Frontier Airlines 2008 Annual Report Download - page 71

Download and view the complete annual report

Please find page 71 of the 2008 Frontier Airlines annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251

|

|

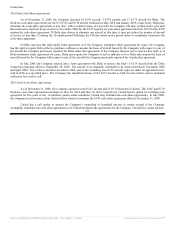

The Company recognizes lease revenue for subleases of six E145 aircraft subleased to an airline in Mexico under operating

leases which expire in 2013 and 2015. In addition, the Company recognizes license revenue from US Airways for commuter slots that

were purchased by the Company in 2005 and were utilized by US Airways through 2006 for the New York LaGuardia commuter

slots, and through 2016 for the Ronald Reagan Washington National commuter slots. Revenues from subleases and the commuter slots

are recognized when earned over time and included in other operating revenue.

The Company records any tax assessed by a governmental authority that is directly imposed on a revenue-producing

transaction between the Company and its customers on a net basis. These taxes are currently not material to the Company’s

consolidated financial statements.

Warrants—Warrants issued to non-employees and Partners are accounted for at fair value on the measurement date as

deferred charges and credits to stockholders’ equity. Warrants surrendered in a non-monetary transaction are recorded at fair value on

the measurement date as reductions to deferred charges and stockholders’ equity. The deferred charges for warrants were amortized as

a reduction of regional airline services revenue over the terms of the code-share agreements.

In March 2007, the Company amended its agreements with Delta and in return for these amended terms, Delta agreed to

surrender its warrants for 3,435,000 shares of the Company’s common stock, and the Company was granted a pre-petitioned,

unsecured, general claim in the amount of $91,000 in Delta's Chapter 11 bankruptcy case. In April 2007, the Company sold the

$91,000 pre-petition claim to a third party for $44,590 in cash. As a result of the Delta amendment, the Company recorded deferred

revenue of $44,590, which represented the net realizable value of the pre-petition claim on the approval date by the Bankruptcy Court.

In addition, the Company recorded deferred revenue on the surrender of the warrants from Delta of $42,735, which was net of the

previously recorded unamortized deferred charge of $6,369. Stockholders' equity was reduced by $32,892, net of tax, resulting from

the surrender of the warrants and their retirement. The deferred revenue for the proceeds of the pre-petition claim and the gain on the

surrender of the warrants totaling $87,325 will be amortized as an adjustment to revenue over the term of the agreements with Delta.

Net Income per Common Share is based on the weighted average number of shares outstanding during the period.

-40-

Source: REPUBLIC AIRWAYS HOLDINGS INC, 10-K, March 16, 2009 Powered by Morningstar® Document Research℠