guidance the method of accounting for a number of... -

Page 77

... and those deposited with other parties. Revenue generally is recognized net of any taxes collected from customers and subsequently remitted to governmental authorities. INTL FCSTONE INC. Form 10 K Revenue Recognition Sales of physical commodities revenue are recognized when persuasive evidence of... -

Page 78

...ts consists primarily of salaries, incentive compensation, commissions, related payroll taxes and employee beneï¬ts. e Company classiï¬es employees as either traders / risk management consultants, operational or administrative personnel, which includes our executive officers. e most signiï¬cant... -

Page 79

... consolidated ï¬nancial statements. In May 2011, the Financial Accounting Standards Board ("FASB") issued an update to the fair value measurement guidance to achieve common fair value measurement and disclosure requirements in U.S. GAAP and International Financial Reporting Standards. e amendments... -

Page 80

...certain employees and directors and shares held in trust for the Provident Group acquisition contain non-forfeitable rights to dividends at the same rate as common stock, and are considered participating securities. Basic EPS has been computed by dividing net income by the weighted-average number of... -

Page 81

... net of omnibus eliminations Other futures commission merchants Securities held for customers in lieu of cash...2011 were primarily related to credit losses recognized on consigned gold transactions, within the C&RM segment, and a clearing customer deï¬cit account within the CES segment. INTL FCSTONE... -

Page 82

...lacked the ï¬nancial capacity to cover the account deï¬cit. Additionally, the Company recorded a $2.5 million charge to bad debt expense related to a Dubai customer to whom INTL Commodities DMCC had consigned gold. As a result of the acquisition of FCStone, the Company acquired notes receivable of... -

Page 83

... (exit price). e Company's exposure to credit risk on derivative ï¬nancial instruments relates to the portfolio of OTC derivative contracts as... foreign government obligations, corporate debt securities, derivative ï¬nancial instruments, commodities, mutual funds and investments in managed funds.... -

Page 84

...September 30, 2011 and 2010...Corporate and municipal bonds - 5.1 U.S. government obligations - 0.8 Foreign government obligations 5.8 0.9 Derivatives 210.5 557.6 Commodities leases and unpriced positions - 66.3 Commodities warehouse receipts 16.2 - Exchange ï¬rm common stock 3.0 0.7 70 INTL FCSTONE... -

Page 85

... stock and ADRs 22.1 0.7 Corporate and municipal bonds - 5.1 U.S. government obligations 0.1 5.3 Foreign government obligations 2.7 0.6 186.0 897.9 Derivatives(2) Commodities leases and unpriced positions - 201.9 Mutual funds and other 1.7 - Investment in managed funds - 1.9 Financial instruments... -

Page 86

... to two investors and the Company retained debentures in the amount of 174.5 million THB ($5.4 million USD). e debentures were secured by a mortgage on the land and hotel buildings, the personal guarantee of the owner, and conditional assignments of accounts and agreements. 72 INTL FCSTONE INC... -

Page 87

...fair value. e discount rate was developed using market ...the consolidated income statements. e Company reports transfers in ...management of the Company. On June 30, 2011, the commodities market experienced downward limit price movements on certain commodities, and on March 31, 2011, the commodities... -

Page 88

... Financial Statements and Supplementary Data e Company has recorded unrealized gains of $0.2 million, net of income tax expense of $0.1 million related to U.S. government obligations and corporate bonds classiï¬ed as available-for-sale securities in OCI as of September 30, 2011. e following... -

Page 89

...$0.3 million in OCI related to equity investments in exchange ï¬rms as of September 30, 2011. e Company monitors ...rate swaps to manage a portion of the aggregate interest rate position. e Company's objective... statements. As of September 30, 2011, $1.1 billion in notional principal of interest rate ... -

Page 90

... in netting and collateral line, of $53.5 million and $0 as of September 30, 2011 and 2010, respectively. e Company's derivative contracts are principally held in its Commodities and Risk Management Services ("C&RM") segment. e Company assists its C&RM segment customers in protecting the value of... -

Page 91

...credit limits based upon a review of the counterparties' ï¬nancial condition and credit ratings. e Company monitors collateral levels on a daily basis for compliance with regulatory and internal...Generally...Management believes that the margin deposits held as of September 30, 2011...by a number of factors... -

Page 92

... to the Company's operating segments as of September 30, 2011 and 2010 is as follows: (in millions) Commodity and Risk Management Services Foreign Exchange Securities GOODWILL September 30, 2011 September 30, 2010 $ 30.9 $ 28.7 6.3 6.3 5.3 5.3 $ 42.5 $ 40.3 78 INTL FCSTONE INC. Form 10 K -

Page 93

... Financial Statements and Supplementary Data NOTE 10 Intangible Assets Intangible assets acquired during the year ended September 30, 2011 relate to acquisitions, as discussed in Note 18. net carrying values of intangible assets as of the balance sheet dates, by major intangible asset class are... -

