Frontier Airlines 2008 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2008 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

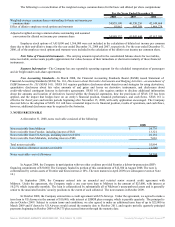

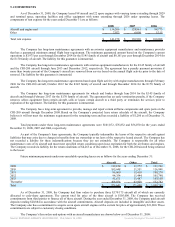

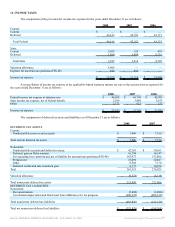

The following is a reconciliation of the weighted average common shares for the basic and diluted per share computations:

For the Years Ended December 31,

2008 2007 2006

Weighted-average common shares outstanding for basic net income per

common share 34,855,190 40,350,256 42,149,668

Effect of dilutive employee stock options and warrants 93,962 695,388 1,466,278

Adjusted weighted-average common shares outstanding and assumed

conversions for diluted net income per common share 34,949,152 41,045,644 43,615,946

Employee stock options of 3,451,000 and 1,366,000 were not included in the calculation of diluted net income per common

share due to their anti-dilutive impact for the year ended December 31, 2008 and 2007, respectively. For the year ended December 31,

2006, all of the employee stock options and warrants were included in the calculation of the dilutive net income per common share.

Fair Value of Financial Instruments—The carrying amounts reported in the consolidated balance sheets for receivables,

notes receivable, and accounts payable approximate fair values because of their immediate or short-term maturity of these financial

instruments.

Segment Information—The Company has one reportable operating segment for the scheduled transportation of passengers

and air freight under code-share agreements.

New Accounting Standards—In March 2008, the Financial Accounting Standards Board (FASB) issued Statement of

Financial Accounting Standards (SFAS) No. 161, Disclosures about Derivative Instruments and Hedging Activities—an amendment of

FASB Statement No. 133 (SFAS 161). SFAS 161 requires qualitative disclosures about objectives and strategies for using derivatives,

quantitative disclosures about fair value amounts of and gains and losses on derivative instruments, and disclosures about

credit-risk-related contingent features in derivative agreements. SFAS 161 also requires entities to disclose additional information

about the amounts and location of derivatives located within the financial statements, how the provisions of SFAS 133 has been

applied, and the impact that hedges have on an entity’s financial position, financial performance, and cash flows. SFAS 161 is

effective for fiscal years and interim periods beginning after November 15, 2008, with early application encouraged. The Company

does not believe the adoption of SFAS 161 will have a material impact to its financial position, results of operations, and cash flows,

however, additional disclosures may be required to the footnotes.

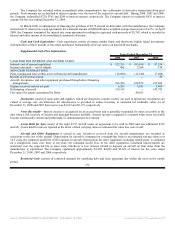

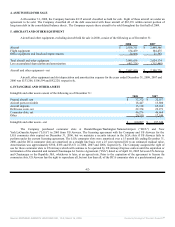

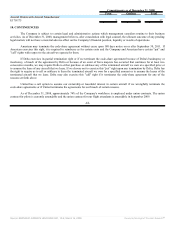

3. NOTES RECEIVABLE

At December 31, 2008, notes receivable consisted of the following:

2008

Note receivable from Midwest $ 24,776

Note receivable from Frontier, including interest of $821 13,321

Note receivable from US Airways, including interest of $181 10,181

Note receivable from Mokulele, including interest of $86 7,616

Total notes receivable 55,894

Less valuation allowance on notes receivable (1,500)

Notes receivable—net of allowance $ 54,394

In August 2008, the Company in participation with two other creditors provided Frontier a debtor-in-possession (DIP)

financing commitment of $30,000. The Company funded its portion of this commitment of $12,500 in August 2008. The note is

collateralized by certain assets of Frontier and bears interest at 16%. The note matures in April 2009 (see subsequent events at Note

16.)

In September 2008, the Company entered into an amended and restated senior secured credit agreement with

Midwest. Under the agreement, the Company made a one year term loan to Midwest in the amount of $25,000, with interest at

10.25% which is payable monthly. The loan is collateralized by substantially all of Midwest’s unencumbered assets and is generally

senior to the unsecured lenders’ security positions to the extent of such collateral. The note matures in October 2009.

In October 2008, the Company entered into a credit agreement with US Airways. Under the agreement, we agreed to make a

term loan to US Airways in the amount of $10,000, with interest at LIBOR plus a margin, which is payable quarterly. The principal is

due in October 2009. Subject to certain terms and conditions, we also agreed to make an additional term loan of up to $25,000 in

March 2009 and if drawn by US Airways would extend the maturity date to October 2011, and require periodic quarterly principal

payments beginning in October 2009 of $4,375 plus accrued interest through the maturity date.

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 16, 2009 Powered by Morningstar® Document Research℠