Frontier Airlines 2008 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2008 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

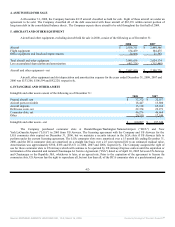

11. CAPITAL STOCK AND STOCK OPTIONS

In March 2007, the Company purchased from WexAir RJET LLC 2,000,000 shares of its holdings in the Company’s

common stock, par value $.001 per share, at a price of $20.50 per share, for total consideration of $41,000. The transaction was

recorded as treasury stock on the Company’s consolidated balance sheet.

In August 2007, the Company’s Board of Directors authorized the purchase of up to $100,000 of the Company’s common

stock. The buy-back program provided for the shares to be purchased on the open market or through privately-negotiated transactions

from time-to-time during the twelve month period following the authorization. Under the authorization, the timing and amount of

purchase would be based upon market conditions, securities law limitations and other factors. The stock buy-back program did not

obligate the Company to acquire any specific number of shares in any period, and could be modified, suspended, extended or

discontinued at any time without prior notice. The Company purchased 4,994,159 shares of which 4,555,000 were purchased from

WexAir LLC and the remainder were purchased on the open market at a weighted average stock price of $20.02 for total consideration

of $100,000. This authorization was closed in November 2007.

In December 2007, the Company’s Board of Directors authorized the purchase of up to $100,000 of the Company’s common

stock for a twelve month period immediately following the authorization. As of December 31, 2007, pursuant to this authorization,

the Company purchased 72,735 shares on the open market at a weighted average stock price of $19.42 for total consideration of

$1,412. During 2008, the Company the company repurchased 2,253,039 shares for total consideration of $39,234. The December 2007

authorization closed on December 14, 2008. In addition, the Company repurchased 12,500 shares of its common stock related to a

non-employee Director’s exercise of vested options for total consideration of $175.

Employee Stock Options and Restricted Stock Grants

The 2007 Equity Incentive Plan provides for the granting of up to 5,000,000 shares of which 2,284,000 shares of our

common stock remain available for issuance under the plan as of December 31, 2008. Stock options granted typically vest ratably

over the term of the employment agreements or between 36 and 48 months and are granted with exercise prices equal to market prices

on the date of grant. The options normally expire ten years from the date of grant. Options are typically granted to officers and key

employees selected by the Compensation Committee of the Board of Directors and have exercise prices ranging from $11.86 to

$20.27.

Non-employee Director Stock Options

The Company also granted options for non-employee directors on the day prior to commencement of the Company’s initial

public offering at a price equal to the fair market value of the common stock on the date of the grant. These options vested over a 3

year period with 1/24 of the shares vesting monthly for the first 12 months and 1/48 of the shares vesting monthly over the remaining

24 months. Additionally, non-employee directors receive 2,500 options on the first trading day after each annual meeting of

stockholders at which he or she is re-elected as a non-employee director. These options vest ratably over 12 months of continuous

service. The non-employee options are exercisable until 10 years from the date of grant.

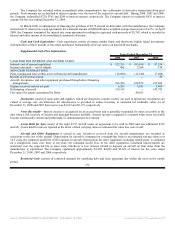

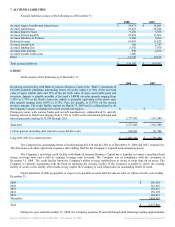

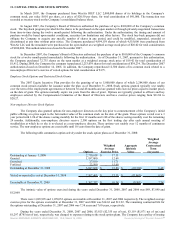

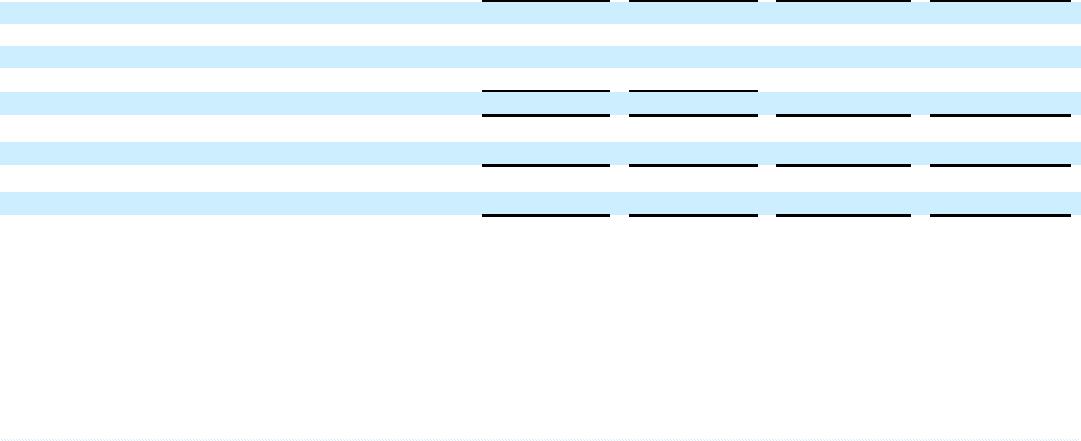

The following table summarizes option activity under the stock option plans as of December 31, 2008:

Options

Weighted

Average

Exercise Price

Aggregate

Intrinsic

Value

Weighted

Average

Contractual

Term

(in years)

Outstanding at January 1, 2008 2,710,818 $ 17.11

Granted 1,187,000 12.69

Exercised 27,650 11.71

Forfeited 22,500 15.69

Outstanding at December 31, 2008 3,847,668 $ 15.80 $ (19,720) 8.48

Vested or expected to vest at December 31, 2008 2,502,403 $ 15.25 $ (11,469) 6.89

Exercisable at December 31, 2008 1,707,752 $ 16.24 $ (9,505) 7.34

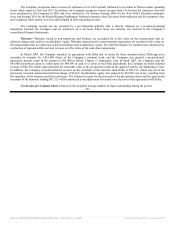

The intrinsic value of options exercised during the years ended December 31, 2008, 2007 and 2006 was $89, $7,090 and

$12,069.

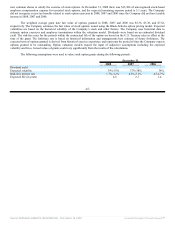

There were 1,029,995 and 1,199,052 options exercisable at December 31, 2007 and 2006 respectively. The weighted average

exercise price for the options exercisable at December 31, 2007 and 2006 was $14.63 and $11.92. The remaining contractual life for

the options outstanding at December 31, 2007 and 2006 was 7.58 years and 7.60 years, respectively.

During the years ended December 31, 2008, 2007 and 2006, $3,925 ($2,355 net of tax), $3,119 ($1,871 net of tax) and

$1,297 ($785 net of tax), respectively, was charged to expense relating to the stock option plans. The Company has a policy of issuing

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 16, 2009 Powered by Morningstar® Document Research℠