Page 94

...agreement contains ï¬nancial covenants related to tangible net worth, as deï¬ned. FCStone Financial was in compliance with this covenant as of September 30, 2011. FCStone Financial paid debt issuance costs of less than $0.1 million in connection with this credit facility, which are being amortized... -

Page 95

... price at which FCStone Merchant Services will be obligated to repurchase the speciï¬ed commodities from lender is calculated as the purchase price plus accrued interest on the purchase price at the cost of funds rate determined by the lender, which was 2.13% as of September 30, 2011. e facility is... -

Page 96

... associated with the energy trading account, which occurred prior to the Company's acquisition of FCStone on September 30, 2009. During the quarters ended March 31, 2011 and June 30, 2011, certain employees of the Company testiï¬ed before the SEC in connection with this investigation. e Company is... -

Page 97

... ï¬led a stipulation of discontinuance in the aforementioned lawsuit and released the Company from any further claims in connection with its prior investment in the Notes. During September, 2011, Highbridge and Leucadia National Corporation converted the remaining $9.0 million, and accrued interest... -

Page 98

... million, for ï¬scal years ended 2011, 2010 and 2009, respectively. e expenses associated with the operating leases and service obligations are reported in the consolidated income statements within occupancy and equipment rental, clearing and related and other expenses. Future aggregate minimum... -

Page 99

... 30, 2011, as follows: (in millions) Subsidiary FCStone, LLC FCStone, LLC INTL Trading FCC Investments, Inc. FCStone Australia FCStone Australia Risk Management Incorporated Hencorp Futures INTL FCStone (Europe) FCStone Europe INTL Global Currencies Limited Regulatory Authority CFTC CFTC SEC SEC... -

Page 100

...employees and consultants. As of September 30, 2011, 750,481 shares were authorized for future grant under this plan. Awards that expire or are canceled generally.... Risk free interest rates are based on the... 30, 2011: Number Shares of Options Available for Grant Outstanding 744,871 1,476,500 (49,323... -

Page 101

...freeze all future beneï¬t accruals, therefore no additional beneï¬ts accrue for active participants under the plans. e Company's funding policy as it relates to these plans is to fund amounts that are intended to provide for beneï¬ts attributed to service to date. INTL FCSTONE INC. Form 10 K 87 -

Page 102

...25% To account for the deï¬ned beneï¬t pension plans in accordance with the guidance in the Compensation - Retirement Beneï¬ts Topic of the ASC the Company makes two main determinations 88 INTL FCSTONE INC. Form 10 K at the end of each ï¬scal year. ese determinations are reviewed annually and... -

Page 103

...rates, and a forecast of expected future asset returns. e Company reviews this long-term assumption on an annual basis. As a result of the de...the number ...reporting date. Equity securities did not include any INTL FCStone Inc. common stock as of September 30, 2011 and 2010, respectively. INTL FCSTONE... -

Page 104

...2011 Level 2 Level 3 0.5 $ 0.9 - - - 6.0 15.5 1.7 24.6 Total 0.5 0.9 - - 0.2 6.0 15.5 1.7 24.8 Assets: Cash equivalents Fixed income: Government and agencies Municipal bonds Corporate... of equity collective funds is based upon review of the audited statement of the funds. Substantially all of the... -

Page 105

... Plan ("the Plan") was a deï¬ned contribution plan which was available to all full-time employees of FCStone and wholly subsidiaries who met established criteria of age and service, prior to the FCStone transaction. In connection with the FCStone transaction, the INTL FCSTONE INC. Form 10 K 91 -

Page 106

...wholly owned subsidiary in the United Kingdom, INTL Global Currencies Limited, agreed to acquire the issued share capital of Ambrian Commodities Limited ("Ambrian"), the London Metals Exchange brokerage subsidiary of Ambrian Capital Plc. In August 2011, the Financial 92 INTL FCSTONE INC. Form 10 K -

Page 107

... 8 Consolidated Financial Statements and Supplementary Data Services Authority granted its approval of the change of control of Ambrian. e transaction was effective on August 31, 2011, subsequently, Ambrian was renamed INTL FCStone (Europe) Ltd. ("INTL FCStone Europe"). INTL FCStone Europe, a non... -

Page 108

...number of restricted shares issuable upon the exercise of the Option is 187,500 shares. e restricted shares will be subject to restrictions on transfer which will lapse at the rate... of purchase accounting during the ï¬rst quarter of 2011. e Company's consolidated ï¬nancial statements include the ... -

Page 109

... of the Company. FCStone is an integrated risk management company that provides risk management consulting and transaction execution services to commercial commodity intermediaries, end-users and producers. e Company believes that the acquisition will create a leading global provider of consulting... -

