Hertz 2015 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2015 Hertz annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

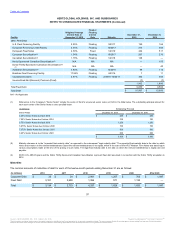

U.S. Fleet Financing Facility

In September 2006, Hertz and Puerto Ricancars, Inc., a Puerto Rican corporation and wholly-owned indirect subsidiary of Hertz ("PR Cars")

entered into a credit agreement that provides for aggregate maximum borrowings of $165 million (subject to borrowing base availability) on a

revolving basis under an asset-based revolving credit facility (the "U.S. Fleet Financing Facility"). The U.S. Fleet Financing Facility is the primary

fleet financing for its car rental operations in Hawaii, Kansas, Puerto Rico and the U.S. Virgin Islands.

The obligations of each of Hertz and PR Cars under the U.S. Fleet Financing Facility are guaranteed by certain of Hertz's direct and indirect U.S.

subsidiaries. In addition, the obligations of PR Cars under the U.S. Fleet Financing Facility are guaranteed by Hertz. The lenders under the U.S.

Fleet Financing Facility have been granted a security interest primarily in the owned rental car fleet used in its car rental operations in Hawaii,

Puerto Rico and the U.S. Virgin Islands and certain contractual rights related to rental vehicles in Kansas, Hawaii, Puerto Rico and the U.S. Virgin

Islands.

In November 2014, the U.S. Fleet Financing Facility was amended to extend the maturity of such facility from September 2015 to March 2017.

European Revolving Credit Facility and European Fleet Notes

In June 2010, Hertz Holdings Netherlands B.V., an indirect wholly-owned subsidiary of Hertz organized under the laws of The Netherlands

(“HHN BV”) entered into a credit agreement that provided for initial aggregate maximum borrowings of €220 million (subject to borrowing base

availability) on a revolving basis under an asset-based revolving credit facility (the “European Revolving Credit Facility”) and issued the 8.50%

Senior Secured Notes due March 2015 (the “Former European Fleet Notes”) in an aggregate original principal amount of €400 million. References

to the “European Fleet Debt” include HHN BV's European Revolving Credit Facility and the European Fleet Notes, collectively.

In November 2013, HHN BV issued the 4.375% Senior Notes due January 2019 (the “European Fleet Notes”) in an aggregate original principal

amount of €425 million. Proceeds of the issuance of the European Fleet Notes were used to redeem all of the then-outstanding Former European

Fleet Notes. Also, HHN BV amended and restated its European Revolving Credit Facility. The amendments to the European Revolving Credit

Facility reflect, among other things, the redemption of the Former European Fleet Notes and certain other updates that conform to the provisions of

the Senior Credit Facilities.

In July 2014, HHN BV amended the European Revolving Credit Facility to provide for aggregate maximum borrowings of up to the equivalent of an

additional €120 million, subject to borrowing base availability, for a seasonal commitment period through December 2014.

In October 2014, HHN BV entered into an amendment agreement pursuant to which certain terms of the European Revolving Credit Facility were

amended to provide for, among other things, (i) an extension of the maturity of the European Revolving Credit Facility from June 2015 to October

2017 and (ii) an increase in aggregate maximum borrowings available under the European Revolving Credit Facility from €220 million to €250

million (subject to borrowing base availability).

In May 2015, HHN BV amended the European Revolving Credit Facility to provide for aggregate maximum borrowings of up to €340 million during

the peak season, subject to borrowing base availability, for a seasonal commitment period through December 2015.

The European Fleet Debt is the primary fleet financing for the Company's car rental operations in Germany, Italy, Spain, Belgium, New Zealand

and Luxembourg and finances a portion of its assets in the United Kingdom, France and The Netherlands, and may be expanded to provide fleet

financing in Australia, Canada, France, The Netherlands and Switzerland.

106

℠

The information contained herein may not be copied, adapted or distributed and is not warranted to be accurate, complete or timely. The user assumes all risks for any damages or losses arising from any use of this information,

except to the extent such damages or losses cannot be limited or excluded by applicable law. Past financial performance is no guarantee of future results.