Hertz 2015 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

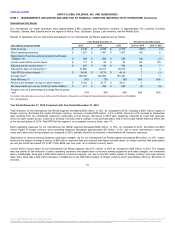

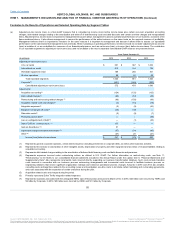

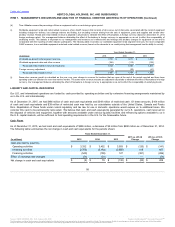

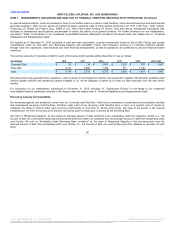

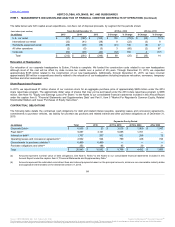

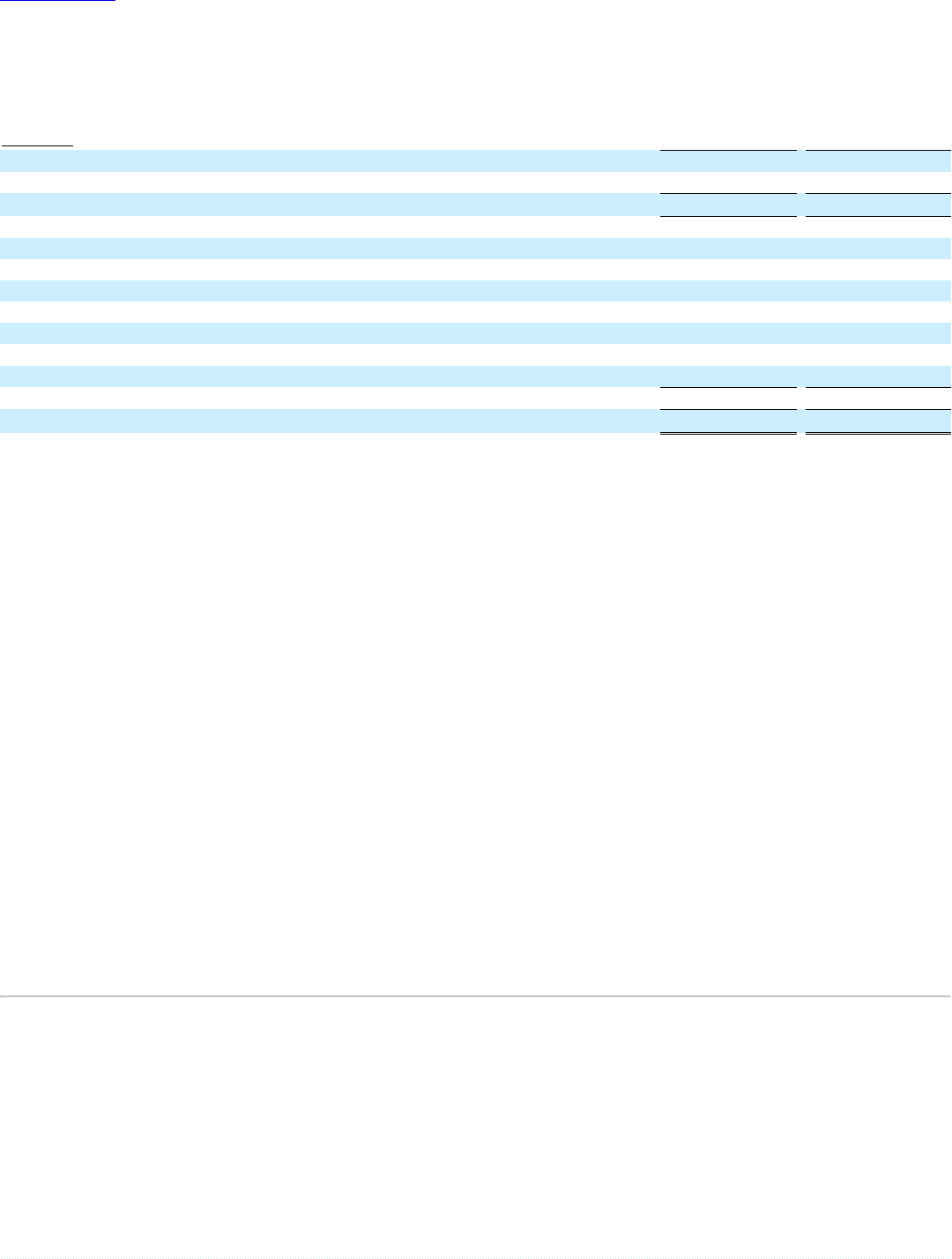

As of December 31, 2015, the following facilities were available to us:

Corporate Debt

Senior ABL Facility $ 1,797

$ 1,668

Total Corporate Debt 1,797

1,668

Fleet Debt

HVF II U.S. Fleet Variable Funding Notes 2,550

—

HFLF Variable Funding Notes 130

—

European Revolving Credit Facility —

—

European Securitization 170

—

Canadian Securitization 105

—

Australian Securitization 84

—

Capitalized Leases 58

2

Total Fleet Debt 3,097

2

Total $ 4,894

$ 1,670

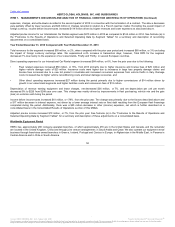

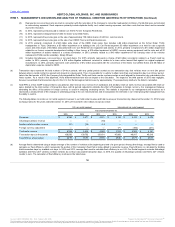

As of December 31, 2015, the Senior ABL Facility had $1,142 million available under the letter of credit facility sublimit, subject to borrowing base

restrictions.

As of December 31, 2015, there were outstanding standby letters of credit totaling $517 million. Of this amount, $503 million was issued under the

Senior Credit Facilities. As of December 31, 2015, none of these letters of credit have been drawn upon.

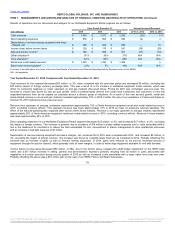

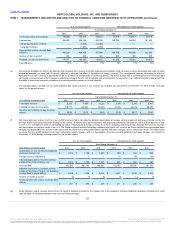

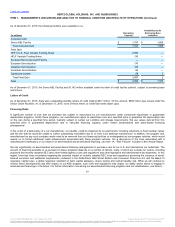

A significant number of cars that we purchase are subject to repurchase by car manufacturers under contractual repurchase or guaranteed

depreciation programs. Under these programs, car manufacturers agree to repurchase cars at a specified price or guarantee the depreciation rate

on the cars during a specified time period, typically subject to certain car condition and mileage requirements. We use values derived from this

specified price or guaranteed depreciation rate to calculate financing capacity under certain asset-backed and asset-based financing

arrangements.

In the event of a bankruptcy of a car manufacturer, our liquidity could be impacted by several factors including reductions in fleet residual values

and the risk that we would be unable to collect outstanding receivables due to us from such bankrupt manufacturer. In addition, the program cars

manufactured by any such company would need to be removed from our financing facilities or re-designated as non-program vehicles, which would

require us to furnish additional credit enhancement associated with these program vehicles. For a discussion of the risks associated with a

manufacturer's bankruptcy or our reliance on asset-backed and asset-based financing, see Item 1A, "Risk Factors" included in this Annual Report.

We rely significantly on asset-backed and asset-based financing arrangements to purchase cars for our U.S. and international car rental fleet. The

amount of financing available to us pursuant to these programs depends on a number of factors, many of which are outside our control, including

proposed and recently adopted SEC (and other federal agency) rules and regulations and other legislative and administrative developments. In this

regard, there has been uncertainty regarding the potential impact of recently adopted SEC rules and regulations governing the issuance of asset-

backed securities and additional requirements contained in the Dodd-Frank Wall Street Reform and Consumer Protection Act and the Basel III

regulatory capital rules, a global regulatory standard on bank capital adequacy, stress testing and market liquidity risk. While we will continue to

monitor these developments and their impact on our ABS program, such rules and regulations may impact our ability and/or desire to engage in

asset-backed financings in the future. For further information concerning our asset-backed financing programs and our indebtedness, see Note 6,

61

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.