Page 110

... share numbers) During the three months ended September 30, 2010, the Company identiï¬ed accounting errors related to the recording of deferred tax assets by FCStone in the amount of $4.0 million that occurred prior to the acquisition. e Company has evaluated materiality under the guidance of SEC... -

Page 111

... (in millions) U.S. International INCOME FROM CONTINUING OPERATIONS, BEFORE TAX $ $ Year Ended September 30, 2011 2010 27.3 $ 4.4 $ 32.2 13.5 59.5 $ 17.9 $ 2009 (4.8) 18.1 13.3 Items accounting for the difference between income taxes computed at the federal statutory rate and the provision for... -

Page 112

... and liabilities and their tax bases and are stated at enacted tax rates expected to be in effect when taxes are actually paid or recovered. e Company collected $37.1 million during 2010, relating to the net operating loss of FCStone Group, Inc. for its ï¬scal year ended August 31, 2009. e Company... -

Page 113

... as of September 30, 2011 was $0.2 million. e Company and its subsidiaries ï¬le income tax returns with the U.S. federal jurisdiction and various state and foreign jurisdictions. e Internal Revenue Service has commenced an examination of the U.S. income tax return of FCStone for its ï¬scal year... -

Page 114

... Statements and Supplementary Data of its subsidiary, the Company liquidated its position in the INTL Trade Finance Fund Limited, a fund managed by INTL Capital. is fund invested primarily in global trade ï¬nancerelated assets. For 2010 and 2009, the Company recorded losses, net of tax, related... -

Page 115

... reports its operating segments based on services provided to customers. e Company's activities are divided into the following ï¬ve functional areas: • Commodity and Risk Management Services • Foreign Exchange • Securities • Clearing and Execution Services • Other e Company generally... -

Page 116

...interest expense. Variable compensation paid to risk management consultants / traders generally represents a ï¬xed percentage of an amount equal to revenues generated, and in some cases, revenues produced less clearing and related charges, base salaries and an overhead allocation. Segment data also... -

Page 117

... 30, 2011 $ As of September 30, 2010 1,182.8 117.6 49.5 594.9 30.8 46.1 2,021.7 Total assets: Commodity and Risk Management Services Foreign Exchange Securities Clearing and Execution Services Other Corporate unallocated TOTAL $ 1,540.8 $ 146.1 104.8 734.4 43.4 66.2 2,635.7 $ INTL FCSTONE INC... -

Page 118

...8 Consolidated Financial Statements and Supplementary Data NOTE 23 Subsequent Event On November 25, 2011, INTL FCStone (Europe), the Company's wholly owned subsidiary in the United Kingdom, arranged with the trustee of MF Global's UK operations to acquire the Metals Division of MF Global UK Limited... -

Page 119

...assets TOTAL ASSETS $ $ LIABILITIES AND EQUITY Liabilities: Accounts payable and other accrued liabilities Payables to lenders under loans... 30, 2011 and 11,257 shares at September 30, 2010 Additional paid-in capital Retained earnings Accumulated other comprehensive loss Total INTL FCStone Inc. ... -

Page 120

PART II SCHEDULE I INTL FCStone Inc. Condensed Income Statements SCHEDULE I INTL FCStone Inc. Condensed Income Statements Parent Company Only (in millions) Year Ended September 30, 2011 2010 $ 3.1 $ -... and related expenses Introducing broker commissions Communication and data services Occupancy and... -

Page 121

PART II SCHEDULE I INTL FCStone Inc. Condensed Statements of Cash Flows SCHEDULE I INTL FCStone Inc. Condensed Statements of Cash Flows Parent Company Only (in millions) Year Ended September 30, 2011 2010 $ (10.0) $ 0.6 1.1 0.2 0.2 2.3 - (0.4) - - 35.7 - (13.6) (0.4) (0.8) 1.7 - (0.5) 16.1 - (1.0)... -

Page 122

PART II SCHEDULE II INTL FCStone Inc.Valuation and Qualifying Accounts SCHEDULE II INTL FCStone Inc.Valuation and Qualifying Accounts (in millions) ose reserves which are deducted in the Consolidated Financial Statements from Receivables Fiscal Year Ended September 30, 2011: Allowance for doubtful... -

Page 123

...8 "Consolidated Financial Statements and Supplementary Data" of this Annual Report on Form 10-K. Changes in Internal Control Over Financial Reporting During the fourth quarter of 2011, the Company reviewed and subsequently reï¬ned various internal controls over ï¬nancial reporting, relating to an... -

Page 124

PART II ITEM 9B Other Information is page intentionally left blank. 110 INTL FCSTONE INC. Form 10 K -

Page 125

... Compensation PART III ITEM 10 Directors, Executive Officers and Corporate Governance A list of our executive officers and biographical information about them and our directors will be included in the deï¬nitive Proxy Statement for our 2012 Annual Meeting of Stockholders to be held on February... -

