Hertz 2015 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

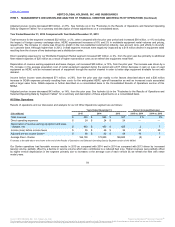

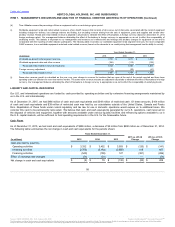

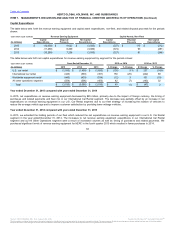

The table below sets forth capital asset expenditures, non-fleet, net of disposal proceeds, by segment for the periods shown:

U.S. car rental $ (57)

$ (187)

$ (162)

$ 130

(70)%

$ (25)

15 %

International car rental (32)

(41)

(38)

9

(22)

(3)

8

Worldwide equipment rental (69)

(28)

(19)

(41)

146

(9)

47

All other operations (2)

(5)

(3)

3

(60)

(2)

67

Corporate (52)

(20)

(24)

(32)

160

4

(17)

Total $ (212)

$ (281)

$ (246)

$ 69

(25)

$ (35)

14

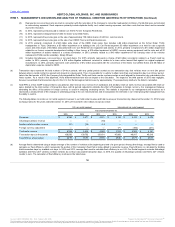

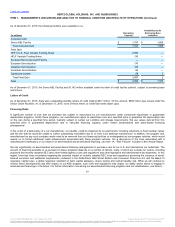

Our relocation of our corporate headquarters to Estero, Florida is complete. We funded the construction costs related to our new headquarters

although most of the cost will be offset by state income tax credits over a period of 20 years. Through December 31, 2015, we expended

approximately $105 million related to the construction of our new headquarters. Additionally, through December 31, 2015, we have incurred

approximately $85 million in expenditures directly related to the relocation of our headquarters including employee relocation, severance, temporary

facilities and other associated costs.

In 2015, we repurchased 37 million shares of our common stock for an aggregate purchase price of approximately $605 million under the 2014

share repurchase program. The approximate dollar value of shares that may yet be purchased under the 2014 share repurchase program is $396

million. See Note 18, "Equity and Earnings (Loss) Per Share," to the Notes to our consolidated financial statements included in this Annual Report

under the caption Item 8, "Financial Statements and Supplementary Data” and Part II, Item 5 "Market For Registrant's Common Equity, Related

Stockholder Matters and Issuer Purchases of Equity Securities".

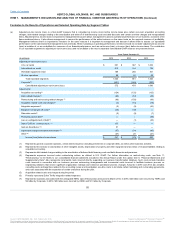

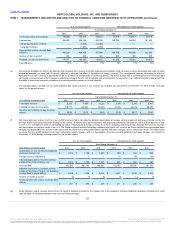

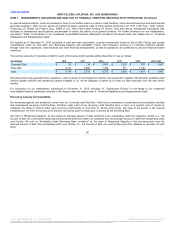

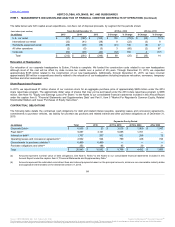

The following table details the contractual cash obligations for debt and related interest payable, operating leases and concession agreements,

commitments to purchase vehicles, tax liability for uncertain tax positions and related interest and other purchase obligations as of December 31,

2015:

Corporate Debt(a) $ 6,055

$ 33

$ 3,015

$ 1,960

$ 1,047

Fleet Debt(a) 9,857

3,101

5,055

1,701

—

Interest on debt(b) 1,707

537

802

296

72

Operating leases and concession agreements(c) 2,502

524

799

436

743

Commitments to purchase vehicles(d) 6,469

6,469

—

—

—

Purchase obligations and other(e) 353

188

95

39

31

Total $ 26,943

$ 10,852

$ 9,766

$ 4,432

$ 1,893

(a) Amounts represent nominal value of debt obligations. See Note 6, "Debt," to the Notes to our consolidated financial statements included in this

Annual Report under the caption Item 8, "Financial Statements and Supplementary Data.”

(b) Amounts represent the estimated commitment fees and interest payments based on the principal amounts, minimum non-cancelable maturity dates

and applicable interest rates on the debt at December 31, 2015.

64

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.