Frontier Airlines 2008 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2008 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

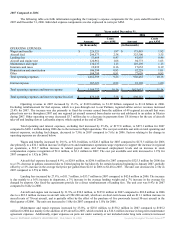

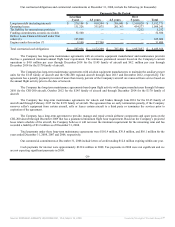

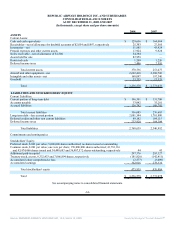

Quarterly Information (unaudited)

The following table sets forth summary quarterly financial information for the years ended December 31, 2008 and 2007.

Quarters Ended

March 31 June 30 September 30 December 31

(dollars in thousands, except net income per share)

2008

Operating revenues $ 363,883 $ 391,372 $ 385,248 $ 339,252

Operating income 65,813 65,761 60,204 63,317

Net income 20,151 28,431 17,007 18,992

Net income per share:

Basic $ 0.56 $ 0.82 $ 0.50 $ 0.56

Diluted $ 0.55 $ 0.81 $ 0.50 $ 0.56

Weighted average number of shares outstanding:

Basic 36,237,981 34,854,532 34,169,104 34,174,167

Diluted 36,561,294 34,977,671 34,169,104 34,174,167

2007

Operating revenues $ 290,443 $ 320,313 $ 330,082 $ 351,839

Operating income 54,829 54,546 57,427 63,476

Net income 19,280 19,041 20,170 24,267

Net income per share:

Basic $ 0.45 $ 0.46 $ 0.50 $ 0.66

Diluted $ 0.44 $ 0.46 $ 0.49 $ 0.65

Weighted average number of shares outstanding:

Basic 42,616,419 41,319,327 40,582,516 36,932,777

Diluted 44,306,067 41,707,625 40,868,412 37,246,265

New Accounting Standards

In March 2008, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standards

(SFAS) No. 161, Disclosures about Derivative Instruments and Hedging Activities—an amendment of FASB Statement No. 133

(SFAS 161). SFAS 161 requires qualitative disclosures about objectives and strategies for using derivatives, quantitative disclosures

about fair value amounts of and gains and losses on derivative instruments, and disclosures about credit-risk-related contingent

features in derivative agreements. SFAS 161 also requires entities to disclose additional information about the amounts and location

of derivatives located within the financial statements, how the provisions of SFAS 133 has been applied, and the impact that hedges

have on an entity’s financial position, financial performance, and cash flows. SFAS 161 is effective for fiscal years and interim

periods beginning after November 15, 2008, with early application encouraged. The Company does not believe the adoption of SFAS

161 will have a material impact to its financial position, results of operations, and cash flows, however, additional disclosures may be

required to the footnotes.

ITEM 7A. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK

We have been and are subject to market risks, including commodity price risk (such as, to a limited extent, aircraft fuel

prices) and interest rate risk.

Interest Rates

Our earnings can be affected by changes in interest rates due to amount of cash and securities held. At December 31, 2008

and December 31, 2007 all of our long-term debt was fixed rate debt. We anticipate that additional debt will be at fixed rates.

However, we believe we could fund any interest rate increases on additional variable rate long-term debt with the increased amounts

of interest income.

We currently intend to finance the acquisition of aircraft through the manufacturer, third-party leases or long-term borrowings.

Changes in interest rates may impact the actual cost to us to acquire these aircraft. To the extent we place these aircraft in service

under our code-share agreements our reimbursement rates may not be adjusted higher or lower to reflect any changes in our aircraft

rental rates.

-31-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 16, 2009 Powered by Morningstar® Document Research℠