Page 126

... in the 2012 Proxy Statement and is incorporated herein by reference. ITEM 14 Principal Accountant Fees and Services Information regarding principal accountant fees and services will be included in the 2012 Proxy Statement and is incorporated herein by reference. 112 INTL FCSTONE INC. Form... -

Page 127

... on Form 14A ï¬led with the SEC on February 11, 2004). 4.7 Amendment to International Assets Holding Corporation 2003 Stock Option Plan (incorporated by reference from the Company's Proxy Statement on Form 14A ï¬led with the SEC on January 23, 2006). 4.8 FCStone Group, Inc. 2006 Equity Incentive... -

Page 128

...'s Current Report on Form 8-K ï¬led with the SEC on December 7, 2010). 14 International Assets Holding Corporation Code of Ethics (incorporated by reference from the Company's Form 10-KSB ï¬led with the SEC on December 29, 2003). 21 List of the Company's subsidiaries. * 114 INTL FCSTONE INC... -

Page 129

... 13a-14(a). * Certiï¬cation of Chief Executive Officer, pursuant to 18 U.S.C. Section 1350.... * Filed as part of this report. Schedules and Exhibits Excluded All schedules...Statements, Summary of Signiï¬cant Accounting Policies, or the Notes to the Consolidated Financial Statements. INTL FCSTONE... -

Page 130

... and Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. INTL FCSTONE INC. Dated: December 14, 2011 /S/ SEAN M. O'CONNOR Sean M. O'Connor Chief Executive Officer Pursuant to the requirements of the Securities and... -

Page 131

...INTL Asia Pte. Ltd INTL Capital and Treasury Global Services Ltd. INTL Capital S.A. INTL CIBSA Sociedad de Bolsa S.A. INTL Colombia Ltda. INTL Commodities DMCC INTL Commodities Mexico S de RL de CV INTL Commodities, Inc. INTL FCStone (Europe) Ltd. INTL FCStone (Netherlands) B.V. INTL FCStone SA INTL... -

Page 132

Name INTL Trading, Inc. INTL Universal Commercial (Shanghai) Co., Ltd. Risk Management Incorporated RMI Consulting, Inc. Westown Commodities, LLC Place of Incorporation Florida, US China Illinois, US Illinois, US Iowa, US E-2 INTL FCSTONE INC. Form 10 K -

Page 133

... of internal control over ï¬nancial reporting as of September 30, 2011, which reports appear in the September 30, 2011 annual report on Form 10-K of the Company. /s/ KPMG LLP Kansas City, Missouri December 14, 2011 We consent to the incorporation by reference in the registration statements (Nos... -

Page 134

...Accounting Firm of INTL FCStone Inc. of our report dated December 14, 2009 relating to the consolidated income statement, statement of stockholders' equity and cash ï¬,ow statement of INTL FCStone Inc. and Subsidiaries for the year ended September 30, 2009, which report appears in this Annual Report... -

Page 135

... with generally accepted accounting principles; (c) Evaluated the effectiveness of the registrant's disclosure I, Sean M. O'Connor, certify that: I have reviewed this Annual Report on Form 10-K of INTL FCStone Inc.; Based on my knowledge, this report does not contain any untrue statement of... -

Page 136

... with generally accepted accounting principles; (c) Evaluated the effectiveness of the registrant's disclosure I, William J. Dunaway certify that: I have reviewed this Annual Report on Form 10-K of INTL FCStone Inc.; Based on my knowledge, this report does not contain any untrue statement of... -

Page 137

...the Company. /S/ SEAN M. O'CONNOR Sean M. O'Connor Chief Executive Officer December 14, 2011 In connection with the Annual Report of INTL FCStone Inc. (the Company...of this written statement required by Section 906, has been provided to INTL FCStone Inc. and will be returned by INTL FCStone Inc. and ... -

Page 138

... December 14, 2011 In connection with the Annual Report of INTL FCStone Inc. (the Company) on Form 10-K for the period ended September 30, 2011 as ï¬led ...of this written statement required by Section 906, has been provided to INTL FCStone Inc. and will be retained by INTL FCStone Inc. and furnished... -

Page 139

is page intentionally left blank. -

Page 140

-

Page 141

...RELATIONS 1251 NW Briarcliff Parkway, Suite 800 Kansas City, MO 64116, USA Phone: +1 866 522 7188 ANNUAL MEETING The annual meeting of shareholders will be held at 10:00 am on Thursday, February 23, 2012 in Chicago, IL, at the following address: JW Marriott Hotel Chicago 151 West Adams Chicago, IL... -

Page 142

708 Third Avenue, Suite 1500 New York, NY 10017, USA Tel: +1 212 485 3500 www.intlfcstone.com