Frontier Airlines 2008 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2008 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

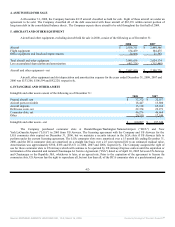

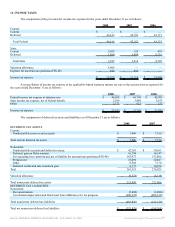

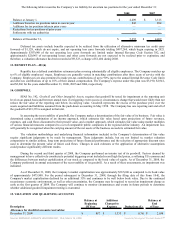

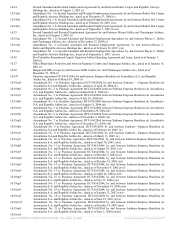

The following table reconciles the Company’s tax liability for uncertain tax positions for the year ended December 31:

2008 2007

Balance at January 1, $ 4,409 $ 3,515

Additions based on tax positions taken in current year 843 894

Additions for tax positions taken in prior years — —

Reductions for tax positions of prior years — —

Settlements with tax authorities — —

Balance at December 31, $ 5,252 $ 4,409

Deferred tax assets include benefits expected to be realized from the utilization of alternative minimum tax credit carry

forwards of $1,128, which do not expire, and net operating loss carry forwards totaling $497,244, which begin expiring in 2021.

Approximately $397,640 of the net operating loss carry forwards are limited under Internal Revenue Code Section 382, and

approximately $20,965 of net operating losses and other carry forwards are not expected to be realized prior to expiration, and

therefore, a valuation allowance has been recorded of $9,523, a change of $1,404 during 2008.

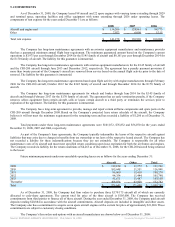

13. BENEFIT PLAN—401(k)

Republic has a defined contribution retirement plan covering substantially all eligible employees. The Company matches up

to 6% of eligible employees' wages. Employees are generally vested in matching contributions after three years of service with the

Company. Employees are also permitted to make pre-tax contributions of up to 90% (up to the annual Internal Revenue Code limit)

and after-tax contributions of up to 10% of their annual compensation. The Company's expense under this plan was $3,190, $2,941,

and $2,266 for the years ended December 31, 2008, 2007 and 2006, respectively.

14. GOODWILL

SFAS No. 142, Goodwill and Other Intangible Assets, requires that goodwill be tested for impairment at the reporting unit

level on an annual basis and between annual tests if a triggering event occurs or circumstances change that would more likely than not

reduce the fair value of the reporting unit below its carrying value. Goodwill represents the excess of the purchase price over the

assets acquired and liabilities assumed from the push-down accounting in May 1998. The Company has one reporting unit and all of

the goodwill of $13,335 is assigned to that unit.

In assessing the recoverability of goodwill, the Company makes a determination of the fair value of its business. Fair value is

determined using a combination of an income approach, which estimates fair value based upon projections of future revenues,

expenses, and cash flows discounted to their present value, and a market approach, which estimates fair value using market multiples

of various financial measures compared to a set of comparable public companies in the regional airline industry. An impairment loss

will generally be recognized when the carrying amount of the net assets of the business exceeds its estimated fair value.

The valuation methodology and underlying financial information included in the Company’s determination of fair value

require significant judgments to be made by management. These judgments include, but are not limited to, market valuation

comparisons to similar airlines, long term projections of future financial performance and the selection of appropriate discount rates

used to determine the present value of future cash flows. Changes in such estimates or the application of alternative assumptions

could produce significantly different results.

During the second and third quarter of 2008, the Company performed an interim test of its goodwill. Factors deemed by

management to have collectively constituted a potential triggering event included record high fuel prices, a softening US economy and

the differences between market capitalization of our stock as compared to the book value of equity. As of December 31, 2008, the

Company performed its annual assessment of the recoverability of its goodwill. As a result of these assessments, no impairment was

indicated.

As of December 31, 2008, the Company’s market capitalization was approximately $367,600 as compared to its book value

of approximately $475,900. For the period subsequent to December 31, 2008, through the filing date of this Form 10-K, the

Company's market capitalization declined by an additional 55% and continues to be well below book value. Due to the continued

recessionary economic environment, as well as other uncertainties, the Company may be required to record an impairment charge as

early as the first quarter of 2009. The Company will continue to monitor circumstances and events in future periods to determine

whether additional goodwill impairment testing is warranted.

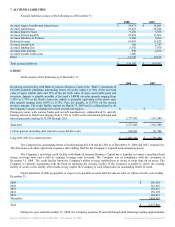

15. VALUATION AND QUALIFYING ACCOUNTS

Description

Balance at

Beginning

Of Year

Additions

Charged to

Expense Deductions (1)

Balance at

End

of Year

Allowance for doubtful accounts receivables:

December 31, 2008 $ 897 $ 1,333 $ (176) $ 2,054

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 16, 2009 Powered by Morningstar® Document Research℠